VA VRS-75 2025 free printable template

Get, Create, Make and Sign vrs-75

How to edit vrs-75 online

Uncompromising security for your PDF editing and eSignature needs

VA VRS-75 Form Versions

How to fill out vrs-75

How to fill out orparp health insurance credit

Who needs orparp health insurance credit?

Instructions and Help about vrs-75

>Sgt;Text: Applying for Survivor Benefits through the Fully Developed Claims Process Sgt;>Graphics: U.S. Department of Veterans Affairs Seal and Logo Sgt;>Narrator: Overview of VA Form 21-534EZ, Application for DIC, Survivors Pension and/or Accrued Benefits, Part One This is Part One of a two-part video series. This part will provide a general overview and cover topics related to pages 1-5 of VA Form 21-534EZ. While there are over 21.8 million living Veterans today that have served our country, VA has not forgotten the sacrifices made by our nation’s fallen soldiers and their families. President Lincoln's second inaugural address so eloquently stated VA’s obligation: “…to care for him who shall have borne the battle and for his widow and his orphan.” Through VA’s Dependency and Indemnity Compensation (DIC), Survivors Pension, and Accrued benefits, VA provides support to eligible survivors of military Service members and Veterans. VA now offers a way for survivors to obtain these benefits faster through the Fully Developed Claims, or FDC, Program. This Program uses new and simplified application forms that tell survivors exactly what records and documentation are required to support their claim. In this video, we will quickly walk through: DIC and Survivors Pension benefits, and VA Form 21-534EZ Application for DIC, Death Pension, and/or Accrued Benefits, which allows eligible survivors to file an FDC for DIC, Survivors Pension, and/or Accrued Benefits. We will also: Review what survivors need to know to accurately file an FDC, and Provide important reminders and tips to ensure documentation is complete and ready for claims submission and review. DIC is a tax-free monetary benefit paid to eligible survivors of military Service members who died in the line of duty, or eligible survivors of Veterans whose death resulted from a service-related injury or disease, or who were rated totally disabled from their service-connected disabilities for a certain period of time. Survivors may include a spouse, unmarried children and in some cases, parents of certain deceased Veterans. Information on eligibility requirements may be found at www.benefits.va.gov. To qualify for DIC, a surviving spouse must generally have been: Married to a Service member who died on active duty, active duty for training, or inactive duty training, OR Been married to a Veteran for at least one year, OR Had a child with a Veteran, AND Cohabited with a Veteran continuously until the Veteran's death or, if separated, was not at fault for the separation, AND is not currently remarried. Note that if you are a surviving spouse and remarry on or after December 16, 2003, and on or after attaining age 57, then you are entitled to continue to receive DIC. If you are a surviving child, you are also eligible for DIC if you are: Not included on a surviving spouse's DIC, AND Unmarried, AND Under age 18, or between the ages of 18 and 23 and attending school. DIC claims by parents of a Veteran are...

People Also Ask about

Does Virginia Retirement System have an app?

Can I cash out my VRS?

Do VRS retirees have life insurance?

Does VRS pension reduce Social Security?

How many years to retire from VRS?

How long does VRS retirement last?

What are the requirements for Virginia State retirement?

How do I start the retirement process?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my vrs-75 in Gmail?

Can I sign the vrs-75 electronically in Chrome?

How do I complete vrs-75 on an iOS device?

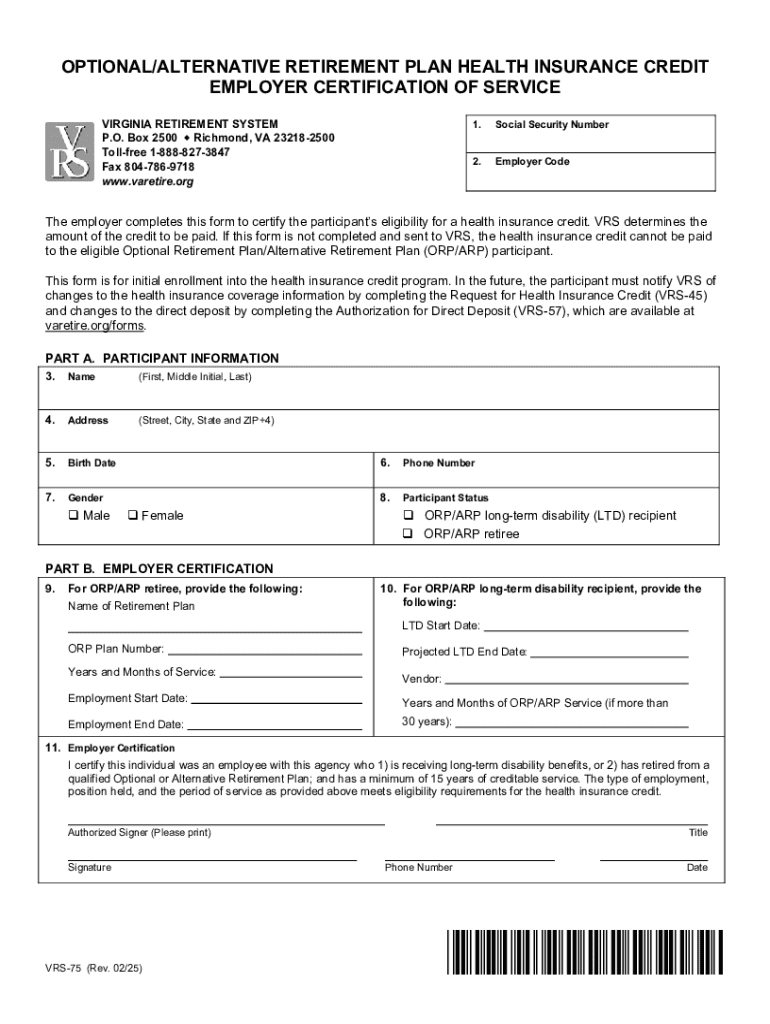

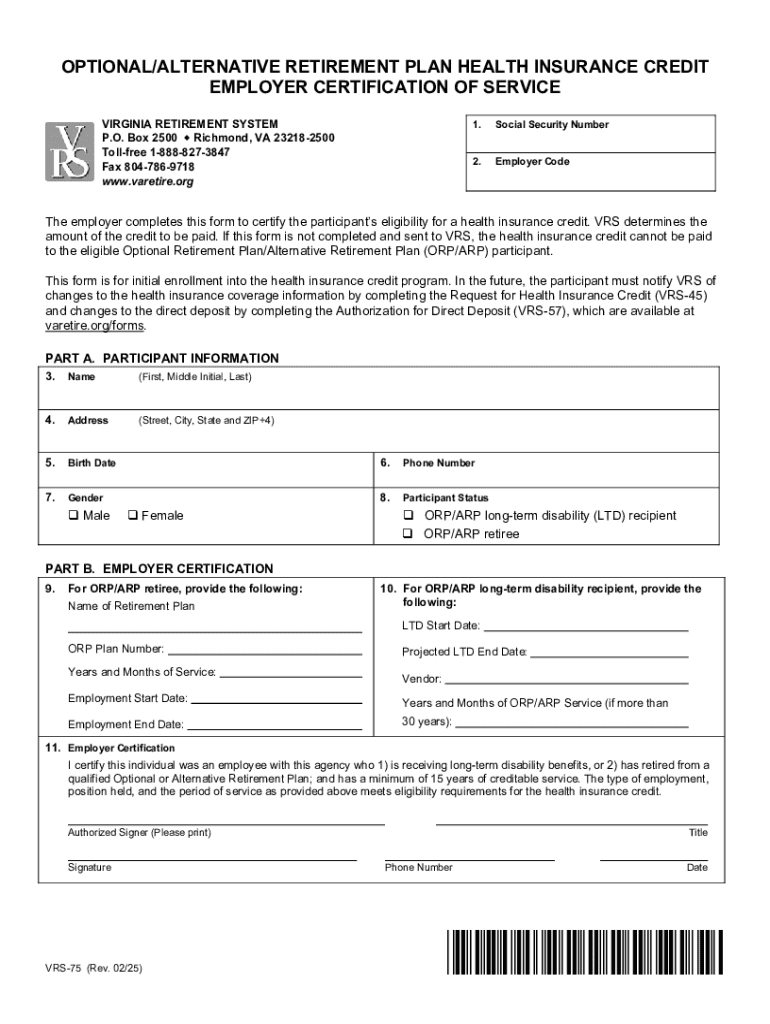

What is vrs-75?

Who is required to file vrs-75?

How to fill out vrs-75?

What is the purpose of vrs-75?

What information must be reported on vrs-75?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.