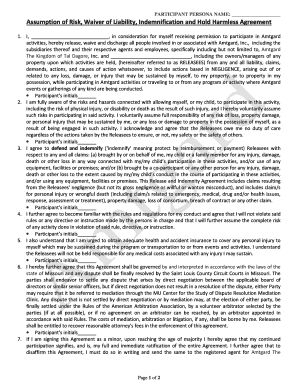

Get the free Installment Note - Interest Included template

Show details

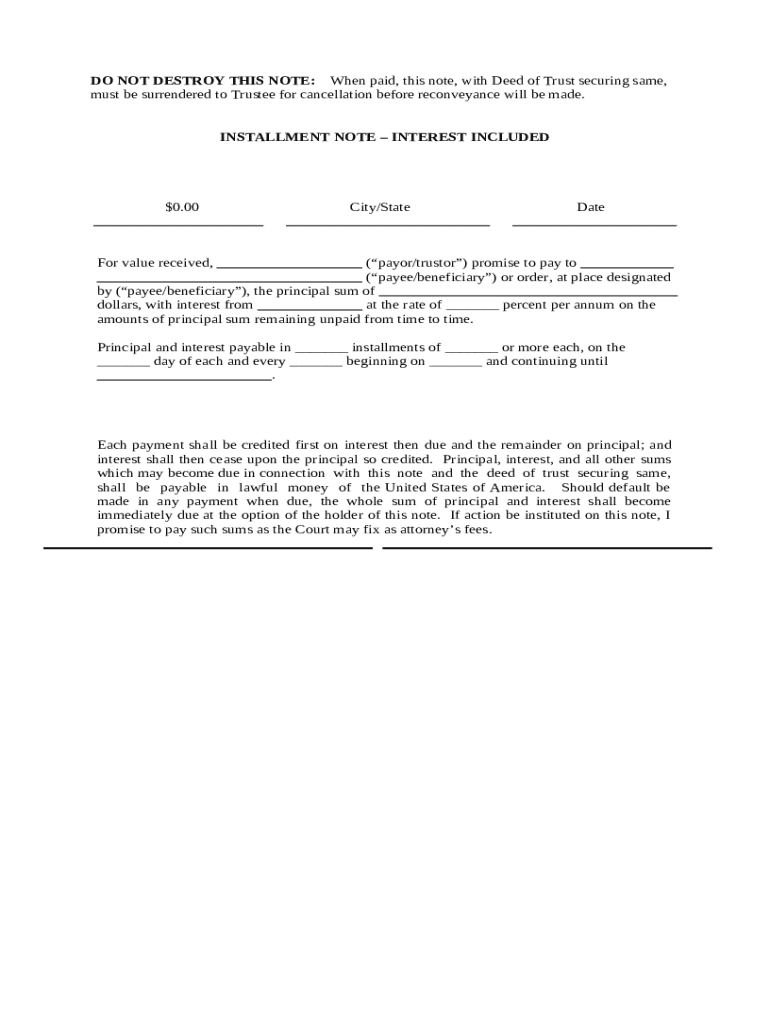

This is a sample Installment Note - Interest Included. Interest-included installment notes may either: be fully amortized through constant periodic payments, meaning the mortgage is fully paid at

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is installment note - interest

An installment note with interest is a financial document that outlines a loan agreement where the borrower agrees to repay the principal amount along with interest in specified installments over a set period.

pdfFiller scores top ratings on review platforms

I love it its soeasy to use

Trusted PDF editor

Trusted PDF editor. Easy to use. Has many useful functions!

very good...!!!

Very happy

Very useful tool.

Has every document that I always need, love this website.

Has every document that I always need. ❤ this website.

pdfFiller is an very valuable software…

pdfFiller is an very valuable software for work at home or outside. They have an excellent customer service which helped me instantly. You can easily edit, combine files, put your own online signature and save a lot of time by using this software. Very easy to handle, sort, upload, share files etc.! Mirko M.

Who needs installment note - interest?

Explore how professionals across industries use pdfFiller.

Complete guide to installment note - interest calculation and management on pdfFiller

How does an installment note work?

An installment note is a financial agreement that outlines the specific terms under which a borrower agrees to pay a lender over time. It is crucial for both parties to understand its key components, which include the principal, interest rate, and payment schedule. An installment note helps ensure that both the lender and the borrower have clear expectations regarding payments, thus reducing potential disputes.

-

The original sum of money borrowed or the amount still owed on a loan.

-

The cost of borrowing the principal, usually expressed as a percentage.

-

The timelines and amounts due for each payment until the loan is fully paid.

Understanding the legal implications is also essential. A deed of trust may be required, and knowledge about the cancellation process is vital to protecting both parties’ rights.

What are the steps to filling out your installment note?

Filling out an installment note is straightforward if you follow a systematic approach. Start with gathering the required information, including your city and state, the date of the agreement, and the details of both the payor and payee.

-

Clearly state the city and state where the agreement is executed.

-

Include the date when the agreement is made, ensuring it’s accurate and clear.

-

Full names and contact details must be noted for both parties.

Next, determining the interest rate is paramount—calculate the correct percentage to ensure fairness in the agreement.

How is the payment structure of installment notes organized?

Knowing how to structure payments in your installment note is essential. Typically, payments consist of both principal and interest, and how they are allocated depends on the agreement terms.

-

Define how much each installment will be and how often it will be paid, typically monthly.

-

Understand how each payment is divided between principal reduction and interest payment.

-

Specify the consequences if payments are missed, which may include additional fees or legal actions.

How to manage your installment note with pdfFiller?

Managing your installment note becomes simpler with pdfFiller’s platform. The software provides various features, including editing and eSigning, which streamline the documentation process.

-

Make changes to your document with ease, ensuring it remains accurate and up-to-date.

-

Legally sign the document electronically, ensuring fast and efficient ratification.

-

Work with your team in real time, improving communication and documentation accuracy.

Moreover, from anywhere in the world, you can securely access your documents thanks to the cloud-based solutions provided by pdfFiller.

What are some common questions regarding installment notes?

Different participants in an installment note may have various queries about the terms and processes involved. Understanding terminology can help clarify the roles of payor, payee, and beneficiary.

-

Understanding who is responsible for payment and who benefits from the payment is crucial.

-

It's important to know the legal steps for ensuring the document is valid and enforceable.

-

Consulting with a legal practitioner can help navigate complex arrangements and rights.

What are examples of completed installment notes?

Studying examples of completed installment notes can provide valuable insights into how to construct your own. For instance, a well-structured installment note template typically includes all necessary terms and obligations.

-

An example format helps visualize how a completed installment note should appear.

-

Examples from different sectors can highlight the adaptability of installment notes to various needs.

-

A clear structure can lead to reduced conflicts and provide clarity in business transactions.

How to fill out the installment note - interest

-

1.Open the PDFfiller application or website and upload your installment note template.

-

2.Start by entering the date in the designated field to indicate when the note is created.

-

3.Fill in the borrower's name and contact information to identify the individual or business taking the loan.

-

4.Next, specify the lender's name and contact details as the entity or individual providing the loan.

-

5.Enter the principal amount of the loan to express how much is being borrowed.

-

6.In the interest rate section, indicate the annual interest rate agreed upon for the loan.

-

7.Input the total number of installments to be made over the repayment period, including the duration in months or years.

-

8.Specify the due date for each installment to clarify the payment schedule for both parties.

-

9.Finally, review all entered information for accuracy and completeness, and save the document.

-

10.Complete the necessary electronic signature process to finalize the agreement before sharing with the involved parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.