Get the free Personal Line of Credit Application - Up Business Loans

Show details

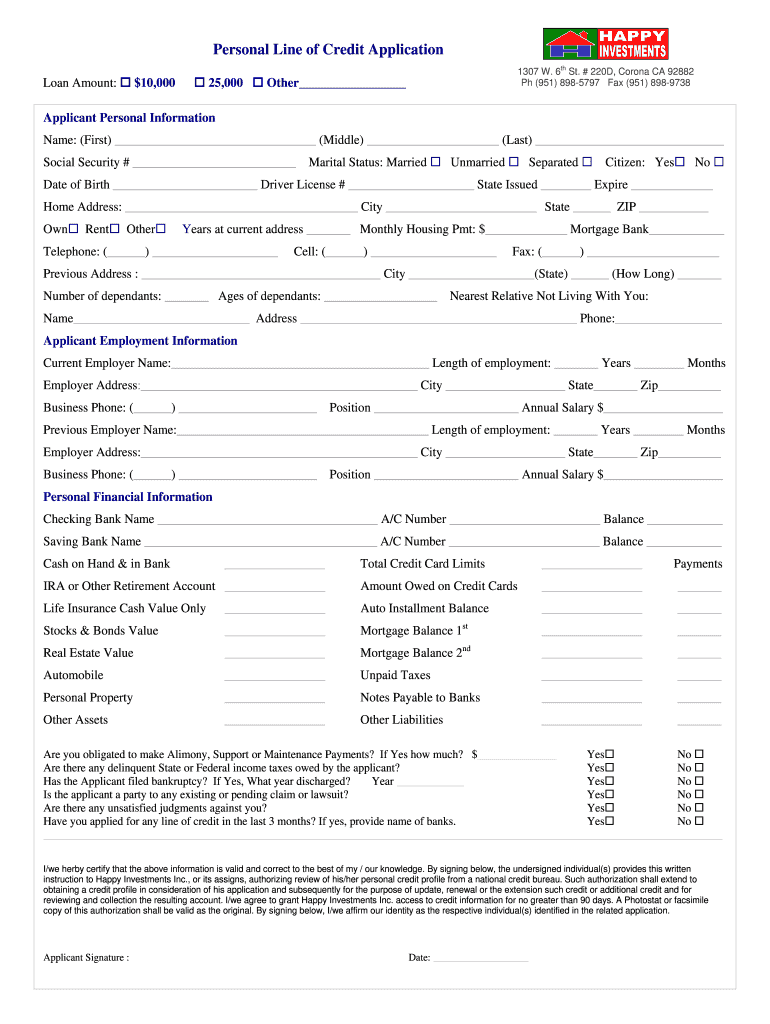

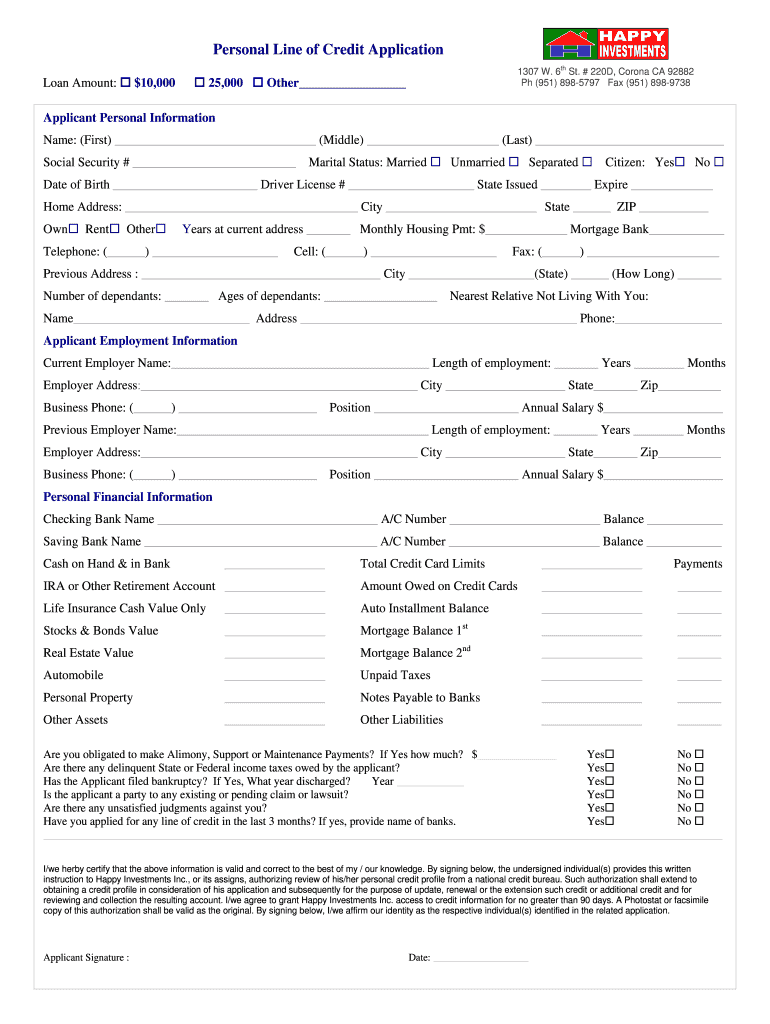

Personal Line of Credit Application Loan Amount: $10,000 25,000 1307 W. 6th St. # 220D, Corona CA 92882 pH (951) 898-5797 Fax (951) 898-9738 Other Applicant Personal Information Name: (First) (Middle)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal line of credit

Edit your personal line of credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal line of credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal line of credit online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit personal line of credit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal line of credit

How to fill out a personal line of credit:

01

Start by researching different financial institutions that offer personal lines of credit. Look for reputable banks or online lenders that have favorable terms and interest rates.

02

Once you have selected a lender, gather all the necessary documents and information they require. This usually includes proof of income, employment details, identification documents, and your credit history.

03

Contact the lender or visit their website to begin the application process. Fill out the necessary forms and provide all the required information accurately and honestly.

04

Be prepared to provide details about the amount of credit you are seeking and the purpose of the line of credit. Personal lines of credit can be used for various purposes, such as financing unexpected expenses, home improvements, or consolidating higher-interest debt.

05

As part of the application process, the lender may request additional documentation or ask for clarification on certain information. It is important to promptly respond to any requests to avoid delays in the approval process.

06

After submitting your application, the lender will review your information and make an assessment based on factors such as your credit history, income level, and debt-to-income ratio.

07

If your application is approved, you will receive a notification from the lender, along with the terms and conditions of the line of credit. Carefully review the terms, including the interest rate, repayment schedule, and any fees associated with the line of credit.

Who needs a personal line of credit:

01

Individuals who need financial flexibility: A personal line of credit can provide a safety net for unexpected expenses or emergencies. Having access to a line of credit can help cover unforeseen costs without resorting to high-interest credit cards or other costly forms of borrowing.

02

Homeowners planning renovations or repairs: If you are a homeowner considering making improvements to your property, a personal line of credit can be a practical financing option. It allows you to borrow the necessary funds as you need them, and you only pay interest on the amount you use.

03

Small business owners or self-employed individuals: A personal line of credit can be beneficial for those who are self-employed or have a small business. It can help with cash flow management, bridge temporary gaps in revenue, or cover business expenses during lean periods.

04

Individuals looking to consolidate debt: If you have multiple high-interest debts, such as credit card balances or personal loans, a personal line of credit can be used to consolidate these debts into one lower-interest payment. This can potentially save you money on interest and make it easier to manage your finances.

05

Those seeking to build or improve their credit: Responsible use of a personal line of credit can positively impact your credit history and score. Making timely payments and managing your credit wisely demonstrates financial responsibility to potential lenders and may lead to better borrowing options in the future.

Remember, before applying for a personal line of credit, it is important to assess your financial situation and determine whether it is the right borrowing option for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is personal line of credit?

A personal line of credit is a type of loan that allows you to borrow money as needed up to a certain limit. It is revolving credit that can be used for various purposes such as home renovations, debt consolidation, or emergencies.

Who is required to file personal line of credit?

Individuals who apply for a personal line of credit from a financial institution are required to file for it.

How to fill out personal line of credit?

To fill out a personal line of credit, you will need to provide personal information, financial details, and agree to the terms and conditions set by the lender.

What is the purpose of personal line of credit?

The purpose of a personal line of credit is to provide borrowers with access to funds that can be used for various expenses and financial needs.

What information must be reported on personal line of credit?

The information that must be reported on a personal line of credit includes personal identification, income details, employment information, and credit history.

How do I modify my personal line of credit in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your personal line of credit and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I create an electronic signature for the personal line of credit in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your personal line of credit in seconds.

How do I edit personal line of credit straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing personal line of credit.

Fill out your personal line of credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Line Of Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.