Get the free Schedule P

Show details

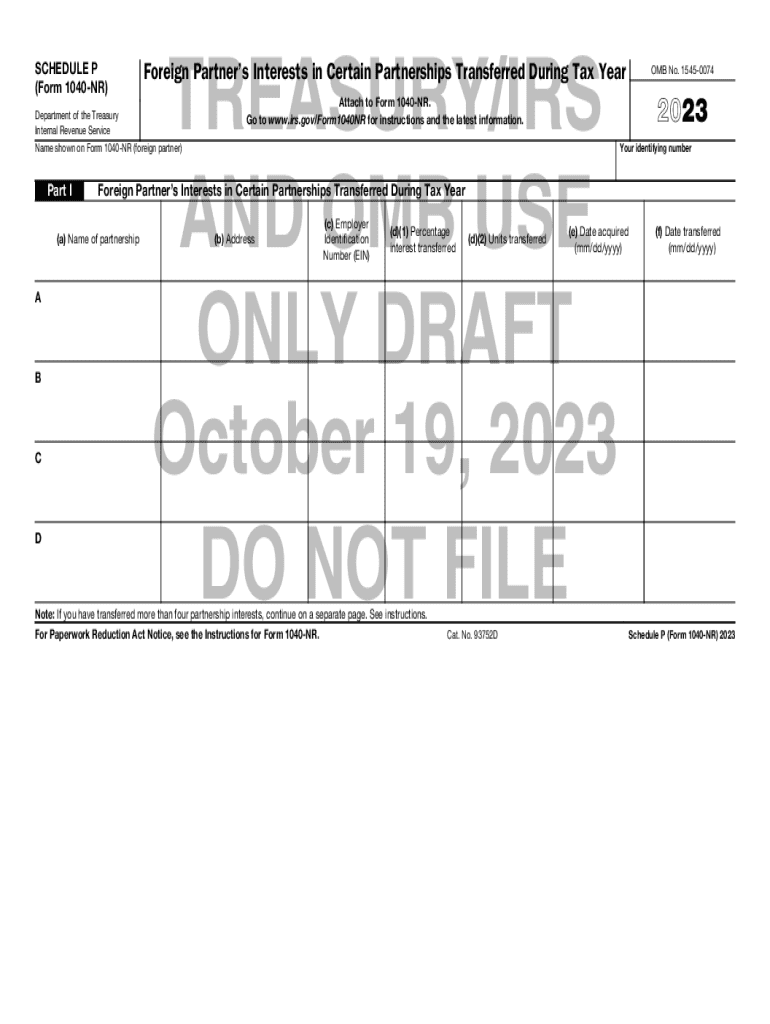

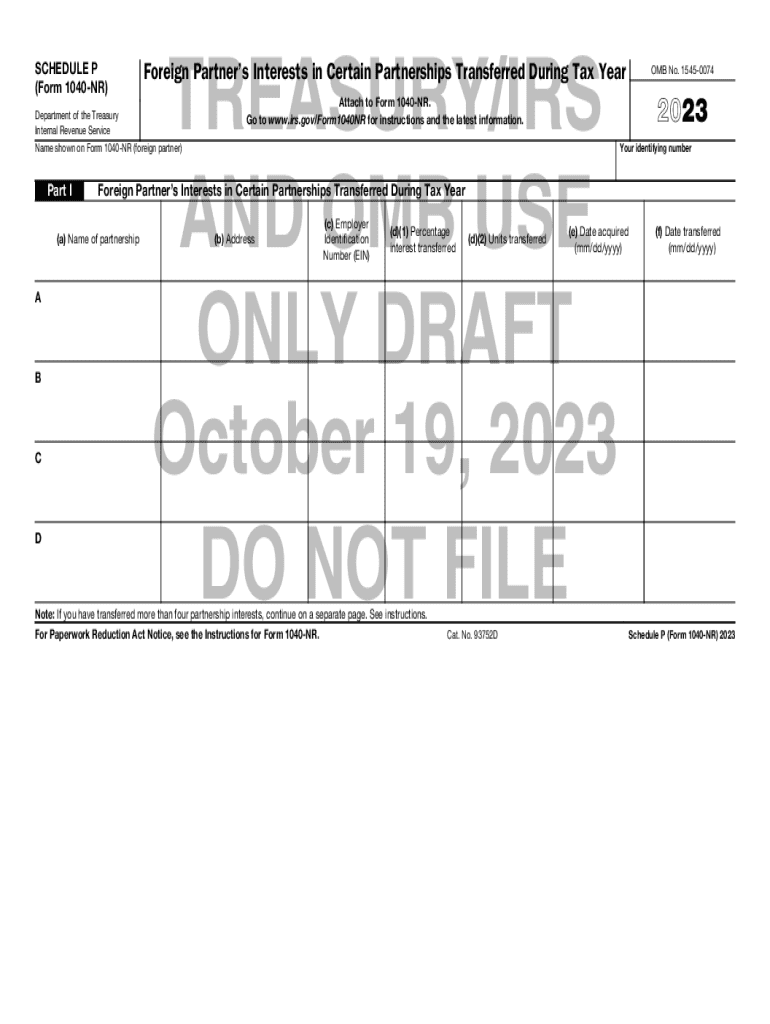

Este es un borrador anticipado del formulario IRS 1040-NR que se ocupa de los intereses de socios extranjeros en ciertas sociedades transferidos durante el año fiscal. No se debe presentar el formulario

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule p

Edit your schedule p form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule p form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule p online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit schedule p. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule p

How to fill out schedule p

01

Gather all relevant income information from your spouse, including wages, interest, and dividends.

02

Collect documentation for any adjustments such as IRA contributions or student loan interest.

03

Determine the total income that qualifies for filing Schedule P based on your household situation.

04

Fill out your basic information at the top of the form, including names and Social Security numbers.

05

Detail each income category in the designated sections, ensuring all numbers add up correctly.

06

Input any adjustments to income in the appropriate sections of the form.

07

Review the completed Schedule P for accuracy, ensuring that it reflects your combined income accurately.

08

Attach the completed Schedule P to your main tax return.

Who needs schedule p?

01

Schedule P is typically needed by married couples filing jointly who have combined income sources to report.

02

Individuals who have income adjustments that need to be reported together with their spouse's income may also need it.

03

Those who qualify for specific tax deductions or credits might require Schedule P to report adjusted income levels.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute schedule p online?

Filling out and eSigning schedule p is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit schedule p on an iOS device?

Create, edit, and share schedule p from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete schedule p on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your schedule p. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is schedule p?

Schedule P is a tax form used to report the income, deductions, and other tax-related information for certain types of entities, often in the context of partnership returns.

Who is required to file schedule p?

Entities such as partnerships, limited liability companies (LLCs) treated as partnerships, and other pass-through entities are typically required to file Schedule P.

How to fill out schedule p?

To fill out Schedule P, taxpayers need to gather relevant financial data, complete the form by entering the required income, deductions, and other specific information, and then submit it with their tax return.

What is the purpose of schedule p?

The purpose of Schedule P is to provide detailed reporting of income and deductions for partnerships and pass-through entities, helping the IRS evaluate the tax obligations of these entities.

What information must be reported on schedule p?

Schedule P requires reporting information such as total income, deductions, partner allocations, distributions, and any other relevant financial data necessary for accurate tax assessment.

Fill out your schedule p online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule P is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.