Last updated on Feb 10, 2026

Get the free Open End Mortgage

Show details

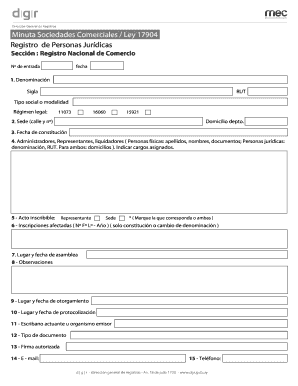

Open End Mortgage

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is open end mortgage

An open end mortgage is a type of mortgage that allows the borrower to borrow additional funds against the equity of their property without having to refinance the original loan.

pdfFiller scores top ratings on review platforms

Great, very straight forward if you have any microsoft experience

Easy to use. Site is user friendly. Convenience is awesome.

PDFfiller is excellent in filling out my tax forms. I was able to locate back-year tax forms to file and amended return Form 1040X.

Worked great for completing numerous medical forms..great product and enjiyed faxing fearure

Works great. Just would like easy accessible to a blank sheet.

My experience has been very productive. Completing my son's Eagle Application and this is working well.

Who needs open end mortgage?

Explore how professionals across industries use pdfFiller.

Ultimate Guide to the Open End Mortgage Form

An open end mortgage form is a specialized document used to secure a form of financing that allows borrowers to draw additional funds at a later time. Understanding how to properly fill out this form can greatly enhance your borrowing experience and ensure compliance with applicable regulations.

This guide will help you navigate the complexities of the open end mortgage form, detailing it from fundamental definitions to practical steps in filling it out using pdfFiller tools.

What is an open end mortgage?

An open end mortgage is a type of loan that permits the borrower to gradually borrow money against the equity of their home. Unlike a traditional mortgage, which provides a one-time lump sum, an open end mortgage allows the borrower to take out additional funds as needed.

-

Open end mortgages are revolving lines of credit secured against the value of a property, similar to a home equity line of credit.

-

They provide flexibility, allowing homeowners to access funds for renovation, education, or unexpected expenses without the need to reapply for a new loan.

-

Typically used by homeowners who need ongoing access to funds, such as for home improvements or other significant expenses, affecting their financial planning.

What are the key fields in the open end mortgage form?

Filling out the open end mortgage form correctly is crucial for a smooth borrowing process. Below are the key fields that need attention.

-

Information about the property, including address and identification details, must be accurate to establish the property's equity.

-

Personal details of the borrower, such as name, current address, and income level, ensure that the lender can assess financial stability.

-

Clearly state the interest rates applicable and the terms of repayment, which affect the cost of borrowing.

How do you fill out the open end mortgage form?

Filling out an open end mortgage form can be straightforward if you follow these steps meticulously.

-

Ensure you have all necessary documents such as title deeds, income verification, and prior mortgage details.

-

Utilize pdfFiller to fill the form electronically, benefiting from features that help auto-fill some sections based on your uploaded documents.

-

Double-check all entries for accuracy and clarity before submitting the form to the lender.

How can you edit and customize your mortgage form?

Using pdfFiller’s platform allows you to efficiently make necessary edits and customization on your open end mortgage form.

-

You can easily edit any fields within the form to ensure all information stays current and accurate.

-

Utilize drag-and-drop tools to rearrange sections for better clarity or presentation.

-

Access a variety of templates that fit your specific mortgage form needs, simplifying the creation process.

What is the eSigning process for your open end mortgage form?

The eSigning process has revolutionized how documents are executed, making it faster and more efficient.

-

Using pdfFiller, you can click to sign electronically by following a straightforward prompt.

-

eSigning is recognized as a legal form of signature in many regions, streamlining the finalization of deals.

-

eSigning reduces paperwork and speeds up the process of securing the mortgage.

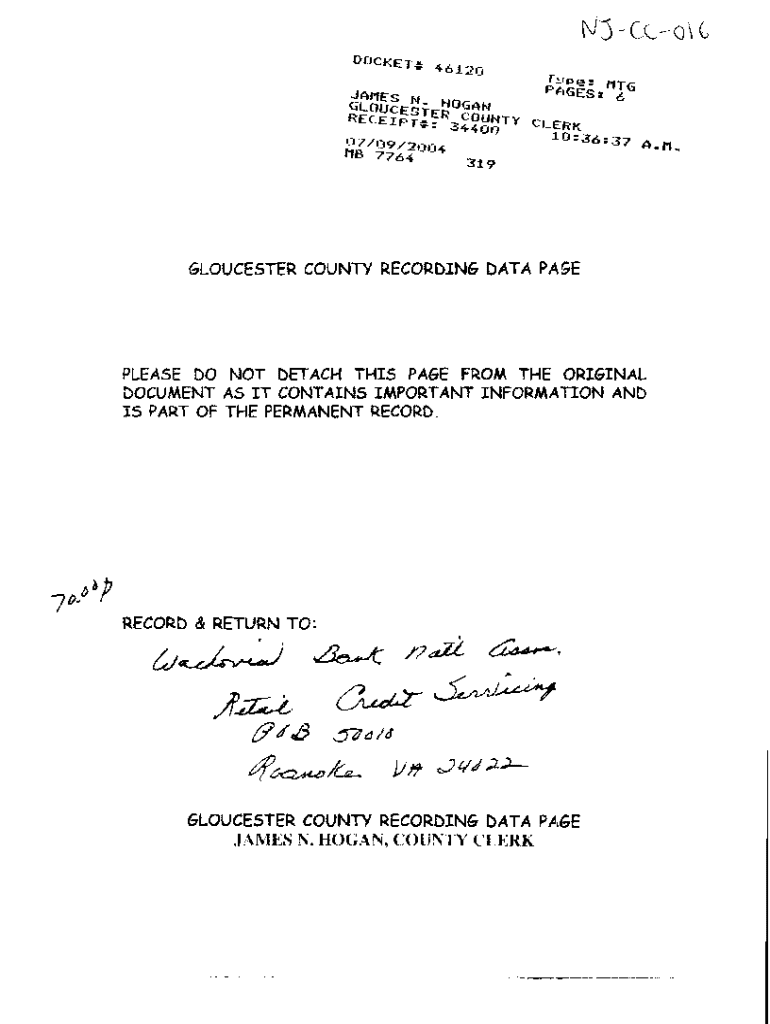

How do you manage your open end mortgage documents?

Organizing your documents is key to maintaining oversight of your finances. pdfFiller provides several tools for efficient document management.

-

Store your completed forms in the cloud for easy access and retrieval whenever necessary.

-

Share your mortgage documents seamlessly with lenders or advisors through pdfFiller’s sharing options.

-

Utilize security features to keep track of document versions and ensure that sensitive information is protected.

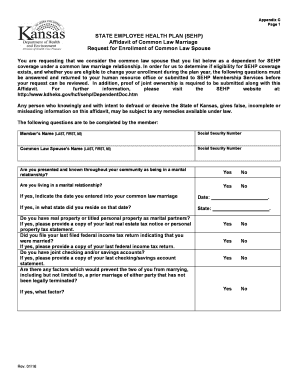

What are the compliance and legal considerations?

Adhering to compliance regulations is crucial when dealing with open end mortgages. Understanding these legal considerations helps prevent issues later.

-

Different regions may have specific rules regarding open end mortgages, so be sure to be aware of the laws governing your area.

-

Ensure all necessary legal language is included in your form to protect both the borrower and the lender.

-

Consult local regulatory agencies or financial advisors for guidance on crafting compliant mortgage documents.

What common mistakes should you avoid?

Common errors can lead to significant delays or complications in the mortgage process, making awareness of these mistakes crucial.

-

Failing to include necessary details can result in an incomplete application, leading to rejection.

-

Any inaccuracies in data, especially financial, can drastically affect the approval of your open end mortgage.

-

Ensure that every necessary party has signed the document to validate it.

What additional resources are available?

Having the right resources at your disposal can enhance your understanding and improve the efficiency of your mortgage process.

-

Explore additional guides on mortgages that offer deeper insights and best practices.

-

Check for a compilation of frequently asked questions related to open end mortgages for more clarity.

-

Reference financial institutions or legal advisors for support regarding mortgage intricacies.

How to fill out the open end mortgage

-

1.Begin by downloading the open end mortgage form from pdfFiller.

-

2.Open the PDF document in pdfFiller's editing tool.

-

3.Fill in the borrower’s full name and contact information in the designated fields.

-

4.Provide the property address and legal description accurately.

-

5.Enter the loan amount you wish to borrow and ensure it aligns with your home equity.

-

6.Review the interest rate section and fill in the agreed interest rate if applicable.

-

7.Specify any terms and conditions of the mortgage in the appropriate section.

-

8.Sign and date the document digitally, ensuring all parties involved will sign too.

-

9.Finally, save the completed document and follow the submission guidelines to send it to your lender.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.