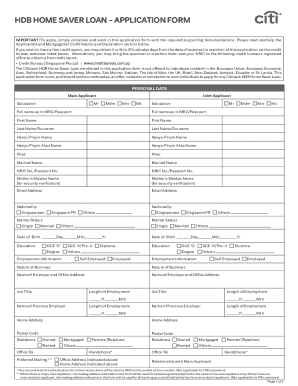

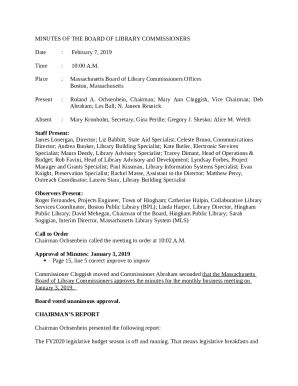

Get the free Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Indi...

Show details

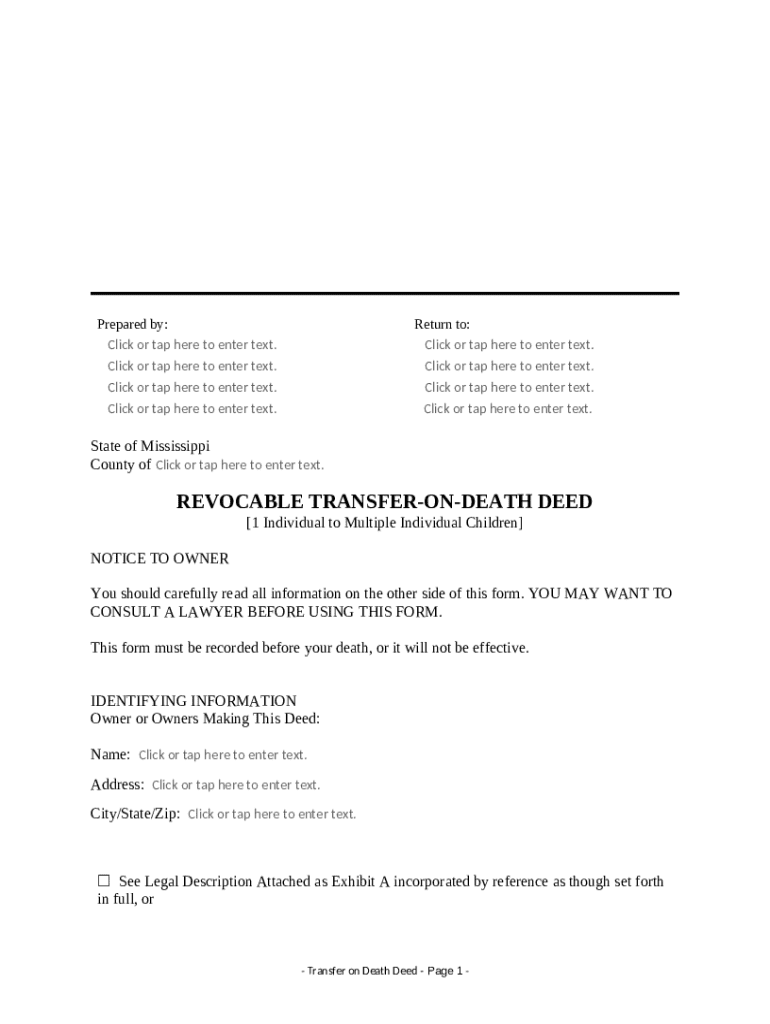

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed allows an individual to transfer real estate property to a designated beneficiary upon their death, avoiding probate.

pdfFiller scores top ratings on review platforms

It was really good. the software was easy to use.

LEARNING AS I GO ALONG. SO FAR, SO GOOD. :)

PDFfiller has saved an enormous amount of time. It is amazing. Thank you!

So far it has been very helpful. I need it to do my job.

the service is great, however the payment option is miss leading, as it says $6/month and when you go to pay you charge the full year up front, in US$ and some of us are poor, so thanks for that.

it helps me find the right forms that I need.

Who needs transfer on death deed?

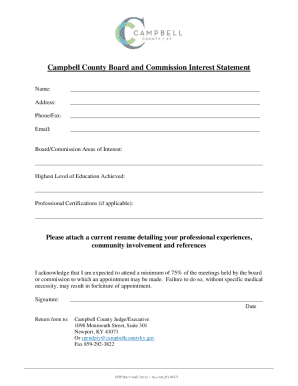

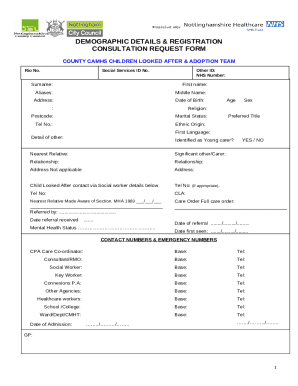

Explore how professionals across industries use pdfFiller.

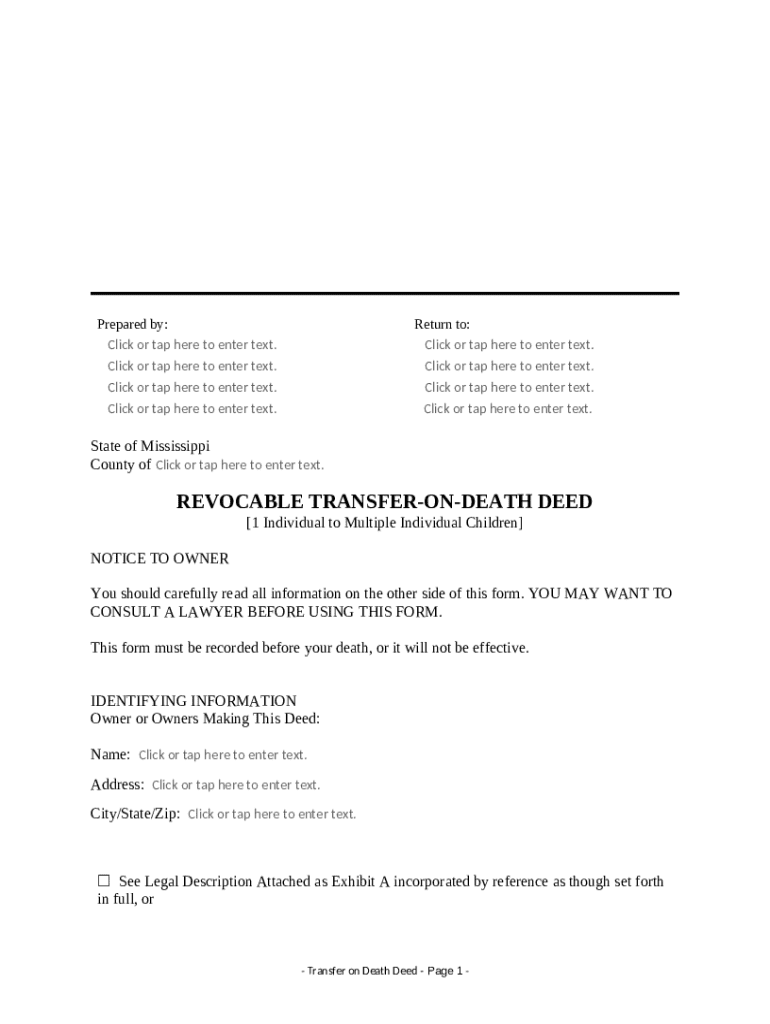

Complete Guide to Transfer on Death Deed Form

How does a transfer on death deed work?

A Transfer on Death Deed (TODD) enables property owners to transfer real estate to designated beneficiaries upon their death without the need for probate court involvement. This form serves as a testamentary document that becomes effective only upon the owner's death, making it a tool of estate planning. In Mississippi, TODDs play a crucial role in simplifying property transfer processes and ensuring an efficient transfer of property upon death.

-

A written document that specifies how property is to be transferred upon the death of the owner.

-

Avoids probate, allowing for a seamless transfer of property directly to beneficiaries.

-

Removes the complexities of probate and provides clarity on property succession.

What do you need to prepare before filling out the form?

Preparing to complete a Transfer on Death Deed effectively requires gathering specific documents and understanding crucial terms related to estate planning. Having the required information will streamline the process and reduce the risk of errors. It’s recommended to consult with a legal expert to ensure compliance with state regulations.

-

Such as current property records, a list of beneficiaries, and identification.

-

Recognize terminologies like beneficiaries, revocation, and property description for clarity.

-

Professional guidance can prevent pitfalls and ensure your document meets legal standards.

How do you complete the Transfer on Death Deed form?

Completing a Transfer on Death Deed form involves detailed steps that ensure clarity for both the owner and the beneficiaries. Each section of the form must be filled out accurately to uphold its legal standing. Below are key sections to focus on while filling out the form.

-

Capture the owner’s details and property address correctly.

-

Specify who will inherit the property; this can include family members or friends.

-

This section allows you to name alternate beneficiaries in case the primary ones cannot inherit.

-

Clarify the percentage of ownership each beneficiary will receive.

-

Ensure that the legal description aligns with public records to avoid disputes.

How to fill out the form on pdfFiller?

Utilizing pdfFiller for filling out the Transfer on Death Deed form (TODD) offers users advanced editing features that enhance the document preparation process. Whether collaborating with others or signing electronically, this platform simplifies the experience significantly.

-

Easily modify fields and adjust settings according to your needs.

-

Use the eSign feature to complete your document in compliance with digital laws.

-

Invite others to review and sign the document to ensure all parties are on the same page.

What steps to take for recording your Transfer on Death Deed?

Recording your Transfer on Death Deed is a crucial step to ensure its enforcement. In Mississippi, specific steps must be followed to allow the deed to hold legal weight after your passing.

-

Visit your local county recorder’s office to file the deed.

-

Typically, the deed should be recorded immediately after completion to prevent any potential legal issues.

-

Delays in recording can lead to disputes among beneficiaries.

How can you revoke or change the Deed?

Changes to a Transfer on Death Deed are possible, as long as the original owner is alive. Understanding the process of revoking the document is important for ensuring that property distribution aligns with changing circumstances.

-

Complete a formal revocation document and file it with the same authority where the deed was recorded.

-

Life events such as marriage, divorce, or changes in personal relationships can prompt the need for updates.

-

Ensure compliance with state laws regarding revocation to avoid disputes.

How to fill out the transfer on death deed

-

1.Open pdfFiller and upload the transfer on death deed form.

-

2.Begin by entering your full name and address in the designated fields.

-

3.Next, provide the name and address of the beneficiary who will receive the property.

-

4.Include a detailed description of the property, including its address and parcel number.

-

5.Review the document for accuracy and ensure all fields are filled appropriately.

-

6.Sign the deed in the designated signature section and date it.

-

7.If required, have the deed notarized by a certified notary public.

-

8.Finally, file the completed deed with the appropriate county recorder’s office to ensure it is legally recognized.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.