Get the free Business Return of Tangible Personal Property Tax

Show details

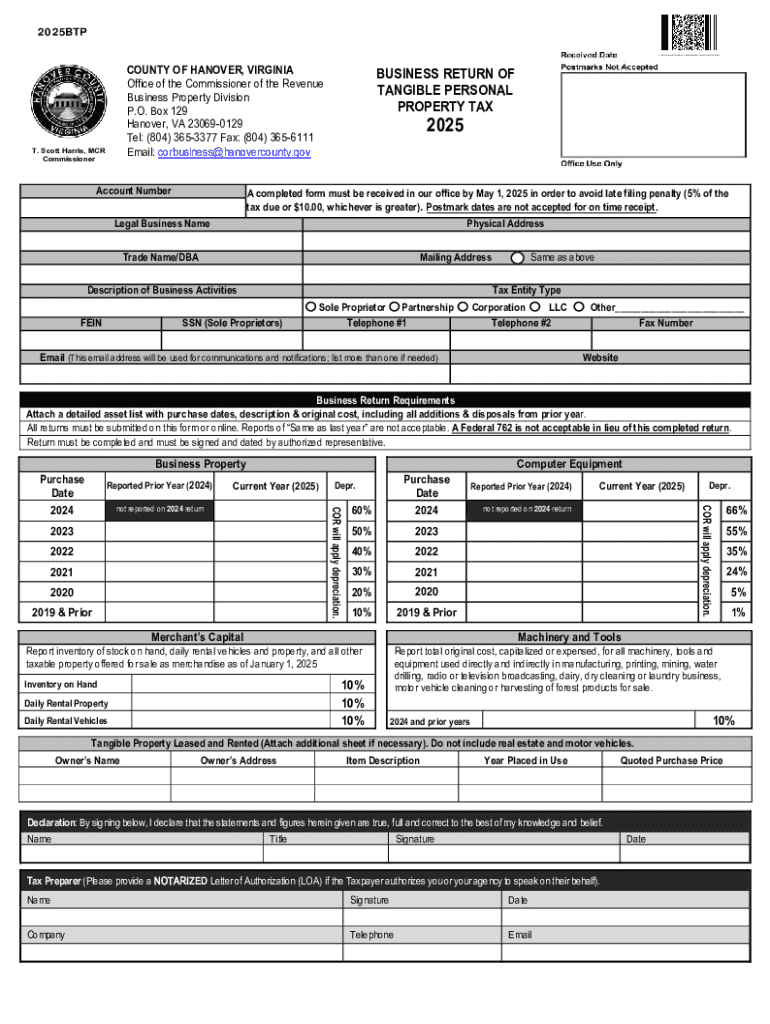

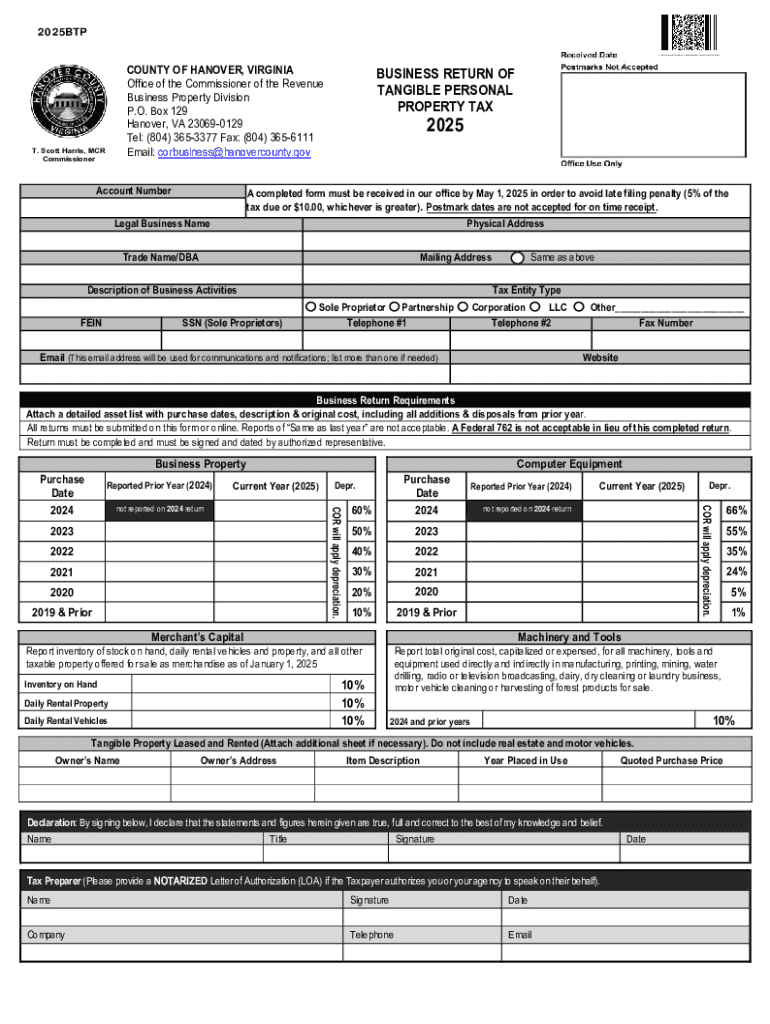

Este formulario es requerido por la Oficina del Comisionado de Ingresos de Hanover County, Virginia, para que todos los propietarios de negocios presenten un retorno de propiedad personal tangible

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business return of tangible

Edit your business return of tangible form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business return of tangible form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business return of tangible online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit business return of tangible. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business return of tangible

How to fill out business return of tangible

01

Gather necessary financial documents, such as income statements and balance sheets.

02

Identify the type of tangible assets your business owns, including equipment, machinery, and property.

03

Complete the business return form by entering the total value of the tangible assets.

04

Provide details about the acquisition date and depreciation methods used for the assets.

05

Attach any supporting documentation, such as receipts or invoices proofing the purchase of the tangible assets.

06

Review the completed form to ensure accuracy and completeness before submission.

07

Submit the business return of tangible to the appropriate tax authority by the designated deadline.

Who needs business return of tangible?

01

Businesses that own tangible assets and are liable to report their value for tax purposes.

02

Small and medium-sized enterprises (SMEs) looking to comply with local tax regulations.

03

Corporations that require an official declaration of tangible assets for accounting and reporting.

04

Professionals and consultants who manage or advise clients on asset management and taxation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get business return of tangible?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the business return of tangible in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute business return of tangible online?

pdfFiller has made filling out and eSigning business return of tangible easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for signing my business return of tangible in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your business return of tangible and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is business return of tangible?

The business return of tangible refers to a tax form used to report the value of tangible personal property owned by a business, which includes items like equipment, machinery, and furniture.

Who is required to file business return of tangible?

Businesses that own tangible personal property and are subject to property tax in their jurisdiction are required to file a business return of tangible.

How to fill out business return of tangible?

To fill out a business return of tangible, gather all relevant information about your tangible assets, complete the form by entering the asset details, values, and any other required information, and then submit it to the appropriate tax authority.

What is the purpose of business return of tangible?

The purpose of the business return of tangible is to report the taxable value of tangible personal property to ensure the correct amount of property tax is assessed.

What information must be reported on business return of tangible?

The information that must be reported on a business return of tangible typically includes the description of the tangible assets, their location, acquisition cost, date of purchase, and current fair market value.

Fill out your business return of tangible online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Return Of Tangible is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.