Get the free Minnesota Registration of Foreign Corporation

Show details

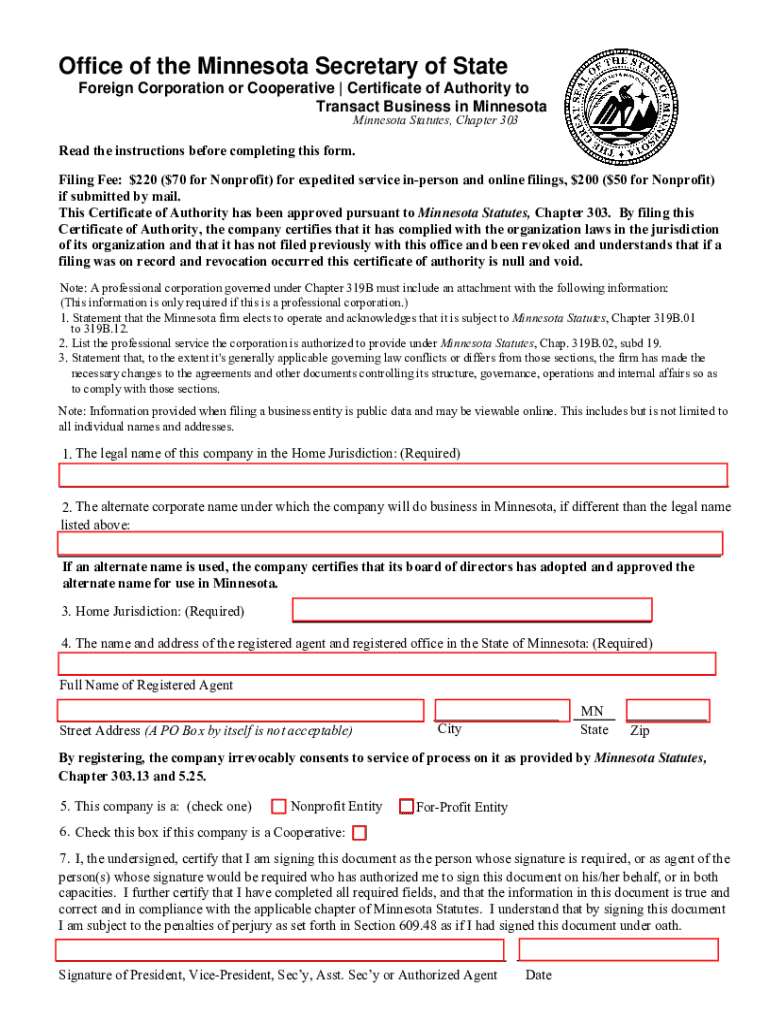

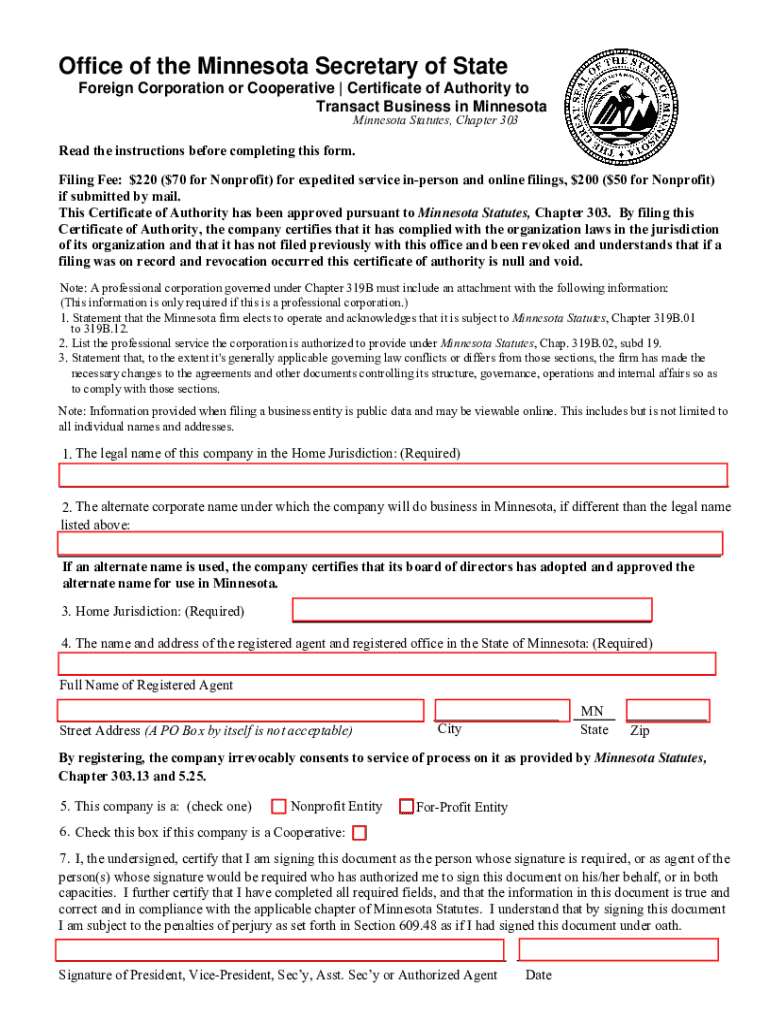

Register a foreign (non-Minnesota) corporation in Minnesota.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is minnesota registration of foreign

Minnesota registration of foreign refers to the process by which a business entity incorporated outside Minnesota registers to conduct business within the state.

pdfFiller scores top ratings on review platforms

So far so good, intuitive and easy to use

doesn't always fill in the correct boxes and had errors!

As a grant writer, I found PDFfiller to be very useful.

Affordable, reliable, and flexible with changes. Could use a little more explaining to become more user friendly without having to get technical assistance all the time.

Not the easiest but better than Legal Zoom!

I got a small mobile welding business and like to see all the features we can use from PDFfille

Who needs minnesota registration of foreign?

Explore how professionals across industries use pdfFiller.

How to navigate the Minnesota registration of foreign corporations

If you need guidance on how to register a foreign corporation in Minnesota, this comprehensive guide will provide you with all the necessary steps, requirements, and resources. We will walk you through the process, ensuring you can complete your Minnesota registration of foreign form form efficiently.

What is the Minnesota registration of foreign corporations?

A foreign corporation is a company that is incorporated in one state but wishes to conduct business in another. In Minnesota, registering as a foreign corporation is crucial for legal recognition and compliance. This registration is governed by specific laws outlined in Minnesota Statutes Chapter 301.

-

A foreign corporation is an entity formed under the laws of another state or country.

-

Registering as a foreign corporation ensures that your business is legally recognized to operate within Minnesota.

-

The process is regulated by Minnesota Statutes Chapter governing foreign registrations.

What are the key requirements for filing the Certificate of Authority?

Before you file your Certificate of Authority in Minnesota, it is essential to understand the eligibility criteria for foreign corporations. You will need to gather specific documents and other information necessary for a successful application.

-

To register, your corporation must be in good standing in its home state and comply with Minnesota laws.

-

Key documents include the Certificate of Existence, corporate bylaws, and appointing a registered agent.

-

Special rules apply to Professional Corporations under Chapter B requiring additional disclosures.

How can you apply for the Certificate of Authority?

The application process is straightforward but requires careful attention to detail. Follow the four key steps outlined below to submit your application successfully.

-

Ensure you have all required documents on hand, including proof of existence from your home state.

-

Fill out the application form accurately, ensuring all information matches your business records.

-

Utilize pdfFiller to upload, edit, and submit your form electronically for efficiency.

-

Be prepared to pay the necessary filing fees and consider expedited options if necessary.

What should you know about filing fees and service options?

Filing fees can vary based on submission methods and whether you opt for expedited services. Understanding these costs can help you plan your budget effectively.

-

Typical fees for filing a foreign corporation can range from $100 to $250 depending on various factors.

-

You can submit your application in-person, online, or via mail; each has its pros and cons.

-

If time is of the essence, expedited services are available for an additional fee, ensuring faster processing.

What to expect after filing and compliance requirements?

Once your application is submitted, it is important to remain compliant with ongoing requirements for foreign corporations in Minnesota. Failure to comply can lead to dire consequences.

-

You will receive confirmation of your application, but be prepared for possible follow-ups if there are issues.

-

Regular filings and fees are required to maintain your corporation’s status, including annual reports.

-

Failure to adhere to regulations may result in penalties and potential revocation of your business registration.

What about public data and information disclosure?

Understanding what public data means in the context of your foreign corporation filing is essential. Certain information is accessible to the general public, which can have privacy implications.

-

Certain data from your filing, such as corporate officers and registered agents, is considered public.

-

Most of your corporation’s information is available online through the Minnesota Secretary of State’s website.

-

It is crucial to weigh the benefits of transparency against the need for privacy when providing personal information.

How can pdfFiller simplify document management?

Using pdfFiller can greatly enhance your experience with managing documents and forms. The platform offers a range of features designed to simplify the process of document preparation and submission.

-

pdfFiller eases the preparation of the Certificate of Authority through customizable templates.

-

You can easily eSign your document, ensuring quick and effective approval.

-

Teams can collaborate seamlessly on document submissions, streamlining the workflow.

What interactive tools and resources are available?

Interactive tools can enhance your document management experience, allowing for efficient access to various resources that could aid in filling out your foreign corporation registration form.

-

Utilize readily available templates on pdfFiller to expedite the completion of forms.

-

Access a variety of tools designed for efficient document editing and storage.

-

Take advantage of tips and resources to get the most out of your pdfFiller experience.

How to fill out the minnesota registration of foreign

-

1.Obtain the 'Minnesota Registration of Foreign Entity' form from the Minnesota Secretary of State's website or pdfFiller.

-

2.Fill in the entity name exactly as it appears on the original formation documents.

-

3.Provide the jurisdiction of incorporation and the date of formation.

-

4.List the principal office address and the registered agent's name and address in Minnesota.

-

5.Indicate the type of business the entity intends to conduct in Minnesota.

-

6.Provide the appropriate tax identification number and any necessary business licenses.

-

7.Review the completed form for accuracy and completeness.

-

8.Sign the form, ensuring that the person signing has the authority to do so.

-

9.Submit the form along with any required filing fees to the Minnesota Secretary of State via mail or online through their portal.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.