Get the free Renunciation and Disclaimer of Property Received by Intestate Succession template

Show details

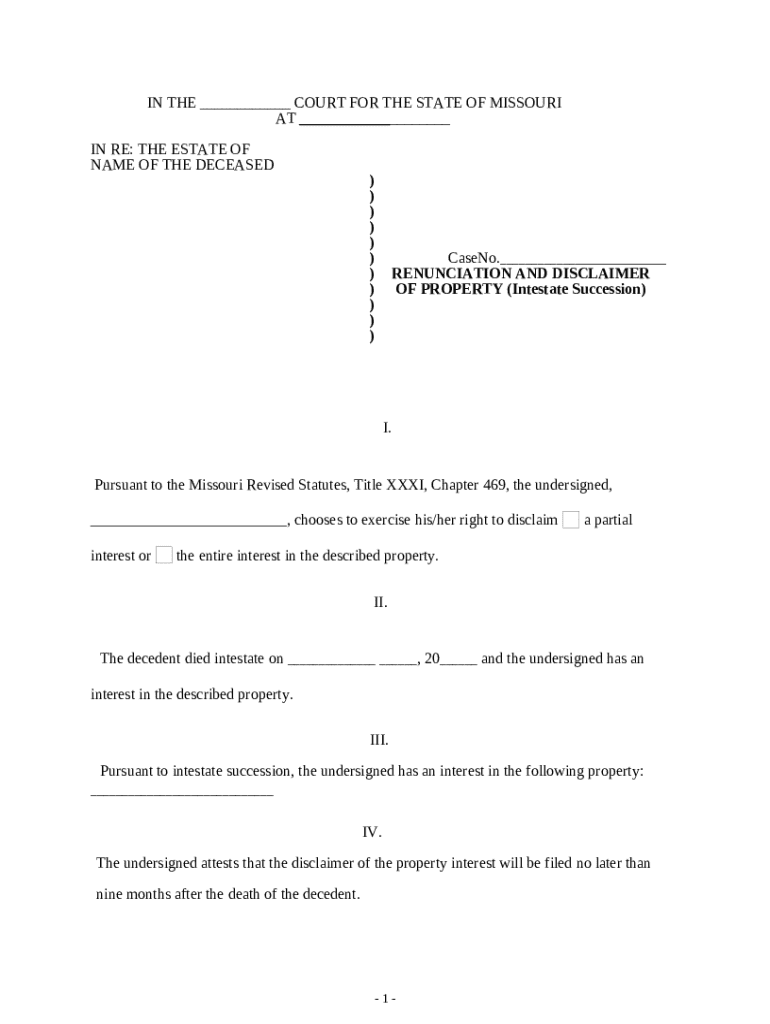

This Renunciation and Disclaimer of Property is received by the beneficiary through intestate succession. The decedent died intestate and the beneficiary is entitled to claim the property described

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is renunciation and disclaimer of

A renunciation and disclaimer of is a legal document in which an individual voluntarily relinquishes their rights or claims to an inheritance or property.

pdfFiller scores top ratings on review platforms

Due to a mixup a annual membership was…gre

Due to a mixup a annual membership was bought. Upon realization of such, cancelation was requested and in a very helpful and easy manner PDFfiller Customer Service Team took care of the problen and in a couple of hours solved the issue and awarded a full refund. If ever in need of a service, PDFfiller will get my business!

Pricing is very good

Pricing is very good. Free trial helped a lot to discover vital features. After trial I have decided to purchase a subscription. Esign, editing, and organizing are working perfectly

Very good easy to use program

Very good easy to use program. Customer service is great I miss read and accidentally signed up for a whole year in one go instead of just for the month, they quickly resolved it for me and refunded the difference. =) if I ever need to do documents online again I will definitely use their service again

This program is SO easy to use and…

This program is SO easy to use and Efficient when you need to fill out forms for work but you cannot physically get to work to turn them in!

VERY EASY TO USE

VERY EASY TO USE. 5 STARS

Working very well so far (after using…

Working very well so far (after using it for 3 docs) and it's saved me a huge amount of work!

Who needs renunciation and disclaimer of?

Explore how professionals across industries use pdfFiller.

Renunciation and disclaimer of form form guide

A renunciation and disclaimer of form is a legal document that allows a beneficiary to refuse their inheritance. This guide will help you understand the process, requirements, and implications involved in completing this form.

What is renunciation and disclaimer?

In estate law, renunciation and disclaimer refer to the legal act of a beneficiary refusing an interest in property or assets. This process is crucial for beneficiaries as it affects their inheritance potential and the distribution of the deceased's estate.

-

Renunciation means giving up a right or claim, while a disclaimer is a formal statement that one declines to accept an inheritance.

-

Understanding this process is vital for beneficiaries to make informed decisions regarding any inherited property.

-

Renouncing an interest can significantly alter how an estate is administered, as it redistributes property to other heirs.

What is the legal framework in Missouri?

Missouri's legal framework for renunciation and disclaimer is outlined in the Missouri Revised Statutes. Familiarity with these statutes is essential for executing this process correctly.

-

The Missouri Revised Statutes provide guidelines on how a beneficiary can legally renounce their interest.

-

Understanding terms like intestate succession, which describes the distribution of estate assets when someone dies without a will.

-

In Missouri, a disclaimer refers to rejecting an interest, whereas renunciation implies a broader refusal of inheritance rights.

How do you fill out the renunciation and disclaimer form?

Completing the renunciation and disclaimer form requires careful attention to detail. A step-by-step approach can help ensure accuracy.

-

Begin by gathering necessary information including decedent details and property interests. Carefully fill out the required fields, and avoid leaving any blank.

-

Understand key terms like 'decedent' (the deceased person), 'property interest' (the property being refused), and 'executor' (the person managing the estate).

-

It is crucial to file the form within nine months after the death for it to be valid; otherwise, rights to the inheritance may be lost.

What tools are available for form management?

Using interactive tools can greatly enhance the experience of filling out and managing the renunciation and disclaimer form.

-

pdfFiller offers a range of interactive tools that assist users in optimizing their form-filling process, making it more user-friendly.

-

Users can edit, sign, and manage the submitted form directly through the platform, ensuring a seamless process.

-

The platform allows users to save and share the completed form online easily, facilitating better collaboration.

What common mistakes should be avoided?

Filling out the renunciation form may seem straightforward, yet there are frequent errors that can have significant consequences.

-

Common mistakes include incomplete fields, incorrect information about the decedent or property, and failing to understand the implications of renouncing.

-

Double-check all entries and ensure clarity in your intentions. It’s advisable to have a legal professional review your form.

-

If uncertain, consulting with a legal expert can help clear up questions about the process and ensure compliance with state laws.

How do you file and deliver the form?

Submitting the renunciation and disclaimer form in Missouri involves specific filing requirements to ensure validity.

-

The completed form must be filed with the probate court in the county where the decedent resided.

-

You can deliver the form personally, or send it via registered or certified mail for added security.

-

The form might require notarization or acknowledgments by other parties to be legally binding.

What post-filing steps should be considered?

After filing the renunciation and disclaimer, there are several important considerations to keep in mind.

-

Once filed, inquire about how the renunciation affects the distribution of assets. The property will then devolve to other beneficiaries.

-

Understand the factors that could lead to a renunciation being contested, which may complicate the distribution of assets.

How to fill out the renunciation and disclaimer of

-

1.Open the renunciation and disclaimer of form on pdfFiller.

-

2.Provide your full name and contact information at the top of the document.

-

3.Specify the relationship to the deceased or the inheritor if applicable.

-

4.Clearly state the assets or rights being renounced in the designated section.

-

5.Add any necessary dates indicating when the renunciation takes effect.

-

6.Sign the document in the signature area.

-

7.If required, have the document notarized to enhance its legal validity.

-

8.Save the completed form and print a copy for your records.

-

9.Submit the signed document to the relevant authority or estate executor.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.