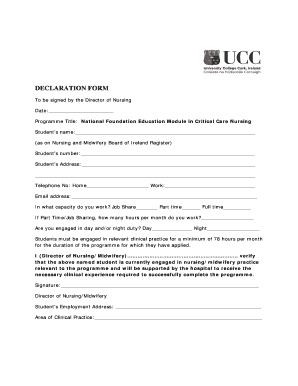

Get the free Judgment on Writ of Garnishment and Order to Pay template

Show details

The court enters an order of garnishment and enters finding of facts about the debtor and the debt.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

pdfFiller scores top ratings on review platforms

I really like this because I was filling the forms out by hand.

This is the easiest program I have ever used.

DOCS ARE UP TO DATE AND ARE EASILY ACCESSIBLE

Super easy to use and very convenient. I would highly recommend to anyone.

Terrific so far! Looking forward to utilizing more options! Thanks!

I worked with Elie tonight and your support is amazing. She was friendly, patient and knowledgeable. She was able me to better understand the PDFfiller and was able to accomplish what I wanted. Very Pleased with your service and product.

Guide to Judgment on Writ of Garnishment

This guide explains everything you need to know about the judgment on writ of form form, including filing processes, creditor and debtor roles, and exemptions. A writ of garnishment is an important legal tool in debt collection, allowing creditors to collect debts directly from a debtor's income or bank account.

What is a writ of garnishment?

A writ of garnishment is a court order that allows a creditor to collect a debt directly from a third party holding the debtor's assets, such as an employer or bank. It plays a significant role in debt collection by legally directing these third parties to withhold a portion of the debtor’s income or bank account balance.

-

A court-issued command that enables a creditor to obtain money from a debtor's income or assets held by a third party.

-

It helps creditors secure repayment of judgments by accessing the debtor's income directly, ensuring they have a legal path to obtain what is owed.

-

It places an immediate financial burden on the debtor while offering creditors a more reliable chance of recovering their funds.

What are the key elements of the writ of garnishment?

Filing a writ of garnishment requires specific elements to be valid and enforceable. Understanding these components is crucial for both creditors and debtors to navigate the process effectively.

-

The creditor must file the writ in the appropriate court, providing necessary details to initiate the garnishment process.

-

Accurate identification of the debtor is critical; any errors can lead to legal complications and delays in collecting the owed amount.

-

The garnishee, typically an employer or financial institution, must be formally notified to ensure compliance with the writ.

How does the court find and proceed with garnishment cases?

The court has specific responsibilities in reviewing and deciding on garnishment cases. It is essential to understand the process to ensure proper compliance and avoid issues.

-

The court must evaluate the submitted writ, ensuring it meets all legal criteria before granting the garnishment.

-

The court keeps records and may require the creditor to provide evidence that all legal avenues to collect the debt have been exhausted.

-

The court may determine if additional costs, such as attorney's fees or court costs, can be added to the total owed by the debtor.

How can a judgment debtor file a claim for exemption?

Judgment debtors can file for exemptions to protect certain income or assets from being garnished. Knowing the process and types of exemptions can significantly affect outcomes.

-

Debtors must submit a claim to the court detailing why certain income or assets should be exempt from garnishment.

-

Common exemptions include protected wages, government benefits, and certain essential property.

-

The court reviews any disputes over exemptions, which can lead to hearings to determine the validity of claims.

What are the responsibilities of the garnishee?

The garnishee has specific legal obligations upon receiving a writ of garnishment. Understanding these responsibilities is essential to prevent penalties and comply with the law.

-

The garnishee must identify their relationship with the debtor to ensure appropriate compliance with the court order.

-

The garnishee is required to submit a response to the creditor confirming whether they hold assets owed to the debtor.

-

If applicable, garnishee must begin withholding the specified amount from the debtor’s wages or accounts as directed by the court.

What are the legal consequences of defaulting garnishees?

Failure of a garnishee to comply with a writ of garnishment can lead to serious legal repercussions. Understanding these consequences is vital for all parties involved.

-

Inaction can lead to court interventions or additional legal actions taken by the creditor against the garnishee.

-

Penalties may include monetary fines or being held liable for the amount that should have been withheld from the debtor.

-

The court has authority to enforce compliance through various means, including contempt proceedings against non-compliant garnishees.

How to manage the aftermath of garnishment?

Post-garnishment steps are crucial for both creditors and debtors to understand. Managing the aftermath effectively can prevent disputes and manage expectations.

-

Debtors should assess their financial position post-garnishment, while creditors need to check compliance with the judgment.

-

Both parties must be aware of any continual obligations or further legal steps to ensure compliance with the court's decisions.

-

pdfFiller empowers users to easily manage their garnishment documents, facilitating edits, signatures, and comprehensive record-keeping in a secure cloud environment.

What features does pdfFiller offer for document management?

Using pdfFiller can significantly enhance how you manage and utilize garnishment documents. Its features are designed to increase efficiency and collaboration.

-

Users can easily template their garnishment documents, ensuring all necessary legal requirements are met with minimal effort.

-

The platform supports electronic signatures, facilitating faster agreement processes among multiple parties, which is particularly useful in legal settings.

-

All documents are stored securely in the cloud, providing easy access from anywhere, paired with robust security protocols to protect sensitive information.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.