Get the free Tax map and parcel #

Show details

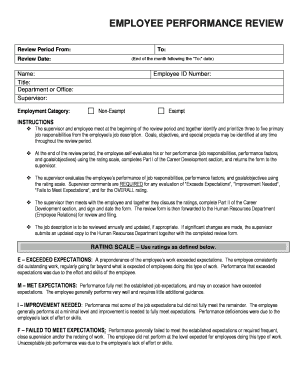

U.S. DEPARTMENT OF AGRICULTURE Farm Service Agency 21315 Berlin Road, Unit 1 Georgetown, DE 19947Class II Environmental AssessmentEstablishment of New Poultry Operation Sussex County, DelawareTax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax map and parcel

Edit your tax map and parcel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax map and parcel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax map and parcel online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax map and parcel. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax map and parcel

How to fill out tax map and parcel

01

Obtain the tax map from your local assessor's office or their website.

02

Identify the property for which you are filling out the tax map and parcel information.

03

Locate the corresponding parcel number, usually found on property tax bills or official documents.

04

Fill in the property details including owner name, address, and any relevant identification numbers.

05

Verify the land use classification and zoning information if required.

06

Include any additional details such as improvements, buildings, or special features of the property.

07

Review all information for accuracy before submission.

Who needs tax map and parcel?

01

Property owners wishing to understand their property taxes.

02

Real estate agents and buyers during property transactions.

03

Tax assessors for valuation and assessment purposes.

04

Banks and financial institutions for mortgage applications.

05

Local government or agencies for planning and zoning decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax map and parcel directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign tax map and parcel and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make edits in tax map and parcel without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing tax map and parcel and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the tax map and parcel electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your tax map and parcel in seconds.

What is tax map and parcel?

A tax map and parcel is a detailed representation of real estate properties used by local tax authorities to assess property taxes. Each parcel is assigned a unique identifier that helps in tracking ownership, boundaries, and tax obligations.

Who is required to file tax map and parcel?

Property owners, real estate developers, and entities involved in property transactions are typically required to file tax map and parcel information to ensure accurate property tax assessment.

How to fill out tax map and parcel?

To fill out a tax map and parcel, one must provide detailed information about the property, including its location, boundaries, ownership details, and any improvements made. It is important to follow local guidelines and use the correct forms provided by the tax authority.

What is the purpose of tax map and parcel?

The purpose of tax map and parcel is to facilitate the assessment and collection of property taxes. They help local governments manage land use, zoning, and planning, and maintain accurate records of property ownership and value.

What information must be reported on tax map and parcel?

The information that must be reported on tax map and parcel includes property address, parcel number, lot dimensions, acreage, property type, owner information, and any improvements or structures on the property.

Fill out your tax map and parcel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Map And Parcel is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.