Get the free Guaranty of Payment of Open Account template

Show details

For valuable consideration and for the purpose of enabling the buyer to obtain and/or continue to obtain credit from the seller,the guarantor, personally, jointly and severally guarantee absolutely

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

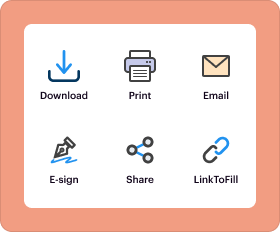

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

pdfFiller scores top ratings on review platforms

i love it it makes filling out pdf's very easy.

It creates a much smoother transition for billing

It's a perfect answer for filling out our order forms

Love it for form filling. Got it for scholarship sumissions and varies forms.

This has made my life 100x easier. I'm able to complete and sign documents. Then file them with the court & it saves ink and paper cost. Thank you!!!!

I have used this program for over a year now, easy to use, and keeps my paperwork very professional looking.

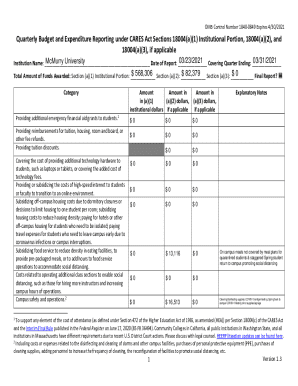

Comprehensive Guide to the Guaranty of Payment Form

TL;DR: To fill out a guaranty of payment form, provide the required information about the parties involved, ensure all terms are clear, and verify the details before signing. This is crucial for securing payment obligations in financial transactions.

What is the guaranty of payment?

The guaranty of payment is a legal document that provides assurance that one party will fulfill their monetary obligations to another. It serves as an important security mechanism for sellers in various financial transactions, particularly when extending credit or payment terms.

-

A guaranty is a formal promise made by a guarantor to assume responsibility for another's debt or obligation if that party defaults.

-

It safeguards the seller's interests by ensuring that they have recourse through the guarantor in case the buyer fails to pay.

-

Essential details include the parties' names, the terms of the payment, and any conditions under which the guaranty may be invoked.

What role does the guarantor play?

The guarantor is a third-party individual or entity that agrees to take on the financial responsibility for the obligations outlined in the guaranty of payment form. Their ability to fulfill this responsibility is critical.

-

Guarantors must ensure they understand the obligations they are assuming and are financially capable of meeting them if needed.

-

A conditional guaranty requires certain events to occur before it is enforced, whereas an unconditional guaranty is immediately enforceable regardless of circumstances.

-

The guarantor's financial health is crucial, as it determines their ability to meet obligations should the primary obligor default.

How do you fill out the guaranty of payment form?

Completing the guaranty of payment form correctly is vital for its legal validity. Clear instructions and attention to detail can prevent disputes in future.

-

Start by gathering essential information about the buyer and seller, then fill in the form methodically, ensuring clarity in each section.

-

Avoid leaving blanks that aren't indicated as optional, and verify the accuracy of dates and financial figures.

-

Include full names, contact information, and any pertinent agreement details regarding payment terms.

What are the legal implications and terms?

Understanding the legal terms associated with the guaranty of payment form is crucial for all parties involved to maintain their rights and responsibilities.

-

Be aware of terms like 'default,' 'obligor,' and 'enforcement,' which define the framework under which the guaranty operates.

-

The guaranty can be enforced under specific conditions laid out in the document, typically related to payment defaults.

-

If obligations are not met, the guarantor may be required to settle the debt, which can lead to legal actions.

What costs and collection provisions should you understand?

Understanding costs associated with collection efforts is important for both sellers and guarantors, as these may increase financial liability.

-

Costs such as court fees and collection agency fees may apply if the borrower defaults, impacting the final amount owed.

-

Legal fees incurred during collection processes can usually be claimed against the debtor, as specified in the guaranty.

-

In case of non-payment, buyers must be aware of their responsibility toward both the seller and the guarantor.

How do you manage changes to the guaranty?

Modifying or terminating a guaranty of payment needs to be handled carefully to ensure all parties remain protected.

-

Modifications should be documented in writing, clearly stating the changes and obtaining signatures from all parties involved.

-

Providing written notice is essential for effective termination to ensure all parties are informed and protected legally.

-

Changes may be necessary due to shifts in financial circumstances or the relationship between the buyer and seller.

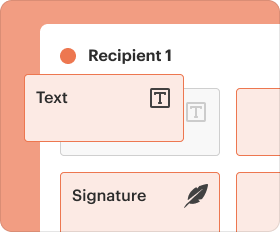

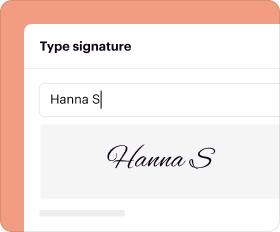

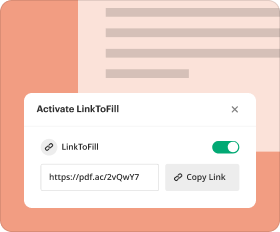

What interactive tools are available for document management?

Modern document management requires tools that facilitate not just editing but collaboration, ensuring that all parties can access and manage the guaranty of payment effectively.

-

Using software like pdfFiller, you can easily edit and eSign PDFs remotely, ensuring accuracy and saving time.

-

pdfFiller provides tools that allow team members to collaborate in real-time, making modifications or clarifications as needed.

-

Access to forms from anywhere using cloud-based platforms enhances the efficiency of document management processes.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.