Get the free hatc self declaration form

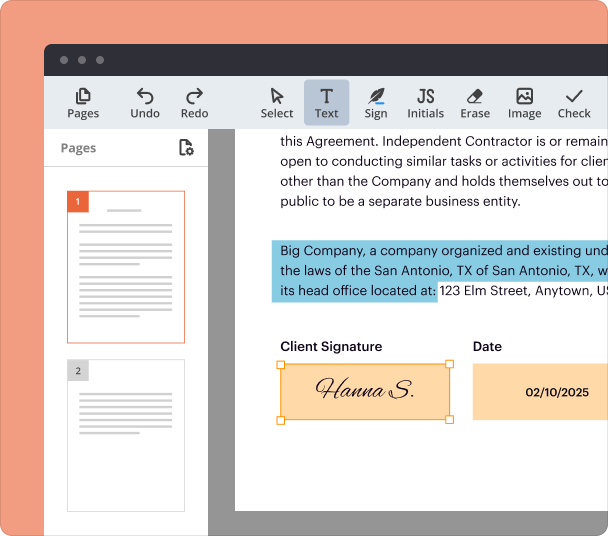

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

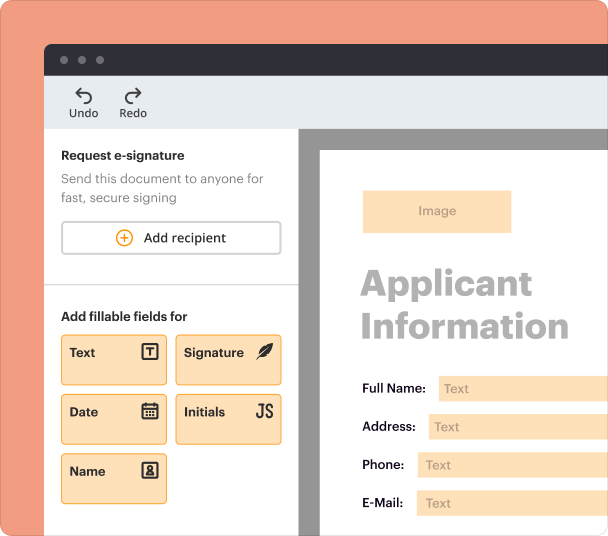

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

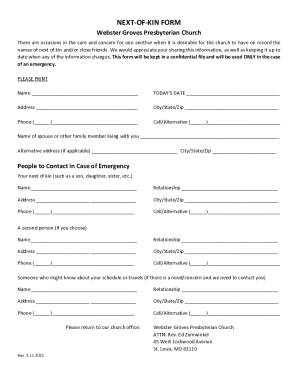

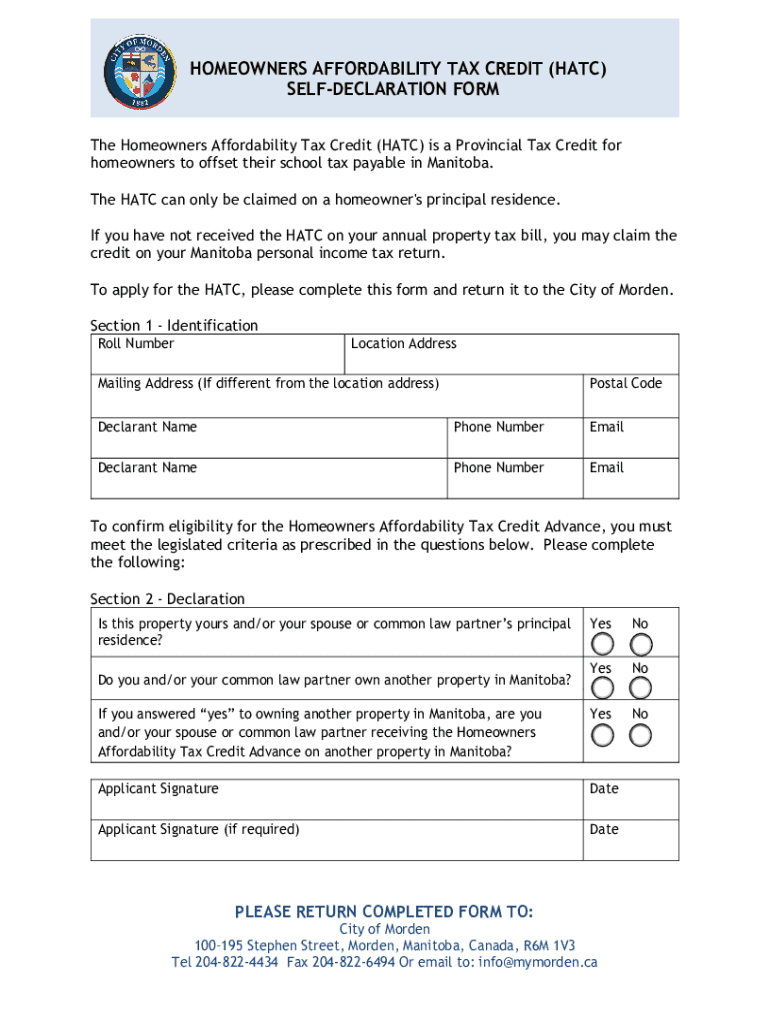

Understanding the HATC Self Declaration Form

Overview of the HATC Self Declaration Form

The Homeowners Affordability Tax Credit (HATC) Self Declaration Form is a crucial document provided by local authorities for eligible homeowners in the United States. This form is designed for individuals seeking to declare their eligibility for the tax credit, which helps offset their school tax obligations. It must be filled out accurately and submitted to the relevant city office to claim benefits.

Eligibility Criteria for the HATC Self Declaration Form

To qualify for the HATC, applicants must ensure that the property listed is their principal residence. Additionally, the applicant should not be claiming the tax credit on any other property. Understanding these criteria is essential for anyone looking to complete the HATC Self Declaration Form successfully.

How to Fill the HATC Self Declaration Form

Filling out the HATC Self Declaration Form involves several key steps to ensure accuracy. Start by entering your identification information, including your roll number, location address, and mailing address if different. Follow with your name, phone number, and email. When addressing eligibility questions, be truthful about ownership and prior claims. Sign and date the form to validate your submission.

Required Documents and Information for Submission

When preparing to submit the HATC Self Declaration Form, it is essential to gather necessary documentation. This may include proof of residency such as a utility bill or property ownership documents. Ensure that all personal contact details provided, including phone numbers and emails, are current and correct to facilitate communication with local tax authorities.

Common Errors and Troubleshooting

Accuracy is vital when completing the HATC Self Declaration Form. Common errors include incorrect roll numbers, misreported addresses, and failure to sign or date the form. To reduce these errors, review your form thoroughly before submission. It is advisable to cross-check all provided information against your official documents.

Submission Methods for the HATC Self Declaration Form

Once the HATC Self Declaration Form is completed, it can be submitted in various ways, depending on local regulations. Common submission methods include mailing the form to the local city office, delivering it in person, or possibly emailing a scanned copy to the designated email address. Check specific instructions from your local tax authority to ensure compliance.

Frequently Asked Questions about homeowners affordability tax credit self declaration form

Who can fill out the HATC Self Declaration Form?

The HATC Self Declaration Form can be filled out by homeowners who are eligible for the Homeowners Affordability Tax Credit and claim the property as their principal residence.

What happens if I submit incorrect information on my HATC Self Declaration Form?

Submitting incorrect information can lead to delays or denial of your tax credit claim. It is important to verify all details before submission to avoid complications.

pdfFiller scores top ratings on review platforms