Get the free pdffiller

Show details

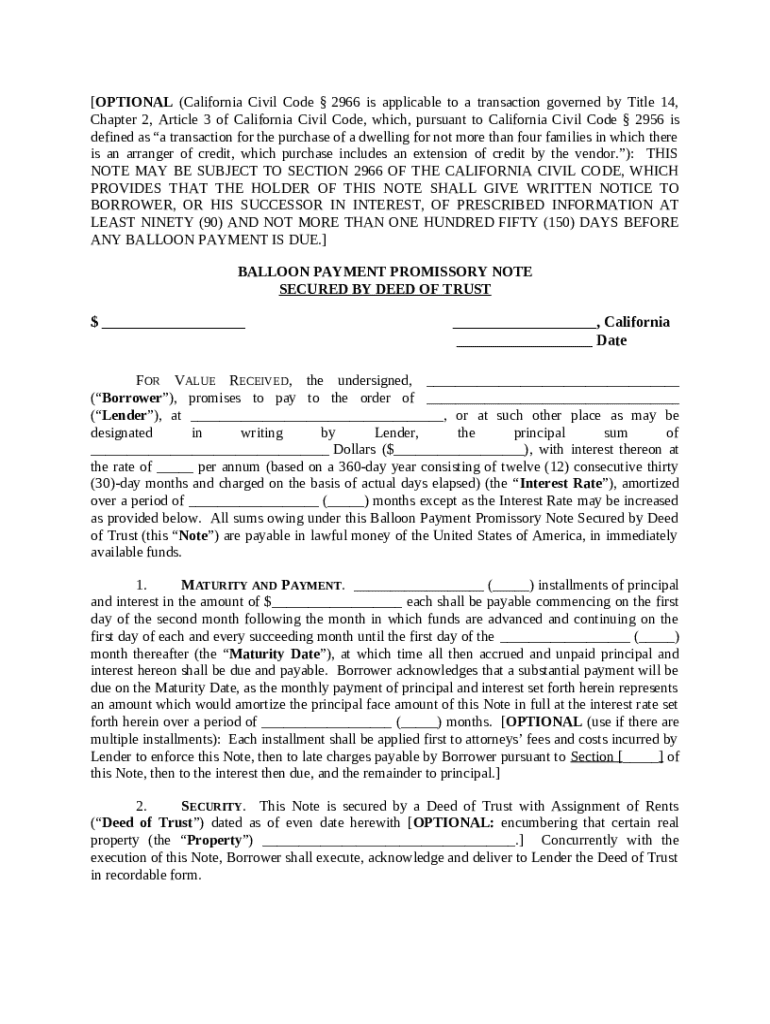

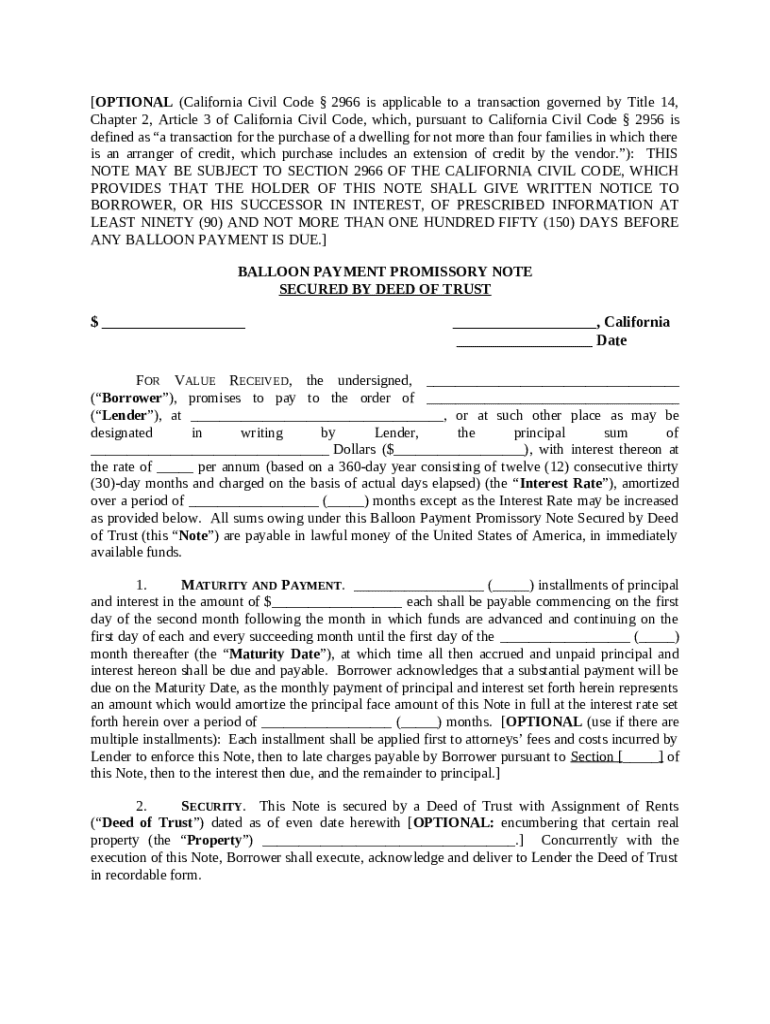

A Balloon Note is a Promissory Note that has one large payment (the balloon payment) that is due upon maturity. A balloon note will often have the advantage of a very low interest rate, thus requiring

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is balloon payment promissory note

A balloon payment promissory note is a loan agreement that requires a borrower to pay a large final payment at the end of the loan term.

pdfFiller scores top ratings on review platforms

I was a little confused but looks like it will be great once I have the time to sit down and go through a tutorial and then set up my "forms"

This is the second time I used it.. so far no problems

Accessing government forms and sharing with veterans has become much easier.

Very quick and convenient way to fill PDF forms

Just started my first company. PDFfiller makes my job a lot easier. Thank you

The fillable form was easy to complete and also easy to modify.

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

How to fill out a balloon payment promissory note form?

Understanding Balloon Payments and Promissory Notes

A promissory note is a legally binding document where one party (the borrower) promises to pay a specific amount to another party (the lender) at a designated time. Balloon payments are large payments due at the end of a loan term, typically following smaller installment payments. Understanding how these two components work together is crucial, especially in real estate transactions.

-

This is a written promise by one party to pay another a specified sum, often including interest. It outlines important details like loan amount and repayment terms.

-

Balloon payments often require small monthly payments until a large sum is due at the end of the loan term. This can make them appealing for borrowers seeking lower initial repayment amounts.

-

These notes allow flexible financing options, often making home purchases more feasible for buyers who expect a financial change before the balloon payment is due.

Legal Framework Governing Balloon Payment Promissory Notes

Understanding the legal framework that governs balloon payments is essential for both lenders and borrowers. Laws vary by state, and in California, specific codes outline how promissory notes and balloon payments should be structured.

-

The California Civil Code provides guidelines for promissory notes, detailing requirements for enforceability and the rights of parties involved.

-

Certain sections focus on the security interests and obligations tied to balloon payments, ensuring borrowers are adequately informed.

-

Both parties must adhere to their responsibilities as outlined by the law, including timely payments and compliance with notification requirements.

Setting Loan Terms and Conditions

When establishing a balloon payment promissory note, it’s essential to define clear loan terms. This ensures that both parties understand their financial commitments and the structure of the repayments.

-

Setting competitive interest rates while considering market trends ensures fairness and feasibility for borrowers.

-

Calculating how much is paid monthly versus the lump-sum balloon payment is crucial for budgetary planning.

-

An amortization schedule breaks down payments over time, allowing borrowers to understand how their payments contribute to the principal and interest.

Creating a Balloon Payment Promissory Note

Filling out a balloon payment promissory note form might seem daunting, but a structured approach makes it much simpler. Accurate details are vital for the document’s effectiveness and legal standing.

-

Start by gathering necessary information about both parties and the terms of the loan before filling out the form to avoid mistakes.

-

Key fields include the names of the borrower and lender, loan amount, interest rate, repayment schedule, and terms surrounding the balloon payment.

-

Double-check details like interest rates or dates to avoid confusion or legal challenges later on.

Sample Balloon Payment Promissory Note

Having a template can greatly assist those unfamiliar with drafting a promissory note. A sample provides a useful reference point for structuring your own document.

-

A template usually includes sections for borrower and lender information, loan details, payment terms, and other legal stipulations.

-

Reviewing a completed sample can reveal nuances, such as how to phrase conditions and validate signatures.

-

Ensure that all legal obligations are covered, particularly around the balloon payment and any contingencies.

Related Documents and Resources

In addition to the balloon payment promissory note itself, there are several related documents and resources that can aid in the overall process of documentation.

-

These can include security agreements or loan agreements that provide additional structure to the transaction.

-

Utilizing reputable online resources can help in understanding your rights and obligations under the law.

-

pdfFiller enables connections to legal professionals who can assist in reviewing documents for compliance and completeness.

Managing and Storing Your Promissory Note

After completing your balloon payment promissory note, proper management and storage of the document are crucial for legal and personal records.

-

Utilize folder systems and tagging features to easily locate and organize your legal documents.

-

Ensure that your notes are protected through strong passwords, two-factor authentication, and encryption to prevent unauthorized access.

-

Employ pdfFiller’s collaboration tools, allowing multiple users to review and edit the document efficiently.

Using pdfFiller for Document Needs

pdfFiller offers a comprehensive platform for managing your balloon payment promissory note and various other legal documents seamlessly. Its cloud-based solution ensures ease of access.

-

pdfFiller allows users to eSign forms and collaborate on documents in real-time, ensuring a smooth and efficient process.

-

Automated tools within pdfFiller simplify the process of creating and filling out documents, reducing the potential for errors.

-

Take advantage of templates and forms tailored for balloon payments to save time and improve accuracy in documentation.

How to fill out the pdffiller template

-

1.Start by downloading the balloon payment promissory note template from pdfFiller.

-

2.Open the template in pdfFiller and ensure all sections are visible.

-

3.Enter the full legal name of the borrower in the designated field.

-

4.Provide the lender's information, including name and address, in the appropriate section.

-

5.Fill in the principal amount being borrowed, clearly stating the numerical and written forms.

-

6.Indicate the interest rate and the duration of the loan term in the specified fields.

-

7.Specify the due date for the balloon payment clearly to avoid confusion.

-

8.Include any special terms or conditions as necessary in the additional notes section.

-

9.Review all entered information for accuracy and completeness before saving.

-

10.Finally, save the finished document and send it for signatures or print it for physical signing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.