Get the free Promissory Note - Horse Equine s template

Show details

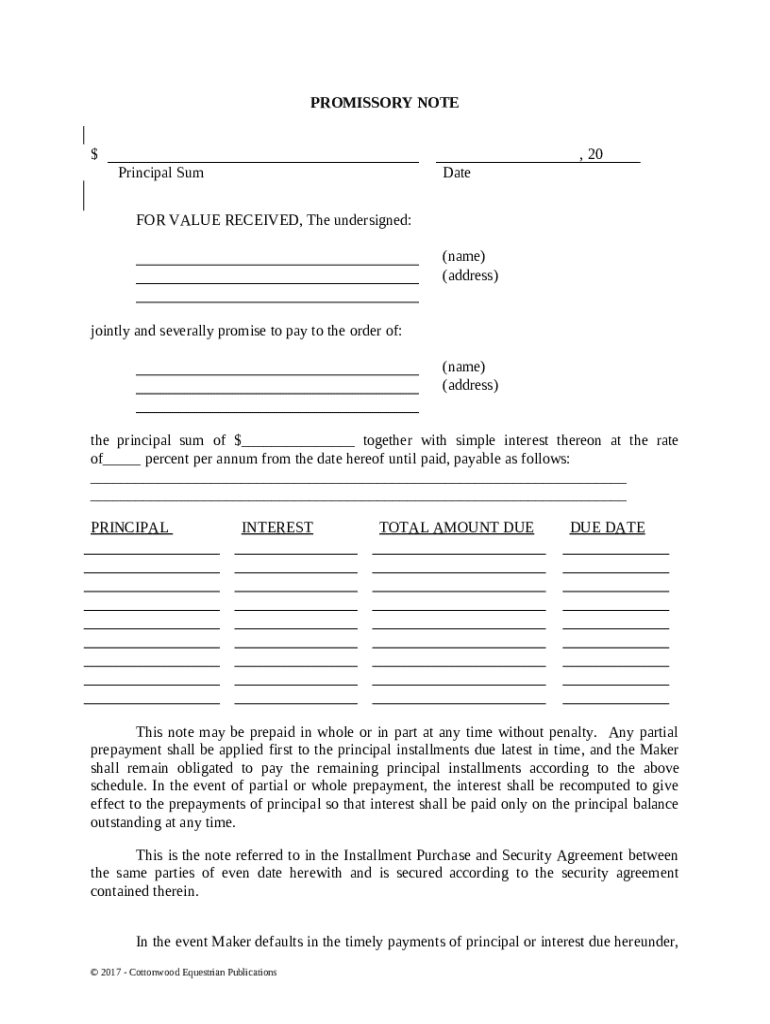

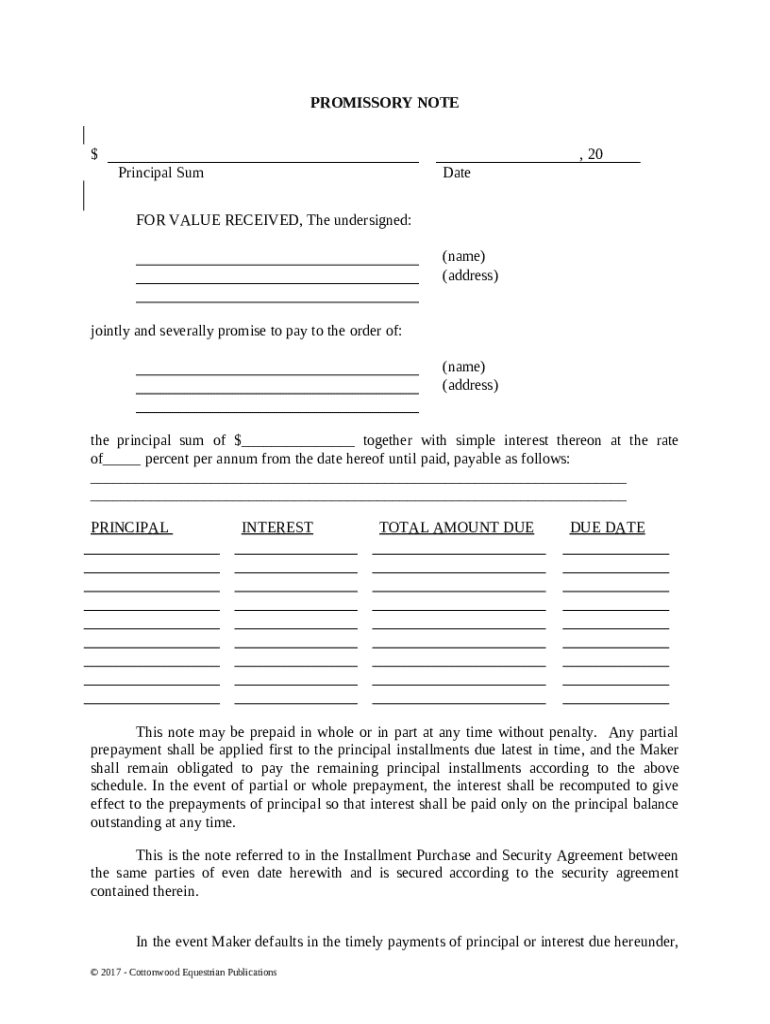

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note - horse

A promissory note - horse is a legal document in which one party agrees to pay a specified amount to another for the purchase of a horse.

pdfFiller scores top ratings on review platforms

Support team is on point.

I was charged for a one year subscription even though I had cancelled before the 30 day free trial was over. The support team immediately resolved my issue. Within a couple of minutes. Special thanks to John.

Excellent service. Website is easy to navigate and the forms available are excellent. In my case, even though the website is user friendly, I think a short webinar to familiarize customers would be of great benefit. I would certainly recommend PDFiler to others.

Very helpful when filling out forms for my family and friends.

VERY EASY AND PLESANT TO USE.

very quick and simple to learn. very satisfied!!

SO FAR SO GOOD

Who needs promissory note - horse?

Explore how professionals across industries use pdfFiller.

Understanding the Promissory Note - Horse Form

What is a promissory note?

A promissory note is a written, unconditional promise to pay a specific amount of money to a designated party at a predetermined date. The legal significance of this document lies in its ability to serve as evidence of a loan agreement, thereby outlining the borrower's obligations. Key components include the principal amount, terms of repayment, and interest rates, which affect both the lender's and borrower's expectations.

-

A promissory note acts as a legal tool in loan agreements and disputes.

-

Includes principal, repayment terms, and any applicable interest rates.

Essential components of the promissory note - horse form

Understanding the components of the promissory note - horse form is crucial in ensuring all necessary details are accurately recorded. The principal sum represents the amount borrowed, while the date marks when the agreement takes effect. The roles of the payee (the person receiving the payment) and maker (the borrower) are vital to identifying who’s responsible for the repayments.

-

This constitutes the total amount being lent and must be clearly stated.

-

Important for tracking the timeline of repayments.

-

Defines who is borrowing and who is owed the money.

Filling out the promissory note

Filling out a promissory note can be straightforward when approached step-by-step. First, ensure that the principal amount, interest rate, and repayment schedule are defined. Common mistakes include omitting key details and failing to sign the document. Tools like pdfFiller can help streamline this process, allowing you to edit, sign, and store your documents effortlessly.

-

Working through every section ensures no critical information is missed.

-

Avoiding details like dates or signatures can invalidate the note.

-

This platform can simplify document management and enhance productivity.

How to understand interest rates and payment terms

Interest rates can significantly influence the overall cost of borrowing. Simple interest is often used in promissory notes where the interest is calculated solely on the principal sum. It's vital to outline repayment schedules, which can clarify what is owed and when, ensuring both parties are informed.

-

It’s calculated based on the principal amount alone, providing transparency.

-

These clarify when payments are due and help in budgeting.

-

Understanding any implications of prepaying is essential for financial planning.

What are the consequences of default and what remedies are available?

Defaulting on a promissory note can have serious consequences, including legal ramifications. Lenders may initiate legal actions to recover the owed amount, and they can implement an acceleration clause, which demands immediate payment of the full balance upon default. Understanding these aspects is crucial for borrowers to avoid unnecessary complications.

-

Legal ramifications can include lawsuits, which are costly and time-consuming.

-

Lenders can pursue court orders to recover debts.

-

This clause can force full repayment upon default, heightening borrower obligations.

How is pdfFiller useful for managing your promissory note?

Utilizing a cloud-based platform like pdfFiller can transform how you manage your important documents. It enhances efficiency through easy editing and eSigning capabilities, allowing both parties to participate in the process without hassle. Further, collaboration tools ensure all stakeholders can review and sign the document seamlessly.

-

Access your documents from anywhere, facilitating quick edits and communication.

-

Makes signing documents simpler, which is crucial for timely transactions.

-

Multiple parties can engage in the document preparation, enhancing teamwork.

What are the legal compliance and regional variations?

Every region has specific legal requirements for promissory notes, which can affect their use and format. Understanding these regulations is imperative for ensuring that your document meets local standards. pdfFiller can assist in adapting the document to comply with these laws efficiently.

-

Some areas may have stricter formatting or notarization needs.

-

Industry-specific practices may influence how notes are structured.

-

Utilizing templates and support from platforms like pdfFiller can safeguard against legal issues.

Conclusion: Mastering your promissory note

In conclusion, mastering the promissory note - horse form can greatly enhance your financial transactions and provide clarity for both parties involved. A solid understanding of its components, the implications of interest rates, and the best practices for completion are imperative. Utilizing pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform, making the process efficient and user-friendly.

How to fill out the promissory note - horse

-

1.Step 1: Open pdfFiller and upload the promissory note template or create a new document.

-

2.Step 2: Enter the date at the top of the document when the note is being signed.

-

3.Step 3: Fill in the buyer's information, including full name and address.

-

4.Step 4: Enter the seller's details, ensuring accuracy in the name and address.

-

5.Step 5: Clearly state the amount to be financed in numeric and written forms.

-

6.Step 6: Specify the interest rate, if applicable, and the payment terms (e.g., monthly, quarterly).

-

7.Step 7: Include a description of the horse, such as breed, age, and registration details.

-

8.Step 8: Outline the payment schedule clearly, including due dates.

-

9.Step 9: Both parties should sign and date the document, ensuring that signatures are legally binding.

-

10.Step 10: Save the completed document and share it with involved parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.