Get the free OVERDRAFT PROTECTION AND OVERDRAFT PRIVILEGE

Show details

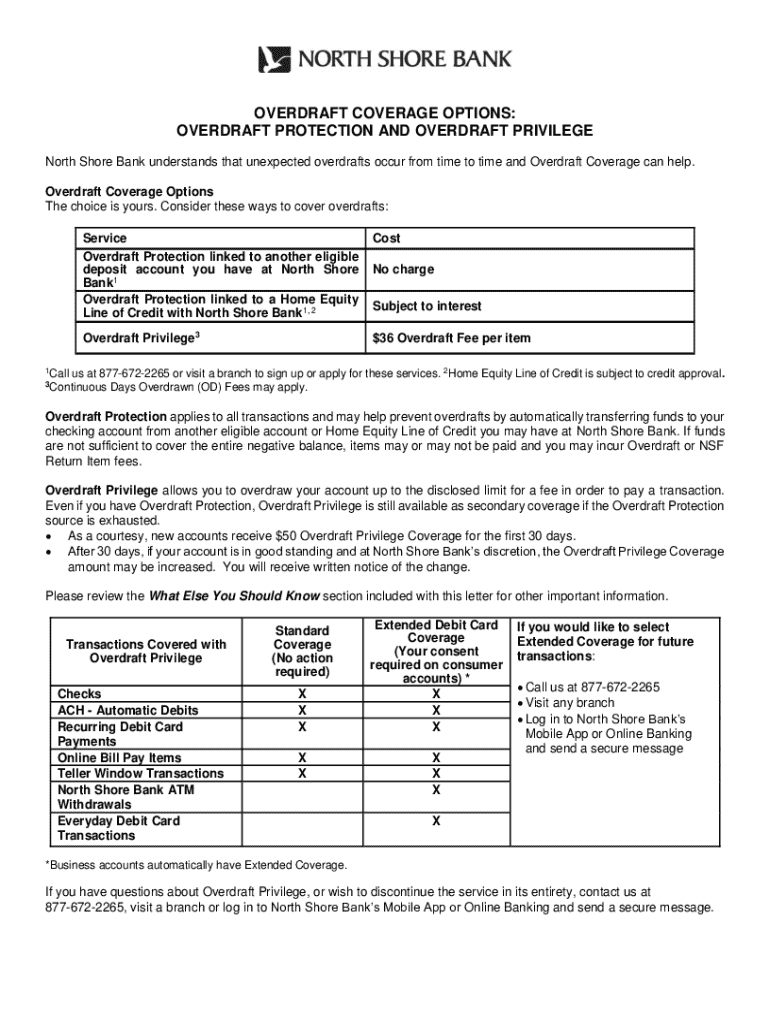

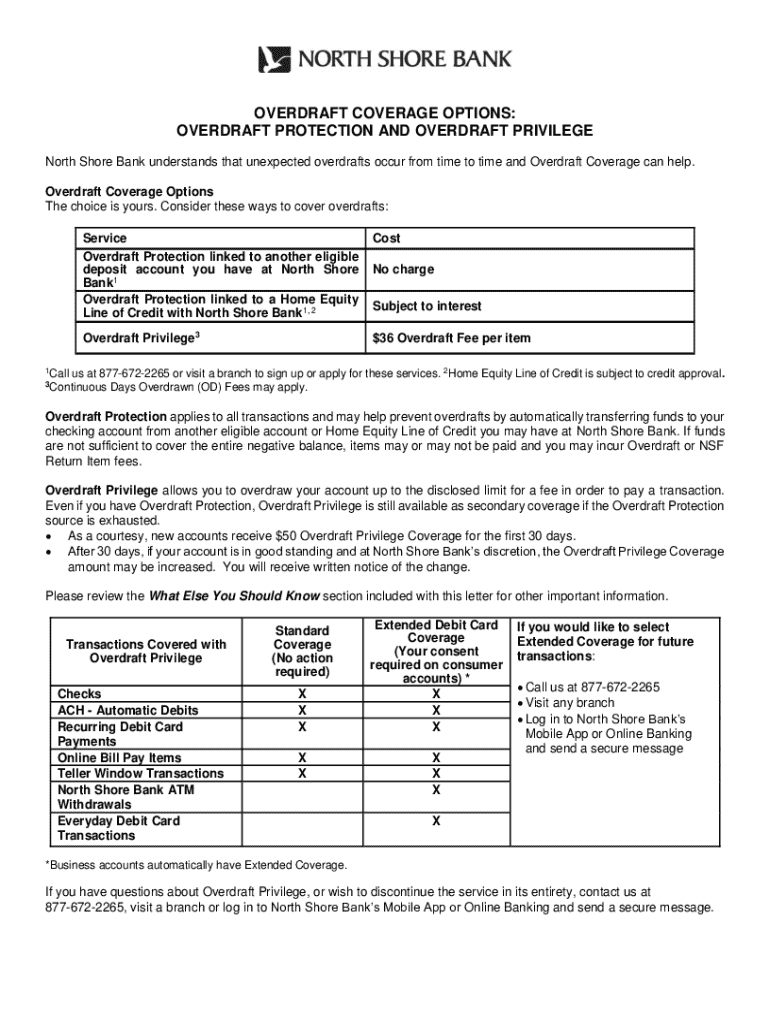

OVERDRAFT COVERAGE OPTIONS: OVERDRAFT PROTECTION AND OVERDRAFT PRIVILEGE North Shore Bank understands that unexpected overdrafts occur from time to time and Overdraft Coverage can help. Overdraft

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign overdraft protection and overdraft

Edit your overdraft protection and overdraft form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your overdraft protection and overdraft form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing overdraft protection and overdraft online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit overdraft protection and overdraft. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out overdraft protection and overdraft

How to fill out overdraft protection and overdraft

01

Log in to your bank account online or visit a local bank branch.

02

Locate the section for overdraft services or protection.

03

Read the terms and conditions carefully to understand the fees and limits.

04

Fill out the application form, providing necessary personal and account information.

05

Select the type of overdraft protection you want, such as linking to savings or a credit line.

06

Review your application for accuracy and submit it online or in-person.

07

Wait for confirmation from your bank regarding your overdraft protection approval.

Who needs overdraft protection and overdraft?

01

Individuals who frequently spend close to their account balance.

02

Those with variable income or unpredictable expenses.

03

People who want to avoid declined transactions or bounced checks.

04

Individuals who prefer peace of mind while managing their finances.

05

Customers who may occasionally require emergency funds to cover unexpected expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit overdraft protection and overdraft straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing overdraft protection and overdraft.

Can I edit overdraft protection and overdraft on an Android device?

You can make any changes to PDF files, such as overdraft protection and overdraft, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I complete overdraft protection and overdraft on an Android device?

Complete overdraft protection and overdraft and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is overdraft protection and overdraft?

Overdraft protection is a financial service that allows a bank account holder to make transactions even when there are insufficient funds in their account, effectively covering the shortfall. An overdraft is the result of an account holder withdrawing more money than is available in their account, leading to a negative balance.

Who is required to file overdraft protection and overdraft?

Typically, account holders who want to utilize overdraft protection must opt in and may need to meet specific eligibility criteria set by their financial institution. Banks may require personal identification and account information for these processes.

How to fill out overdraft protection and overdraft?

To fill out an application for overdraft protection, individuals usually need to provide personal information, account details, and possibly sign an agreement that outlines the terms and conditions of the overdraft service.

What is the purpose of overdraft protection and overdraft?

The purpose of overdraft protection is to prevent declined transactions and potential fees by covering shortfalls in a bank account. It helps maintain a good credit rating and ensures customers can complete necessary transactions even with insufficient funds.

What information must be reported on overdraft protection and overdraft?

Information that must be reported on overdraft protection includes the account holder's name, account number, overdraft limits, fees associated with the overdraft service, and any repayment terms.

Fill out your overdraft protection and overdraft online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Overdraft Protection And Overdraft is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.