Get the free Line of Credit Instrument

Show details

Line of Credit Instrument

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is line of credit instrument

A line of credit instrument is a flexible loan option that allows borrowers to access funds up to a specified limit as needed.

pdfFiller scores top ratings on review platforms

The program locks up a lot and fails to load. I have to restart the program several times during each use

When you have to fill out the same form (W2) many times and you have to continually have to go back and find the form again after each one.

New to the program. Like it, but not sure what all it can do. A little confused on how to submit a second form after the first one is submitted.

Its been really helpful & educational to me. I've really enjoyed it made my life much easier. Thanks

I love this program. Wish I knew what all it does besides the basics

Great experience. A bit Pricey, but definitely worth it for the quality of the work provided.

Who needs line of credit instrument?

Explore how professionals across industries use pdfFiller.

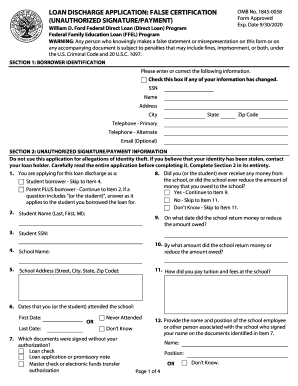

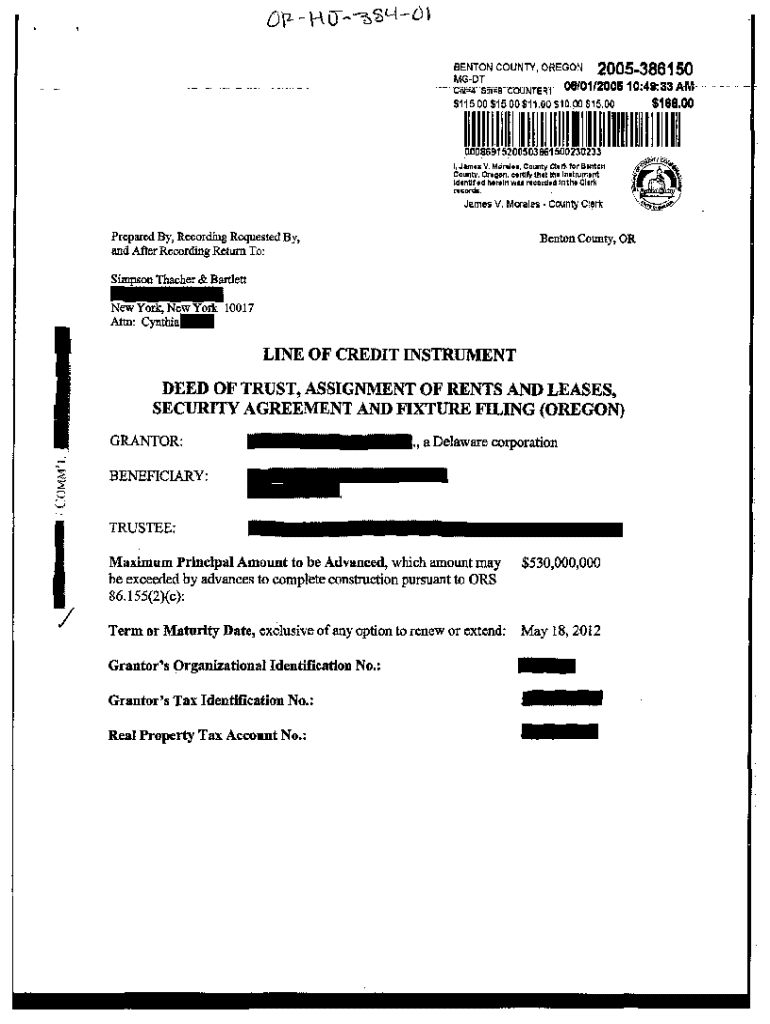

Comprehensive Guide to Line of Credit Instrument Form

A line of credit instrument form is a critical financial document that outlines the terms under which a lender provides borrowing to a borrower. Understanding how to fill out a line of credit instrument form effectively can help streamline the borrowing process, ensuring that all necessary components are addressed and both parties are protected.

What is a line of credit instrument?

A line of credit instrument is a financial agreement that allows borrowers to draw money as needed, up to a specified limit. This flexibility makes it useful for personal financing, such as managing unexpected expenses, as well as for businesses looking to cover operational costs or invest in growth opportunities. It impacts creditworthiness, as responsible usage can improve credit scores, while misuse may lead to financial pitfalls.

What are the essential components of the form?

Key elements of a line of credit instrument form include:

-

Identification of the lender and borrower, establishing who is participating in the agreement.

-

Details on the credit limit, interest rates, repayment terms, and conditions under which the credit can be accessed.

-

Clauses that determine collateral or assets tied to the line of credit, providing the lender with security against default.

How do you fill out the line of credit instrument form?

Filling out a line of credit instrument form involves careful attention to detail. Here’s a guide to ensure accuracy:

-

Accurately fill in your details such as name, address, and contact information.

-

Clearly outline the desired credit amount, acceptable interest rates, and repayment schedule.

-

Read through clauses regarding security interests and obligations, ensuring understanding of the commitments involved.

Make sure to utilize tools like pdfFiller for customization, as they streamline the editing process and help prevent common mistakes. Always double-check entries to minimize errors.

What should you know about eSigning and submitting your form?

Electronic signatures (eSignatures) legally bind agreements when appropriately used, enhancing the convenience of form submission. Using pdfFiller, you can create a secure eSignature that meets legal standards, making the process smooth and compliant.

-

Ensure your eSignature adheres to local laws governing digital agreements.

-

Utilize pdfFiller’s straightforward interface to place your eSignature in the designated spot on the form.

-

Explore various ways to submit your completed form, whether via email or direct upload, paying attention to any deadlines.

How can you manage your line of credit document effectively?

Once your line of credit instrument form is completed and submitted, effective document management becomes crucial. Adopting best practices ensures that your agreement remains accessible and compliant with legal requirements.

-

Utilize secure cloud storage options for easy access from anywhere, ensuring that you can retrieve your documents when needed.

-

Engage with team members using pdfFiller’s collaborative features, which allow for real-time feedback and updates on shared forms.

-

Regularly revisit your line of credit agreement, making necessary revisions based on changing financial situations.

What compliance and regulatory aspects matter?

Compliance with local lending laws is essential for maintaining the legality of your line of credit instrument. Accurate documentation helps safeguard both lenders and borrowers, creating a transparent interaction.

-

Stay informed on local lending norms to ensure your agreement meets all legal criteria.

-

Keeping updated records prevents legal disputes or misunderstandings.

-

Using pdfFiller’s templates ensures your forms are regularly updated for compliance with essential regulations.

How to fill out the line of credit instrument

-

1.Open the PDF document for the line of credit instrument on pdfFiller.

-

2.Begin by entering your personal information in the designated fields, including your name, address, and contact details.

-

3.Next, fill in the details of the financial institution providing the line of credit, including name, address, and contact information.

-

4.Specify the credit limit you wish to apply for, ensuring that it aligns with your financial needs.

-

5.If required, provide details of your income and employment situation to demonstrate your ability to repay the line of credit.

-

6.Review the terms and conditions section carefully, ensuring you understand the repayment schedule and interest rates.

-

7.Sign and date the document in the appropriate fields to validate your application.

-

8.Finally, save or submit the completed document according to the instructions provided on the platform.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.