Get the free Special Warranty Deed template

Show details

A special warranty deed to real estate offers protection to the buyer through the seller's guarantee that the title has been free and clear of encumbrances during their ownership of the property.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is special warranty deed

A special warranty deed is a type of real estate transfer document in which the seller guarantees that they have not incurred any title defects during their ownership, providing limited protection to the buyer.

pdfFiller scores top ratings on review platforms

Very easy to use

great, I'm new at insurance billing and you guys made it easy!

asny document templates ive needed ..its available and perfect ...easy and stress free

helper

I am still learning.

It is nice there is a free trial!

Who needs special warranty deed template?

Explore how professionals across industries use pdfFiller.

How to Complete a Special Warranty Deed Form on pdfFiller

Filling out a special warranty deed form can be a straightforward process if you understand the key components and steps involved. This guide will walk you through the essentials of the form, its components, and how to complete it on pdfFiller.

Understanding the special warranty deed

A special warranty deed is a legal document used in real estate transactions that guarantees the grantor (seller) only warrants that they have not done anything to affect the title during their period of ownership. Unlike a general warranty deed, which offers broader protections, the special warranty deed limits the seller's liability.

-

This deed type ensures protection for the grantee (buyer) against defects in the title that arose only during the grantor's ownership.

-

The main difference lies in the scope of warranties; general warranty deeds provide broader coverage while special warranty deeds are more limited.

-

Understanding these implications is crucial, as it affects recourse options in case of title disputes.

Key components of a special warranty deed

Filling out the form accurately is essential. A special warranty deed form contains several key components, all of which must be completed correctly.

-

These fields identify the transaction, the seller, and the buyer.

-

Ensure that all addresses are complete and accurate to avoid future disputes.

-

This is the value exchanged for the property, which must be clearly stated.

-

The property must be described in detail, including boundaries and any relevant characteristics.

-

Any existing agreements or encumbrances related to the property should be noted.

Steps to fill out a special warranty deed form

The process of filling out the form can be simplified by utilizing pdfFiller’s user-friendly platform.

-

Once logged in, you can find the template in the document directory.

-

Click on the fields to enter information or make corrections as needed.

-

You can invite team members to review or edit the document simultaneously.

-

Secure your document with an electronic signature, ensuring it’s legally binding.

-

Use pdfFiller’s cloud storage to keep your documents safe and accessible.

Common scenarios for using a special warranty deed

Special warranty deeds are commonly utilized in various real estate transactions, typically when the seller has limited knowledge about the property’s history.

-

Often used in sales by banks or developers who do not wish to assume liability for prior ownership issues.

-

Frequent in foreclosures, real estate resales by fiduciaries, or corporate transactions.

-

Each state may have unique laws governing the usage of special warranty deeds that must be adhered to.

State-by-state considerations for special warranty deeds

State laws differ significantly, affecting the use and execution of special warranty deeds.

-

In Alaska, for instance, all deeds must be notarized and filed in the appropriate recording office.

-

These can affect the deed’s validity, so it's essential to research local laws.

-

Consulting with a real estate attorney can help ensure compliance with all state regulations.

Comparative analysis: Special warranty vs. general warranty deeds

Understanding the pros and cons of special and general warranty deeds can guide buyers and sellers in making informed decisions.

-

Special warranty deeds are less comprehensive but also pose fewer liabilities for sellers.

-

In real estate transactions where liability limitation is prime, a special warranty deed may be ideal.

-

A series of obligations arise with each deed type, reflecting the varying levels of security for the buyer.

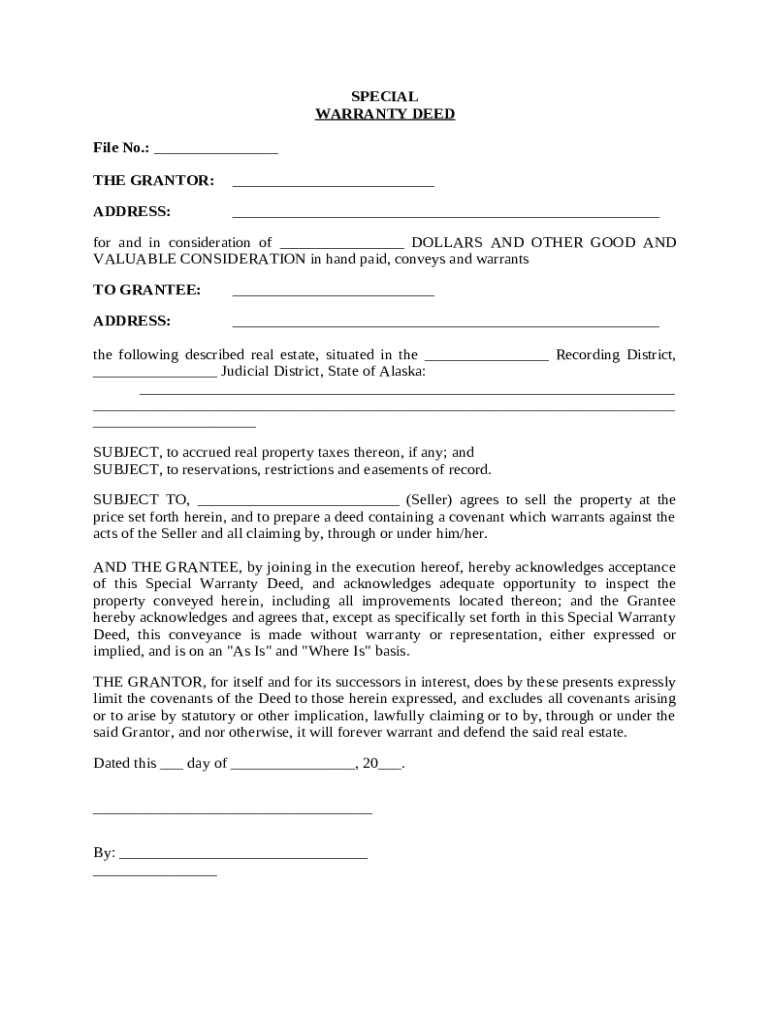

Sample special warranty deed

Visual aids can significantly enhance understanding when completing a special warranty deed.

-

An image of a filled-out form can clarify what a completed document looks like.

-

A detailed description of the specific sections helps users understand their functions.

-

Case studies showcasing successful transactions using special warranty deeds reinforce learning.

Finalizing and recording your special warranty deed

The completion of your special warranty deed is not the end of the process; it also requires notarization and recording.

-

Important to validate the document legally, notarizing it is often necessary.

-

The completed deed must be submitted to the local office responsible for maintaining property records.

-

Organizing your records in a system that allows easy access will save you future hassles.

How to fill out the special warranty deed template

-

1.Access pdfFiller and log in to your account.

-

2.Search for the special warranty deed form or upload a blank template if necessary.

-

3.Begin filling in the grantor's information, including their full name and address.

-

4.Next, enter the grantee's name and address; ensure both parties’ details are accurate.

-

5.Describe the property being transferred; include legal description, address, and parcel number.

-

6.In the area for the warranty clause, clearly state the limited warranty provided by the grantor.

-

7.Fill in the date of the transaction and any relevant tax information required for recording.

-

8.Review all entered information for accuracy and completeness before saving your document.

-

9.Once complete, choose to save or print the document; you can also securely share it as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.