Get the free Occasional Duty Fees & Expenses Claim Form

Show details

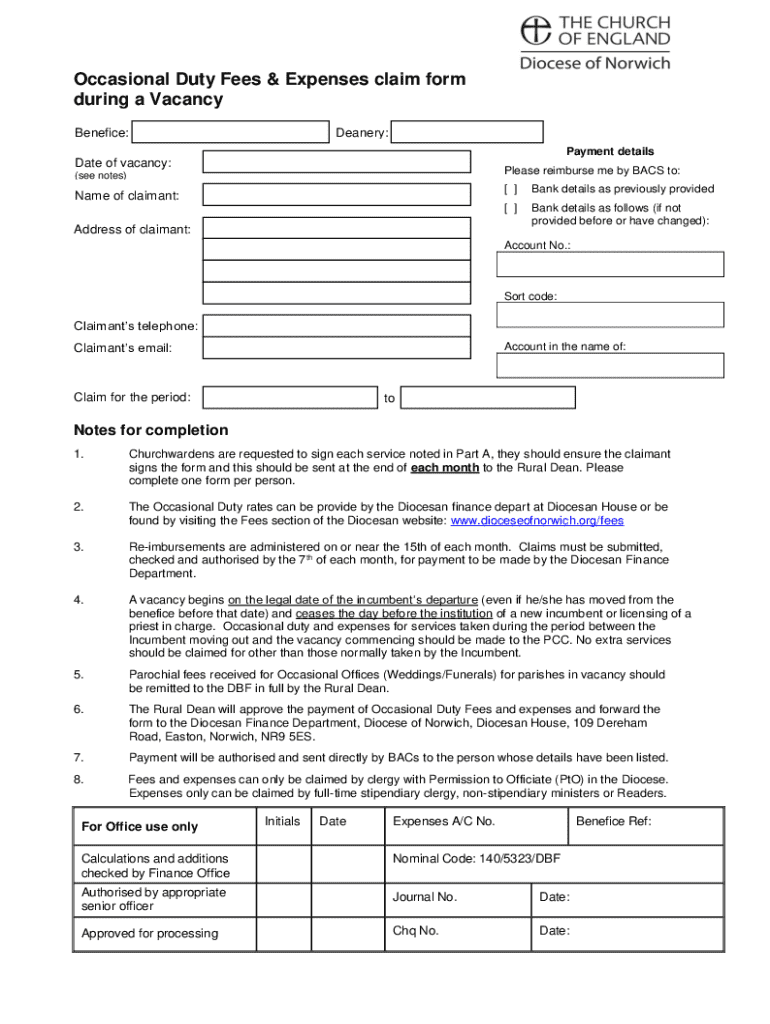

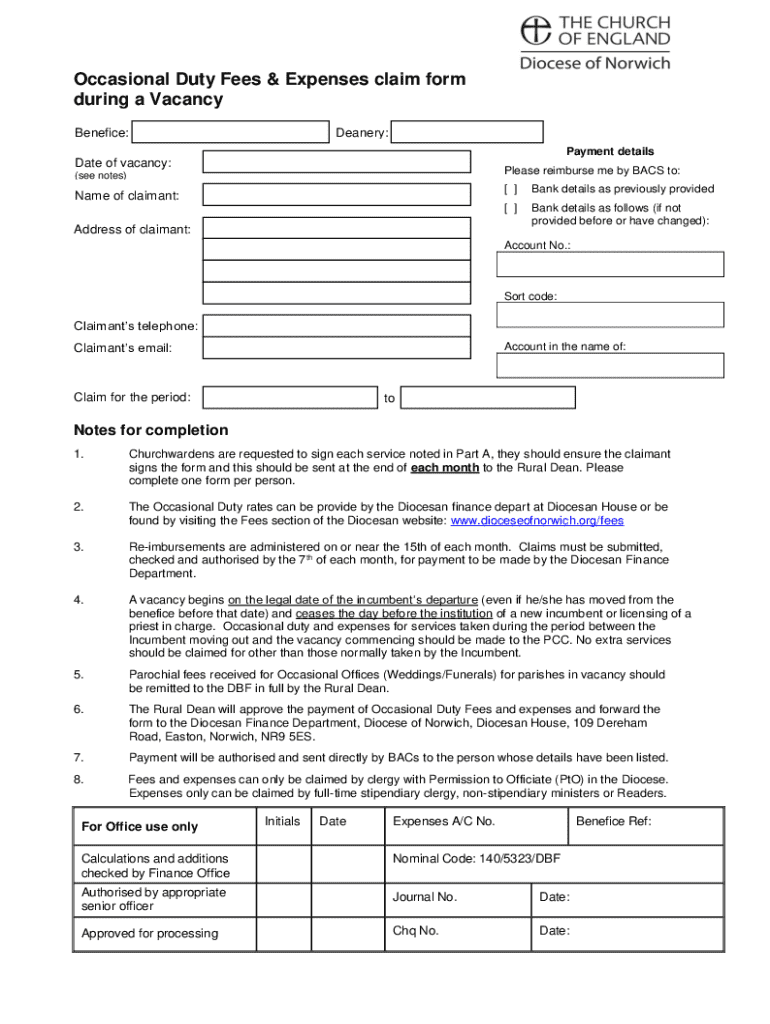

Este formulario se utiliza para reclamar tarifas y gastos de deber ocasional durante una vacante en el beneficio. Incluye detalles sobre la reclamación, instrucciones para completar, y procedimientos

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign occasional duty fees expenses

Edit your occasional duty fees expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your occasional duty fees expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing occasional duty fees expenses online

Follow the steps down below to take advantage of the professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit occasional duty fees expenses. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out occasional duty fees expenses

How to fill out occasional duty fees expenses

01

Gather all relevant receipts for expenses related to occasional duties.

02

Organize your receipts by date and type of expense.

03

Fill out the occasional duty fees expenses form with your name and contact information.

04

List each expense under the appropriate category (e.g., travel, meals, supplies).

05

Enter the date of each expense and the total amount in the designated fields.

06

Provide a brief description of each expense to clarify its purpose.

07

Attach photocopies of the receipts to the completed form.

08

Review the form for accuracy, ensuring all information is correct.

09

Submit the completed form along with the receipts to the appropriate department for reimbursement.

Who needs occasional duty fees expenses?

01

Employees who undertake occasional duties and incur related expenses.

02

Contractors or freelancers who are hired for specific tasks and need to claim reimbursement.

03

Organizations that provide stipends or reimbursements for work-related expenses.

04

Anyone who is required to report and document their occasional duty fees for accounting purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete occasional duty fees expenses online?

pdfFiller has made it easy to fill out and sign occasional duty fees expenses. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit occasional duty fees expenses on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute occasional duty fees expenses from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete occasional duty fees expenses on an Android device?

Complete occasional duty fees expenses and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is occasional duty fees expenses?

Occasional duty fees expenses refer to the costs incurred related to duties and fees that are not regularly occurring, typically associated with customs duties for imports or specific transactions.

Who is required to file occasional duty fees expenses?

Individuals or businesses that import goods and are subject to customs duties and related fees are required to file occasional duty fees expenses.

How to fill out occasional duty fees expenses?

To fill out occasional duty fees expenses, one must gather necessary documentation regarding the importation or transaction, complete the appropriate forms detailing the costs incurred, and submit them to the relevant customs or tax authority.

What is the purpose of occasional duty fees expenses?

The purpose of occasional duty fees expenses is to accurately account for and report incurred duties and fees as part of financial records, ensuring compliance with tax regulations and customs laws.

What information must be reported on occasional duty fees expenses?

Information that must be reported includes the total amount of duties and fees paid, the description of the goods imported, the date of the transaction, and other relevant particulars as required by customs authorities.

Fill out your occasional duty fees expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Occasional Duty Fees Expenses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.