Get the free Financing Statement template

Show details

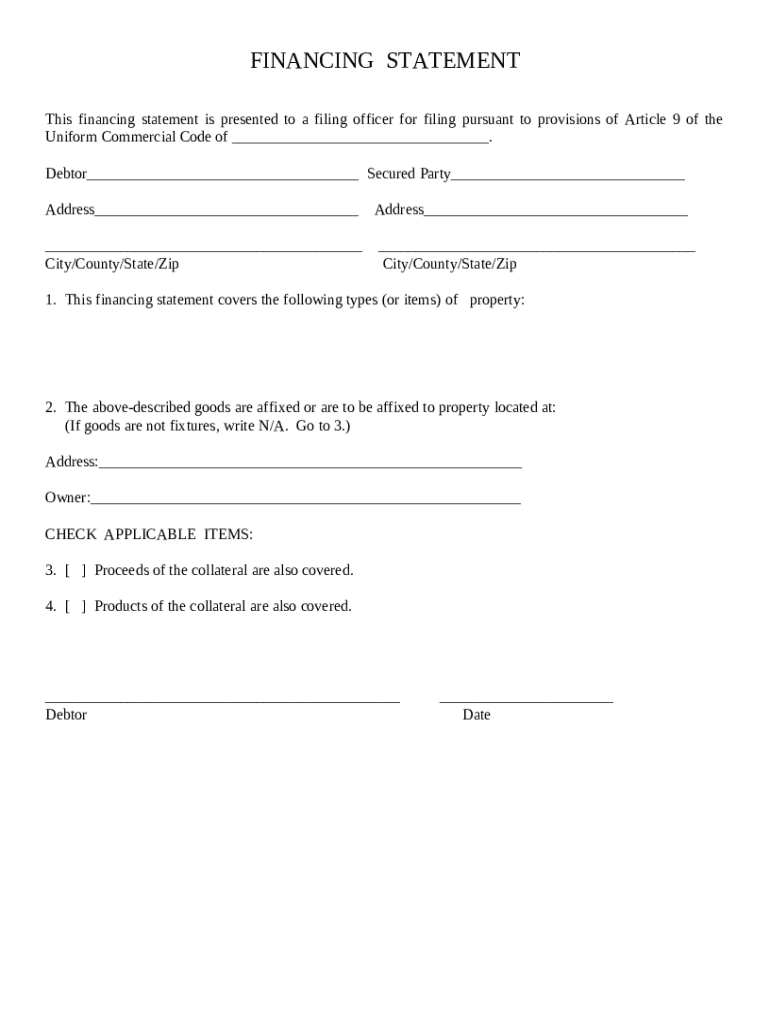

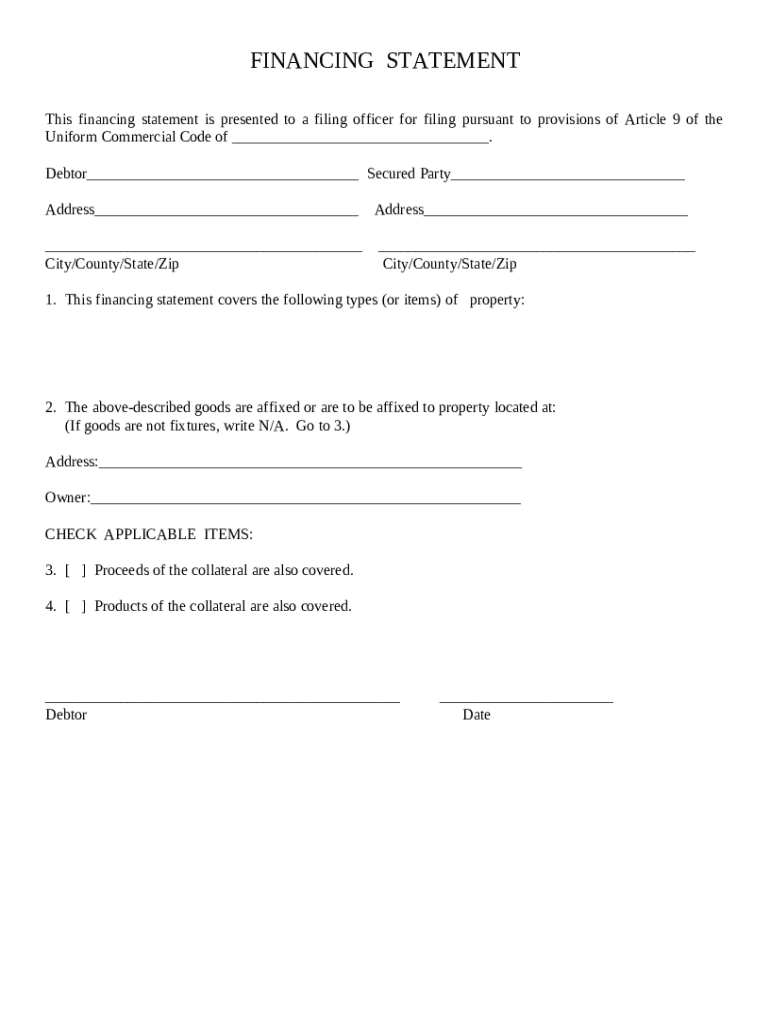

Financing Statement:

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

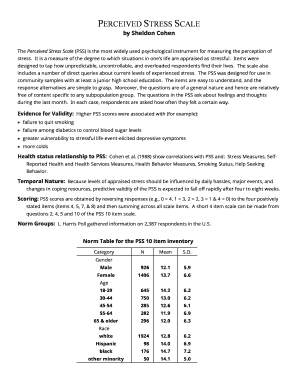

What is financing statement

A financing statement is a legal document used to perfect a security interest in personal property and establish the priority of claims against that property.

pdfFiller scores top ratings on review platforms

I am happy with what PDFfiller enables me to do.

It does a good job once you know how to use it. Could have used some help learning how it works.

Easy to use. Exactly what I was looking for!

intuitive, easy to use and add signatures!

I found this invaluable for professional business presentation to clients.

Works very well.....I'm glad I signed up!

Who needs financing statement template?

Explore how professionals across industries use pdfFiller.

How to Effectively Use the Financing Statement Form

What is a financing statement?

A financing statement is a legal document used to secure interests in personal property under Article 9 of the Uniform Commercial Code (UCC). These statements are crucial for creditors, as they mark claims on collateral that can help recover debts. Filing the financing statement properly is vital to ensure the creditor's rights are recognized and enforceable.

-

Definition and purpose: A financing statement serves to publicly disclose a creditor's interest in the specified property.

-

Importance of filing: Filing protects the rights of creditors and provides legal notice to other stakeholders.

-

Filing locations: Statements can typically be filed with state agencies, often the Department of State or a similar office.

How do identify the debtor and secured party?

Accurately identifying the debtor and secured party is crucial for the validity of the financing statement. The debtor is the individual or entity borrowing money, while the secured party is the entity providing the loan.

-

Clear definitions: Specify who the debtor is and the role of the secured party to prevent confusion.

-

Filling the fields: Ensure names and addresses are entered accurately to avoid misfilings.

-

Common mistakes: One common error is inconsistent naming that may lead to complications in enforcing the filing.

What are the address details for all parties?

Accurate address information is not merely a formality; it is a legal requirement. Providing the correct addresses helps in establishing the identity of each party involved.

-

Legal significance: An incorrect address can lead to legal repercussions or invalidation of the financing statement.

-

Instruction on filling: Address fields should clearly note if they are business or personal addresses.

-

Differences: Be cautious of various submission requirements for business versus personal addresses.

How should collateral be described?

Describing collateral accurately is necessary because it specifies what property is included under the secured interest. Proper descriptions avoid misunderstandings and support enforceability.

-

Guidance on detailed descriptions: Clearly articulate the types of property to avoid vague terms that could lead to disputes.

-

Examples from industries: Collateral descriptors should be industry-specific to reflect common terminology.

-

Compliance: Ensuring compliance with local laws regarding property descriptions is critical.

What are the property affixation details?

It is essential to declare if goods are fixtures attached to real property, as this impacts the priority of security interests. Understanding this classification is vital for creditors.

-

When to declare: Clarifying whether goods are affixed can affect who has the superior claim in case of default.

-

Instructions: Fill out this section with precision depending on the property’s nature.

-

Common issues: Misclassification often leads to complications or legal disputes regarding ownership.

What about proceeds and products of collateral?

Understanding the implications of proceeds and products is critical for future claims. When filling out the financing statement, deciding whether to include these options can affect the scope of the security interest.

-

Implications: Including proceeds and products can extend the security interest to future assets derived from collateral.

-

Guidelines: Analyze whether these options should be included based on the nature of the collateral.

-

Thoroughness importance: Ensuring all aspects are covered aids in claims and recovery efforts.

How do finalize and file my financing statement?

Finalizing your financing statement is a fundamental step that involves multiple checks. Utilizing platforms like pdfFiller can streamline this process immensely.

-

Step-by-step process: Conduct final checks, ensuring correct information and obtaining necessary signatures.

-

Using pdfFiller: Leverage their tools for completing, editing, and managing your financing statement efficiently.

-

Legal considerations: Be aware of the legal ramifications of post-filing actions to maintain your secured interests.

How to fill out the financing statement template

-

1.Open the financing statement form on pdfFiller.

-

2.Enter your name and address in the appropriate fields as the debtor.

-

3.Provide the secured party's name and address accurately.

-

4.Describe the collateral you are claiming an interest in, using clear and specific language.

-

5.Ensure the document is signed appropriately; digital signatures are acceptable on pdfFiller.

-

6.Review all entered information for accuracy before proceeding.

-

7.Submit the form for filing and keep a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.