Get the free independent insurance for career people

Show details

Independent insurance for career people comprehensive travel insurance policy ? 0601:229/V2 End sleigh Insurance Services Limited. Company No: 856706 registered in England at Burlington Road, Cheltenham

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent insurance for career

Edit your independent insurance for career form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent insurance for career form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit independent insurance for career online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit independent insurance for career. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

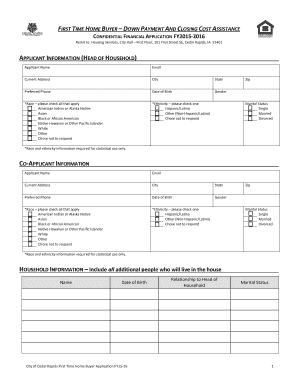

How to fill out independent insurance for career

How to fill out independent insurance for career:

01

Research and understand the different types of independent insurance available for your career. This may include health insurance, disability insurance, liability insurance, or other specific types depending on your profession.

02

Determine the coverage needs specific to your career. Consider factors such as the level of risk involved in your profession, the potential financial impact of any unforeseen events or accidents, and any legal or regulatory requirements for your industry.

03

Shop around and compare different insurance providers. Obtain quotes from multiple insurers to ensure you are getting the best coverage at the most competitive rates. Look for insurers with a strong reputation and a track record of reliable customer service.

04

Read the policy details carefully. Understand the terms, conditions, and exclusions of the insurance policy you are considering. Pay close attention to the coverage limits, deductibles, and any additional riders or endorsements that may be necessary or beneficial for your specific career.

05

Gather all necessary documentation and information. This may include personal identification documents, proof of income, medical information, and any other relevant details required by the insurance provider. Ensure that all information provided is accurate and truthful, as any misrepresentation may result in denial of coverage or potential legal consequences.

06

Complete the application form accurately and thoroughly. Double-check all the information you have provided to ensure its accuracy and completeness. Be prepared to disclose any prior claims, pre-existing conditions, or other relevant details that may impact the insurance coverage.

07

Submit the application along with any required documentation. Follow the instructions provided by the insurance provider to submit your application. Keep copies of all submitted documents for your records.

Who needs independent insurance for career:

01

Self-employed individuals: Independent insurance is crucial for individuals who work for themselves and do not have the benefit of employer-provided insurance. This includes freelancers, contractors, consultants, and entrepreneurs.

02

Professionals in high-risk industries: Certain professions, such as construction workers, electricians, or medical practitioners, carry a higher risk of accidents or liability claims. Independent insurance can help protect these professionals from financial losses and legal costs associated with potential risks.

03

Individuals with specialized skills: If your career requires specific skills or knowledge, such as a personal trainer, nutritionist, or IT consultant, independent insurance can offer protection against claims arising from professional negligence or errors.

04

Those seeking additional coverage: Even if you have employer-provided insurance, it may not be sufficient to cover all potential risks associated with your career. Independent insurance can provide additional coverage and peace of mind.

05

Those without access to group insurance: Some individuals may not have access to group insurance plans, such as part-time employees, temporary workers, or individuals who are not eligible for employer benefits. Independent insurance can fill this gap and provide coverage tailored to their specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is independent insurance for career?

Independent insurance for career is a type of insurance coverage that individuals may purchase to protect their income in case they are unable to work due to illness, injury, or disability.

Who is required to file independent insurance for career?

Individuals who rely on their income to support themselves or their families may choose to purchase independent insurance for career.

How to fill out independent insurance for career?

To fill out independent insurance for career, individuals must provide information about their occupation, income, medical history, and desired coverage amount.

What is the purpose of independent insurance for career?

The purpose of independent insurance for career is to provide financial protection in case individuals are unable to work due to illness or injury.

What information must be reported on independent insurance for career?

Information such as occupation, income, medical history, and coverage amount must be reported on independent insurance for career.

How can I manage my independent insurance for career directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your independent insurance for career and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send independent insurance for career for eSignature?

Once your independent insurance for career is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I edit independent insurance for career on an Android device?

The pdfFiller app for Android allows you to edit PDF files like independent insurance for career. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your independent insurance for career online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Insurance For Career is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.