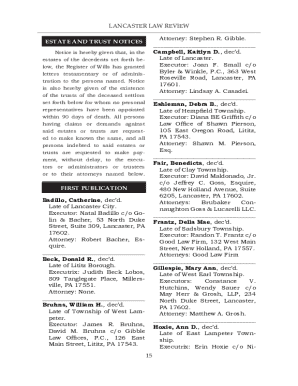

Get the free Loan Modification Agreement (Providing for Fixed Interest Rate template

Show details

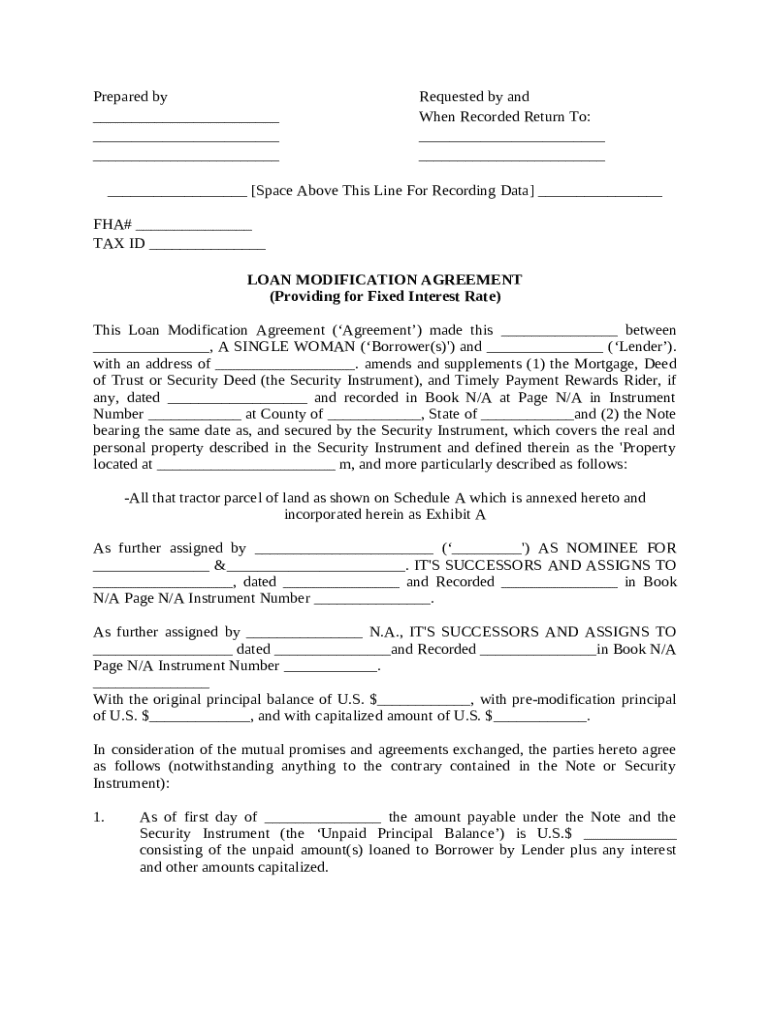

Loan modification agreement is the legal document that codifies your loan modification, making it legally binding. It covers every facet of the newly modified loan, including the money you still owe,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is loan modification agreement providing

A loan modification agreement providing is a legal document that alters the terms of an existing loan to improve the borrower's financial situation.

pdfFiller scores top ratings on review platforms

satisfied

good

Could do with being allowed more pages per PDF

fantastic

awesome

It's very convenient and effectively help to edit forms or files.

Who needs loan modification agreement providing?

Explore how professionals across industries use pdfFiller.

Loan modification agreement providing form guide

A loan modification agreement providing form is a critical document for borrowers seeking to alter their loan terms. This guide will help you understand what a loan modification agreement entails, how to fill it out using pdfFiller, and other important considerations.

What is a loan modification agreement?

A loan modification agreement is a legal document that alters the terms of an existing loan. Its primary purpose is to make the loan more affordable for the borrower, often by adjusting the interest rate or extending the repayment period.

-

Loan modification agreements serve to provide borrowers relief from financial distress by adjusting unacceptable loan terms.

-

Borrowers may explore modification when facing difficulty making payments, experiencing a drop in income, or after a financial crisis.

-

While both processes change loan terms, modification retains the original loan while refinancing creates a new loan, often with different terms.

What are the key components of a loan modification agreement?

-

This section identifies who prepared the document and who has requested the modification, along with any necessary recording details.

-

Clearly specifying both the borrower and lender is crucial to ensure all parties are correctly represented.

-

Accurate property descriptions reduce misunderstandings and legal issues pertaining to the asset involved.

-

This section outlines the amount owed on the loan before modification and is essential for calculations.

-

Detailing the current interest rate and any changes post-modification highlights the new financial obligations of the borrower.

How to fill out a loan modification agreement?

-

Before you fill out the form, collect relevant financial data such as income, expenses, and current loan terms.

-

Visit pdfFiller to find the loan modification agreement template, which you can easily fill out online.

-

Clearly enter the names and contact information for both the party preparing the document and the one requesting the modification.

-

Accurate identification here is critical for the validity of the agreement.

-

Ensure property details are complete and precise to avoid any potential disputes.

-

Double-check your calculations to ensure accuracy in this critical figure.

-

Use pdfFiller’s editing features to revise any sections before finalizing the document.

How to edit and sign using pdfFiller?

-

Use the intuitive interface of pdfFiller to make necessary adjustments easily.

-

pdfFiller allows you to insert eSignatures, making the process fast and convenient.

-

Share the document with other stakeholders to facilitate review and approval.

-

Storing documents in the cloud ensures secure access from anywhere, promoting seamless collaboration.

What common mistakes should be avoided?

-

Double-check names and details to avoid disputes or delays in the modification process.

-

Ensure all descriptions adhere to legal standards to prevent issues related to rights and ownership.

-

Errors in this figure can affect the new loan terms and lead to further complications.

-

Records must be maintained according to local regulations; failing to do so could invalidate the modification.

What are the compliance and legal considerations?

-

Depending on your region, specific legal requirements may apply to loan modifications.

-

It is important to know what you are agreeing to when signing a modification to protect your interests.

-

If there are complexities or uncertainties, consulting with a legal expert can be beneficial.

How to finalize and manage your loan modification agreement?

-

Follow through with any additional requirements laid out by your lender after submitting your agreement.

-

pdfFiller's cloud storage options ensure your documents are safely kept and easily accessible.

-

Ongoing dialogue with your lender can help resolve any follow-up issues quickly.

-

Have a strategy in place to address any challenges that arise after your loan modification.

How to fill out the loan modification agreement providing

-

1.Start by downloading the loan modification agreement template from your preferred source.

-

2.Open the PDF in pdfFiller and review the initial information for clarity.

-

3.In the borrower section, fill in your full name, address, and contact details accurately.

-

4.Provide the lender's name and contact information, ensuring it matches the original loan documents.

-

5.In the loan details section, input your loan number, original loan amount, and the current outstanding balance.

-

6.Review the proposed modifications, including new interest rates and payment terms, and fill in the proposed amount.

-

7.Ensure that all sections regarding borrower signatures and dates are completed correctly.

-

8.Once all information is filled in, double-check for any missing details or errors.

-

9.Save the completed document and print it for your records, and ensure it's signed by both parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.