Get the free pdffiller

Show details

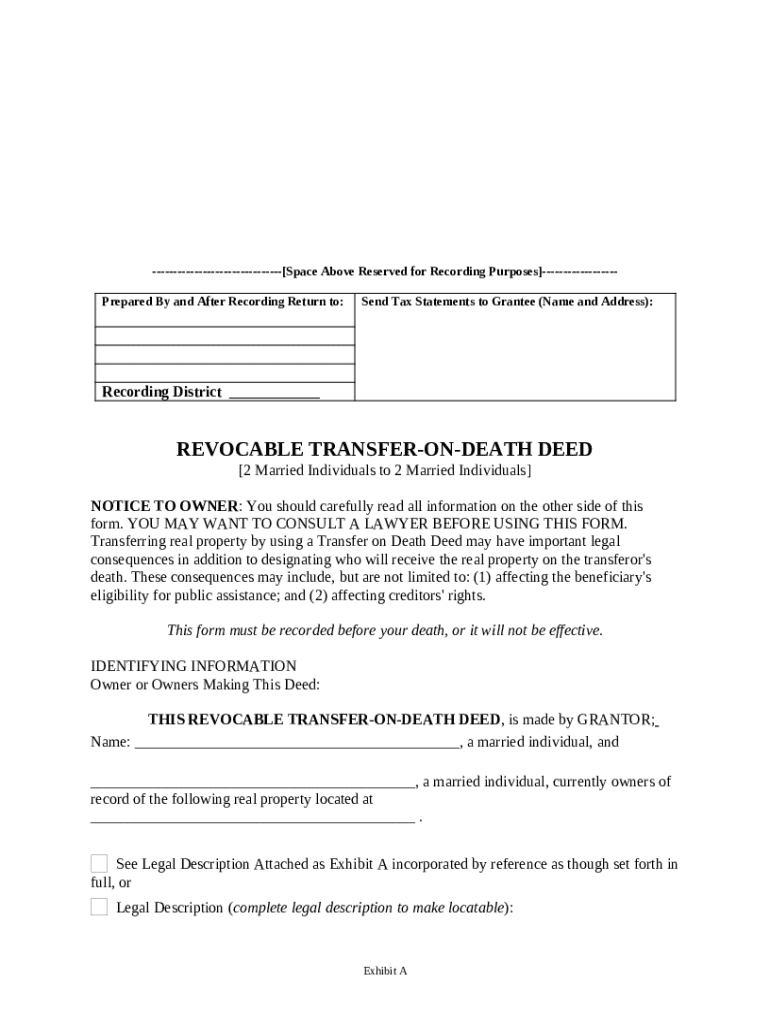

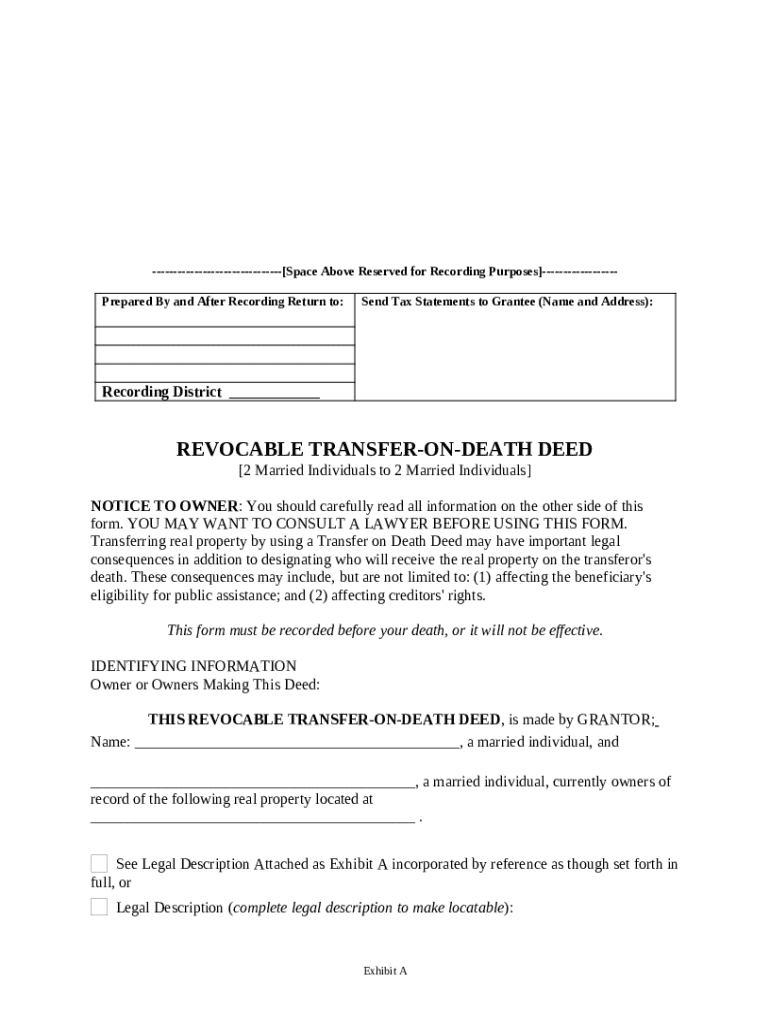

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed allows an individual to designate a beneficiary to receive real estate upon their death without the property going through probate.

pdfFiller scores top ratings on review platforms

Customer support was very helpful not to mention 24/7. They were able to remotely take over my computer and trouble shoot all my problems.

Easy to use and is very intuitive form to fill out, save, print & email

GOOD FOR SOMEONE WHO HAD A BIG NEED FOR FILLING OUT DOCUMENT =S THRU THE YEAR

The live chat went really well, they were very helpful. also, the site itself is easy to work with.

So far, it is excellent for moderately tweaking content. It would be nice if I could select images and move them like Adobe but this is so rarely needed....

they have all the forms I need . thank you

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

How to fill out a transfer on death deed form form

Filling out a transfer on death deed form can be an essential step in planning your estate as it allows you to transfer property to your beneficiaries without the need for probate.

Understanding the transfer on death deed

A Transfer on Death Deed (TODD) is a legal document that allows an individual to transfer real estate to designated beneficiaries upon their death. This type of deed enables you to bypass probate, making it easier for your loved ones to inherit your property.

-

Legal implications of using a TODD include the fact that the transfer only occurs upon death, freeing the property from the probate process.

-

It's advisable to consult a lawyer before completing a TODD as there may be specific rules and requirements based on your state.

Preparing the transfer on death deed

Before filling out the deed, it is vital to prepare by identifying all owners of the property and understanding the legal description. This ensures that the deed is accurate and compliant.

-

Identifying owners making the deed is crucial as all property owners must agree and sign the TODD.

-

The legal description of the property must be precise to avoid disputes and ensure that the correct property is transferred.

-

Understanding recording district requirements is important, as different jurisdictions may have unique rules for recording a TODD.

Filling out the deed – detailed instructions

Completing the TODD requires attention to detail. Here’s a step-by-step guide to ensure everything is filled out correctly.

-

Start with the owner section, including names and addresses.

-

Make sure to clearly detail the beneficiaries, both primary and alternate, to avoid complications.

-

The 'prepared by' section must include your name or the name of your attorney, reinforcing the document's legitimacy.

-

Pay attention to the 'after recording' fields to ensure they are filled in correctly, marking when the deed goes into effect.

Potential legal consequences and considerations

While a TODD offers numerous benefits, it’s important to be aware of potential legal consequences.

-

Transferring property via a TODD can affect public assistance eligibility, which requires assessment of your financial situation before filing.

-

Considerations related to creditors’ rights mean that transferred property might not be fully shielded from debt claims after your death.

-

Recording the form prior to the transferor's death is critical; otherwise, the TODD may become invalid.

Post-completion steps after filling the deed

Once you've filled out the transfer on death deed form, there are several critical steps to ensure everything is in order.

-

Ensure the form is recorded correctly with the local recording office, as required by state law.

-

Return tax statements to the grantee promptly to avoid confusion regarding property taxes.

-

Keep track of copies and confirmations post-filing, as these documents are vital for proving the deed's validity.

Utilizing pdfFiller for your transfer on death deed

pdfFiller provides an excellent platform to complete your TODD form seamlessly, allowing for easy editing and signing.

-

pdfFiller's features allow you to efficiently edit PDFs, ensuring your document is error-free.

-

Interactive tools on pdfFiller streamline form completion, making the process straightforward.

-

The benefits of managing documents in the cloud include easier access and collaboration from anywhere, making pdfFiller a valuable resource.

How to fill out the pdffiller template

-

1.Obtain a blank transfer on death deed form from a legal website or your local government office.

-

2.Fill in your name and the details of the property you wish to transfer, including the legal description of the property.

-

3.Designate the beneficiary or beneficiaries by including their full names and any relevant details such as addresses.

-

4.Ensure that the deed includes a statement that it will be effective upon your death.

-

5.Have the deed signed in front of a notary public to ensure its validity.

-

6.Record the notarized deed with your local county recorder's office to make it legally binding and ensure it is accessible upon your death.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.