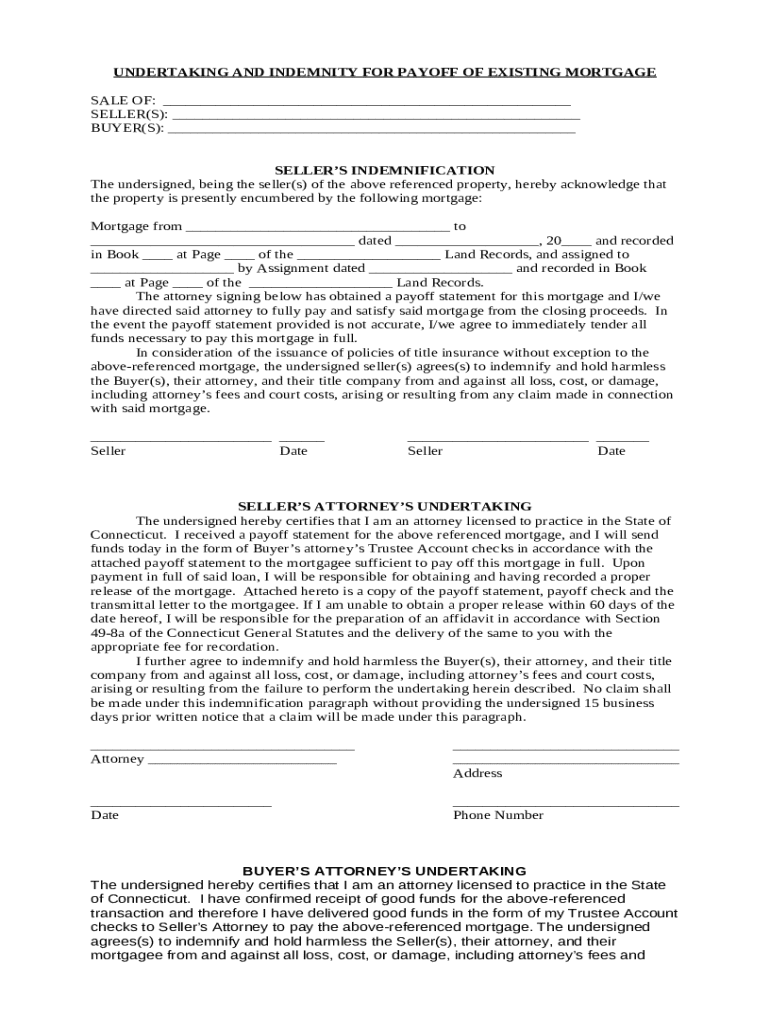

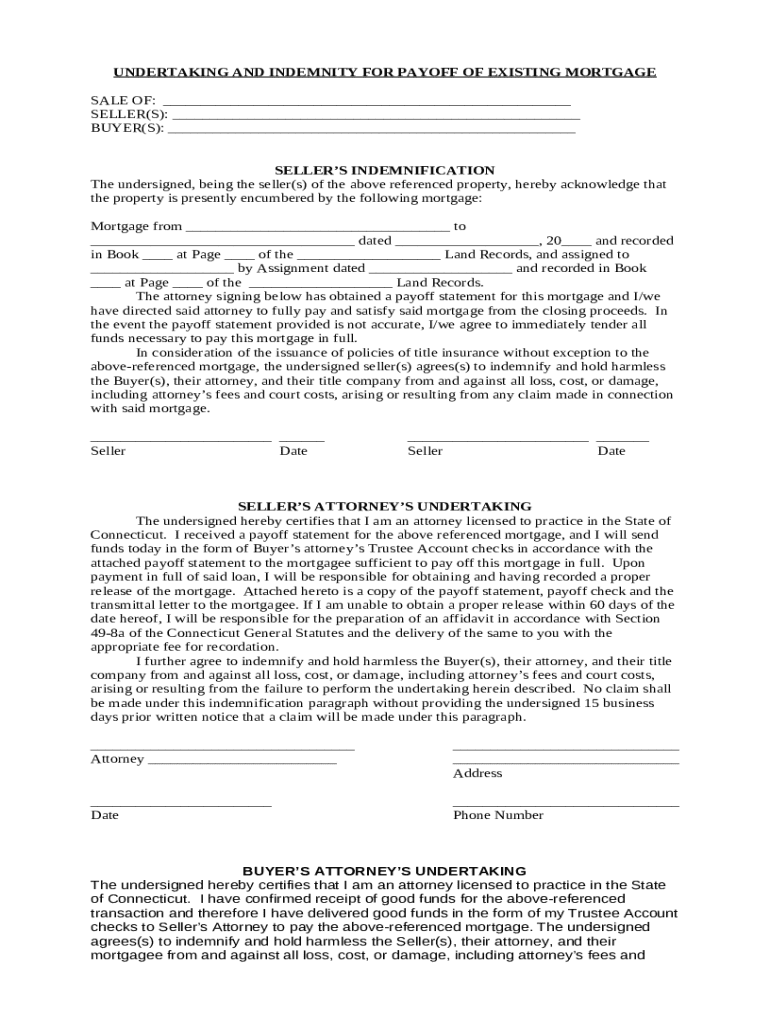

Get the free Undertaking and Indemnity for Payoff of Existing Mortgage template

Show details

Seller of real estate acknowledges that real property is currently encumbered by a specific mortgage. The seller's and buyer's attorneys signs to indicate that a payoff statement for the mortgage

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is undertaking and indemnity for

An undertaking and indemnity for is a legal document in which one party agrees to take on certain responsibilities and indemnify another party against potential losses or claims.

pdfFiller scores top ratings on review platforms

Great Experience

at times the space for the email is not enough space to type even in small letters, and the place for phone number the ( ) don't line up correctly

It was seemless

Had some difficulty aligning new…

Had some difficulty aligning new paragraphs with existing ones. However with a little patience, I managed to do what I needed, great product.

very easy to use

Brilliant App

Brilliant App, easy to use very happy

Who needs undertaking and indemnity for?

Explore how professionals across industries use pdfFiller.

Guide to undertaking and indemnity for payoff of existing mortgage

How does an undertaking and indemnity work?

An undertaking and indemnity is a crucial legal document specifically designed for mortgage transactions. It serves to protect all parties involved—typically the buyer, seller, and their respective attorneys—focusing on satisfying an existing mortgage when a property changes hands. Understanding this document is essential for ensuring smooth transactions and minimizing legal disputes.

-

It describes the agreement wherein one party agrees to indemnify (compensate) another for any loss—commonly used when a mortgage must be paid off at closing.

-

They safeguard both buyers and sellers by clarifying responsibilities and ensuring all financial obligations are met before the sale is completed.

-

These include situations where the seller has an existing mortgage that needs to be settled before transferring the property to a buyer.

What are the key components of the indemnity agreement?

The indemnity agreement is built around several critical components that define the rights and responsibilities of each party. This clarity helps to avoid potential conflicts and misunderstandings during and after the transaction.

-

This includes specifics like the lender's name, the terms of the mortgage, and total amounts owed.

-

Clearly outlines what is expected from sellers, buyers, and their attorneys throughout the mortgage payoff process.

-

These clauses specify what liabilities the indemnifying party is willing to cover, safeguarding against potential financial losses arising from the transaction.

How do you fill out the undertaking and indemnity form?

Filling out the undertaking and indemnity form accurately is crucial to avoid any legal issues. By using tools like pdfFiller, you can follow a structured approach to ensure completeness.

-

Start with the basic information required: names of the parties involved, details of the mortgage, and the specific obligations.

-

Utilizing the clicking features in pdfFiller allows for easy editing, ensuring that all entries are updated in real time.

-

Watch out for inaccuracies in personal or mortgage information, which can lead to significant delays or legal issues.

What are the seller's acknowledgments and responsibilities?

Sellers have specific legal obligations in the indemnity process that are vital for the transaction's integrity. Failure to comply might lead to consequences such as financial loss or legal disputes.

-

The seller must confirm if the mortgage is active and accurately represent the outstanding balance.

-

It is essential for the seller to ensure that the mortgage is paid in full and there are no leftover amounts at closing.

-

Any misrepresentation in the payoff statement can lead to disputes, involving potential financial liabilities or breaches of contract.

What is the attorney's role in the indemnity process?

The role of an attorney is critical in managing the payoff process and ensuring that all legal standards are met. Their expertise can safeguard the interests of both buyers and sellers.

-

They coordinate the communication between the buyer, seller, and lender to secure a smooth transaction.

-

Attorneys verify that the correct documents are filed and that all regulations concerning mortgage releases are adhered to.

-

Documentation confirming mortgage status and payoff calculations must be collected and reviewed before settlement.

What are the legal implications of the undertaking and indemnity?

Understanding the legal implications is vital for all parties involved. These implications can range from liability concerns to compliance requirements that may vary by region.

-

The undertaking serves to protect parties against losses due to non-disclosure or inaccuracies in mortgage details.

-

In the case of disagreements arising from the indemnity, legal processes may need to be engaged to reach a resolution.

-

Specific laws governing indemnity agreements may apply, particularly in states like Connecticut, affecting how documents must be structured.

What are the best practices for utilizing the undertaking and indemnity form?

Implementing best practices can enhance the effectiveness of the undertaking and indemnity form, leading to better outcomes during real estate transactions.

-

Review all entries multiple times before finalizing, and cross-check against original mortgage documents to ensure precision.

-

Parties should openly discuss and negotiate indemnification terms to reflect their comfort levels and reduce potential conflicts.

-

Engaging in consistent dialogue among all parties ensures that everyone is aligned with expectations and reduces misunderstandings.

How to manage the document within pdfFiller?

Managing the undertaking and indemnity form is straightforward with pdfFiller's user-friendly platform. This cloud-based solution offers several tools for editing, sharing, and signing documents.

-

Users can easily upload the completed form and share it seamlessly with parties involved in the transaction.

-

pdfFiller allows users to add legally binding electronic signatures, enhancing the authenticity and security of the document.

-

This platform provides features for tracking edits and managing document revisions, ensuring everyone stays updated.

How to fill out the undertaking and indemnity for

-

1.Open pdfFiller and upload your 'undertaking and indemnity for' document.

-

2.Review the template for any pre-filled information and determine what needs to be changed.

-

3.In the designated fields, enter your name and address as the party providing the undertaking.

-

4.Input the recipient's details who will benefit from the indemnity in the specified section.

-

5.Clearly describe the undertaking obligations you are agreeing to fulfill in the relevant area of the form.

-

6.Fill in the section that outlines the indemnity clause, specifying what risks or losses you are covering.

-

7.Include any additional terms or conditions relevant to the agreement if prompted.

-

8.Double-check all entries for accuracy and completeness before saving.

-

9.Once satisfied, securely save your document and download it in your preferred format.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.