Last updated on Feb 17, 2026

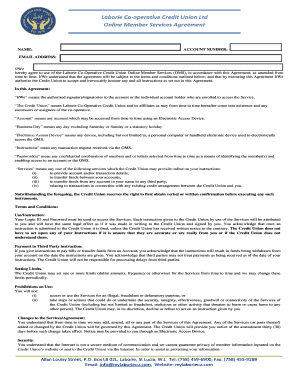

Get the free Order Reing Mortgage template

Show details

The court in a foreclosure action agrees to allow the underlying mortgage to be reformed to include the correct legal description.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

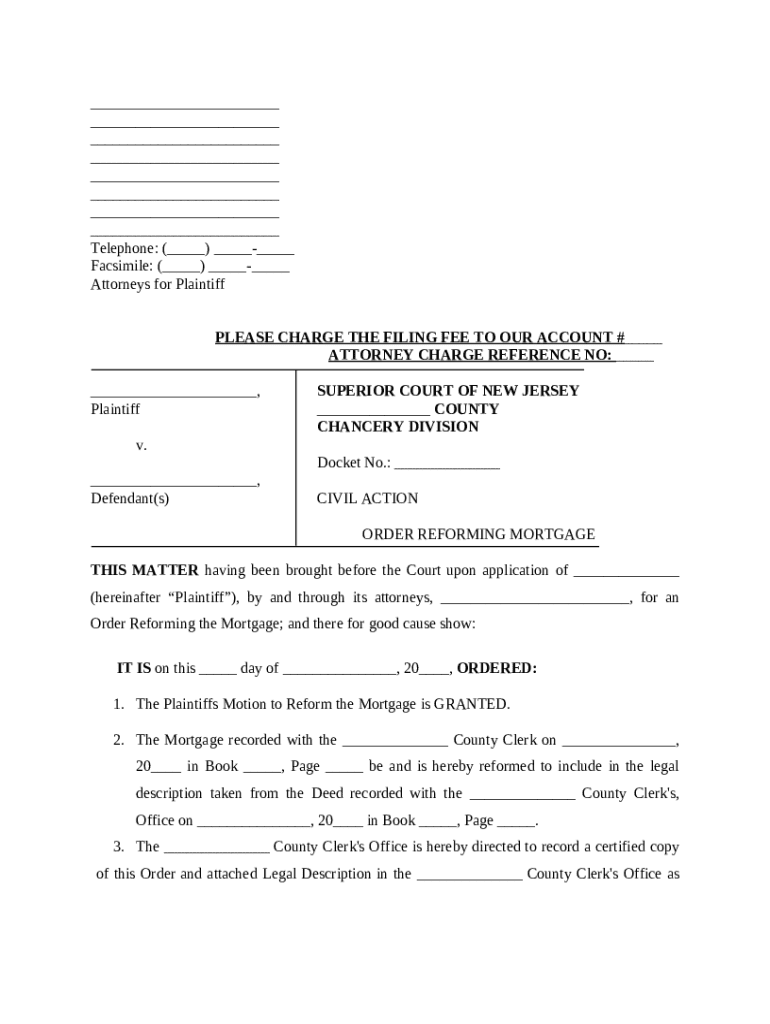

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is order reforming mortgage

An order reforming mortgage is a legal document used to modify the terms of an existing mortgage agreement.

pdfFiller scores top ratings on review platforms

Would like financial forms easier to fill out, with numbers lining up. Too much time spent trying to do that manually

Makes editing & signing pdfs that can't be converted to Word or Excel quick & easy

Wonderful product. Easy to use, fairly priced.

nice job, help line was very good but would like more written instructions on text size and spacing.

I have found PDFfiller very user friendly. Access to the necessary forms was more than adequate and easy to access.

As far as I have been using it it looks nice, the only problem that I found was when I choose to convert my pdf into a word document some letters and format change or is missing.

Who needs order reing mortgage template?

Explore how professionals across industries use pdfFiller.

Guide to Order Reforming Mortgage Form on pdfFiller

What is mortgage reformation?

Mortgage reformation is a legal process used to correct errors in a mortgage document. This process is crucial in ensuring all parties involved have accurate information and can avoid potential disputes or financial loss. Understanding the importance of correcting mortgage errors not only aids individuals but also supports the integrity of financial transactions.

-

Mortgage reformation legally alters existing mortgage documents to rectify inaccuracies.

-

Correcting errors ensures legal clarity and protects the interests of all parties involved.

-

Reasons include clerical mistakes, incorrect property descriptions, and changes in loan terms.

How do you use the order reforming mortgage form?

The use of the order reforming mortgage form can effectively streamline the correction process. With interactive tools available on pdfFiller, filling out this form becomes more manageable. Users can take advantage of features that allow easy editing, signing, and document management, making the entire process more efficient.

-

Follow intuitive prompts available on pdfFiller for a hassle-free experience.

-

Utilize tools that help you fill, sign, and store your documents securely.

-

Easily amend details and manage versions of your mortgage documents online.

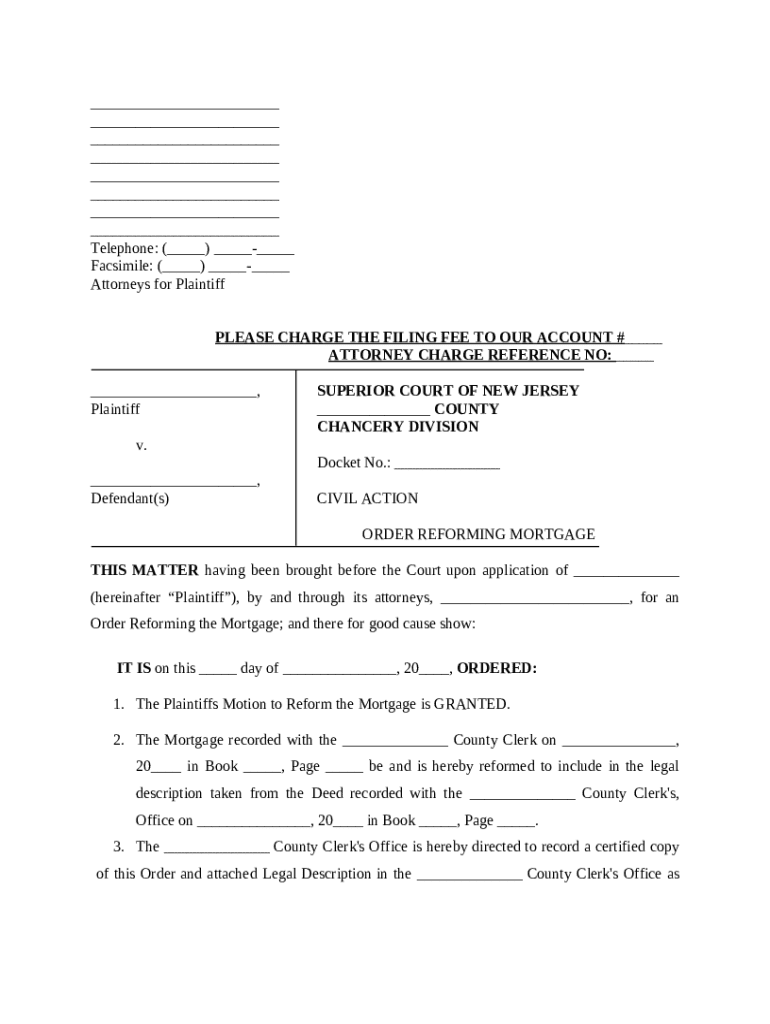

What are the key sections of the form?

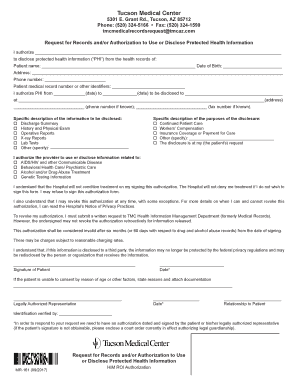

Filling out the key sections of the order reforming mortgage form is vital for clarity and legal compliance. Important sections include the identification of the parties, details of the mortgage in question, and court-related information that provides context for the reformation.

-

Accurate identification of all involved parties is essential.

-

Include comprehensive details regarding the mortgage that needs reformation.

-

A legal description of the property should be included for clarity.

-

You must provide the court details and the associated docket number for processing.

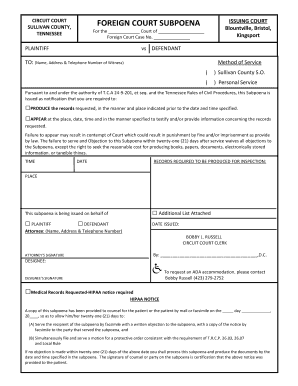

How do you navigate legal requirements in your region?

Each region has state-specific compliance guidelines for mortgage reformation. Understanding these legal requirements empowers individuals to submit accurate forms and reduces the risk of complications during the approval process.

-

Research the laws in your state regarding the reformation process.

-

The County Clerk's office often oversees the submission process for mortgage forms.

-

Ensure to follow local guidelines for serving documents to all involved parties.

What are common issues when filling out the form?

Mistakes can occur when completing the order reforming mortgage form, leading to delays or denials. Identifying common mistakes can save time and resources, and help ensure a seamless reformation process.

-

Double-check all entries to avoid clerical errors that could hinder processing.

-

Easily amend previously submitted forms through pdfFiller's editing tools.

-

Consult a lawyer if you encounter specific legal complexities.

How do you finalize your order reforming mortgage submission?

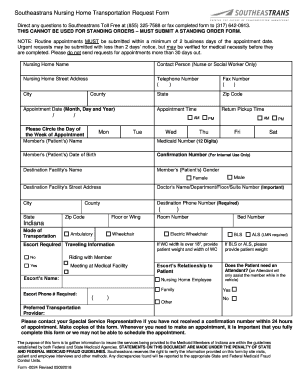

Finalizing your submission involves ensuring that all required documents are correctly filled out and submitted to the court. It's crucial to track your application status for timely updates on your order's acceptance.

-

Follow exact local guidelines for submitting the order for it to be considered.

-

Use tools provided by pdfFiller to monitor your application's progress.

-

Ensure that you receive official confirmation once your order has been filed.

What enhancements does pdfFiller offer?

pdfFiller's platform boasts several enhancements that simplify the document management process. Features such as real-time collaboration, cloud-based storage, and eSigning capabilities significantly improve the overall efficiency of handling mortgage reformation documents.

-

Collaborate with your legal team instantly on the platform.

-

Access your documents from anywhere, ensuring flexibility and efficiency.

-

eSigning expedites the signing process, ensuring quick turnaround times for your documents.

How to fill out the order reing mortgage template

-

1.Open the PDF file of the order reforming mortgage in pdfFiller.

-

2.Review the document for any pre-filled information, and ensure it is accurate.

-

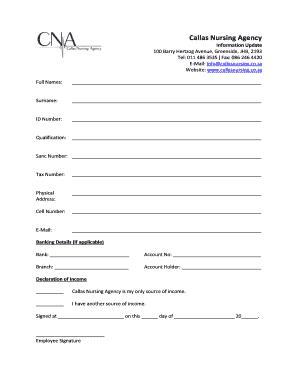

3.Fill in your personal information in the designated fields, including your name, address, and contact details.

-

4.Locate sections pertaining to the existing mortgage details and enter the relevant information, such as the original loan amount and lender's name.

-

5.Provide the proposed changes to the mortgage terms, including new interest rates or payment schedules in the specified sections.

-

6.If applicable, add any additional clauses or stipulations regarding the mortgage reform.

-

7.Sign the document electronically or print it out for a physical signature in the designated signature field.

-

8.Review the entire document for completeness and accuracy before submission.

-

9.Save the filled document in your pdfFiller account or export it to your preferred format.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.