Get the free Notice of State Tax Lien template

Show details

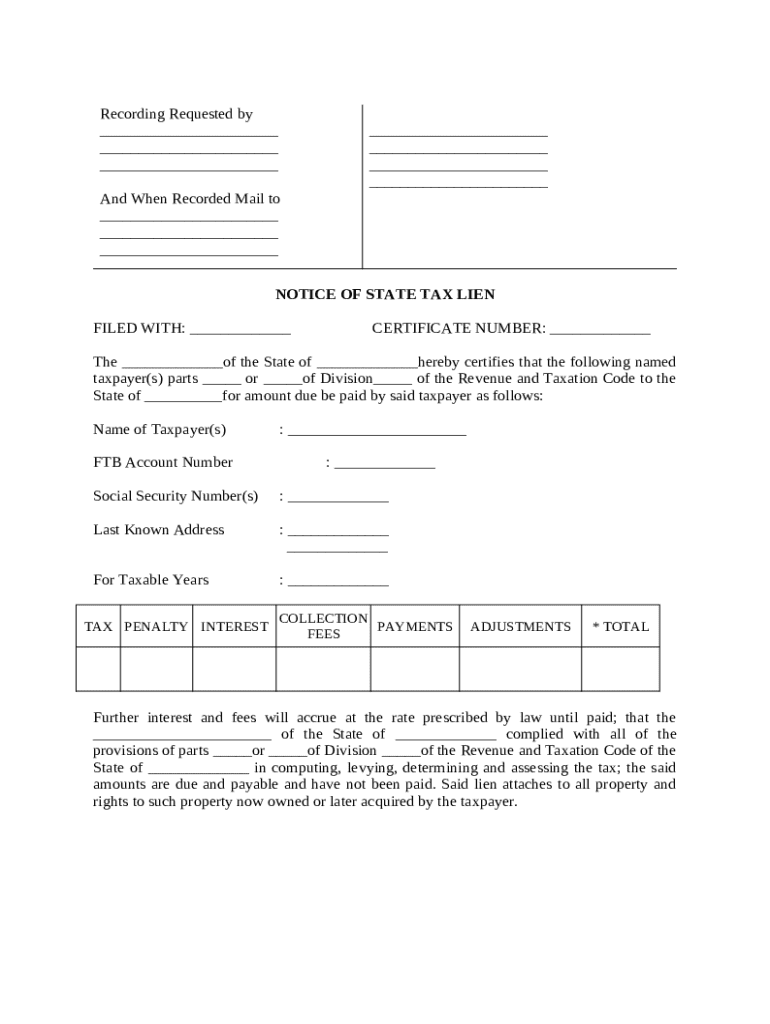

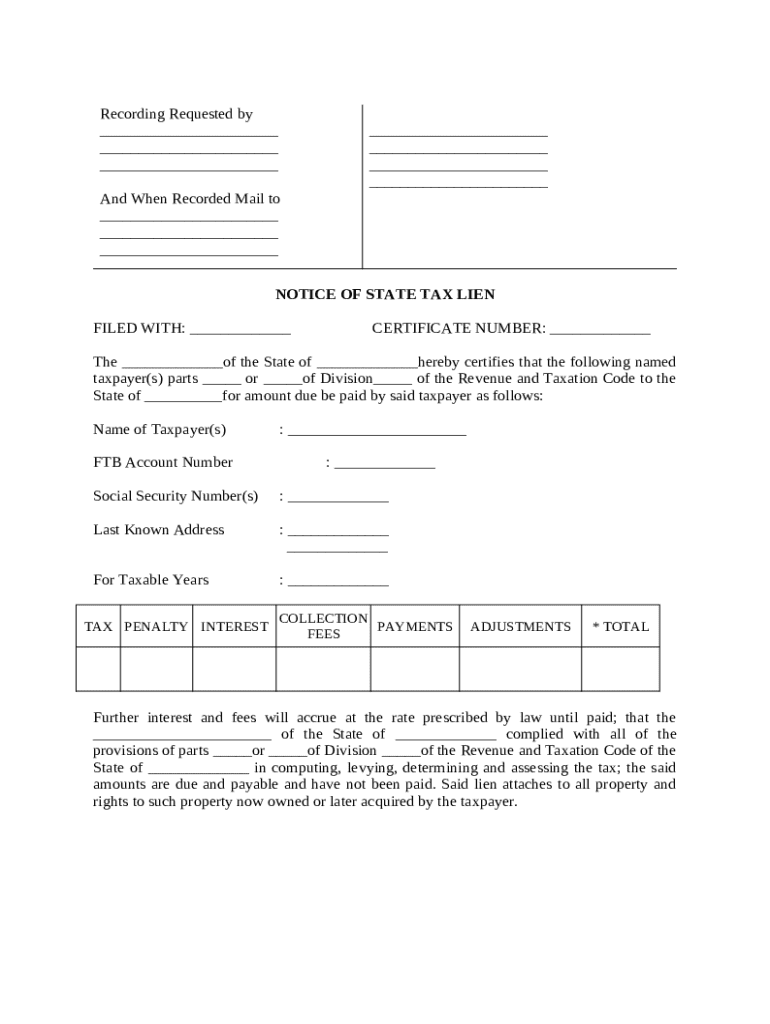

A lien exists in favor of the State of California for nonpayment of tax, interest, penalties, and costs as assessed.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is notice of state tax

A notice of state tax is a formal communication from the government regarding tax obligations and requirements.

pdfFiller scores top ratings on review platforms

Good. Saving files could be a lot easier, but other than that I'm very satisfied.

C'est vraiment super pratique de pouvoir modifier ses documents!

Simple and easy to use. No regrets for our annual subscription.

Just wish I could save more documents then 5 in my docs

This is great for filling out forms. We have used it a lot and it has really made the work easier.

PDF filler has saved me hours filing a Form 990 for a non-profit I am involved with.

Who needs notice of state tax?

Explore how professionals across industries use pdfFiller.

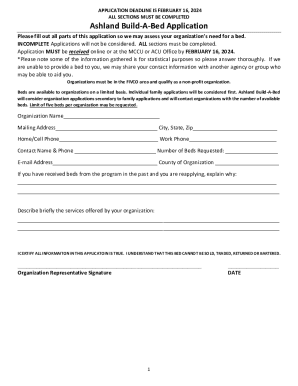

How to fill out the notice of state tax

-

1.Obtain the notice of state tax form from the state revenue department or download from the official website.

-

2.Open the received form in pdfFiller or upload the document if using a paper version.

-

3.Begin by filling out the taxpayer information section, providing your full name, address, and tax identification number.

-

4.Complete the tax period details, indicating the specific tax year or quarter to which the notice pertains.

-

5.Fill in the income and tax liability sections as required, based on your financial records or previous tax returns.

-

6.Include any credits or deductions you are claiming on the form to ensure accurate calculations.

-

7.Review the completed form for correctness and ensure all necessary information is included.

-

8.Once verified, save the document in pdfFiller and follow the prompts to submit electronically or print for mailing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.