ED Loan Discharge Application: False Certification (Unauthorized Signature/Payment) 2017-2025 free printable template

Show details

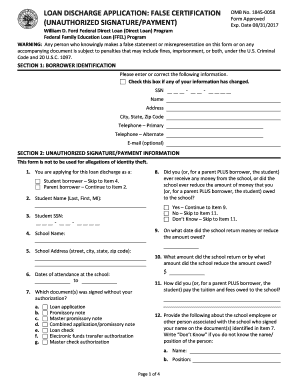

LOAN DISCHARGE APPLICATION: FALSE CERTIFICATION

(UNAUTHORIZED SIGNATURE/PAYMENT)OMB No. 18450058

Form Approved

Exp. Date 9/30/2020William D. Ford Federal Direct Loan (Direct Loan) Program

Federal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unauthorized loan discharge form

Edit your application certification loan discharge form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your false unauthorized loan discharge form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application loan discharge borrower online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit signature unauthorized loan discharge form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ED Loan Discharge Application: False Certification (Unauthorized Signature/Payment) Form Versions

Version

Form Popularity

Fillable & printabley

4.2 Satisfied (38 Votes)

4.3 Satisfied (47 Votes)

How to fill out application false loan discharge form

How to fill out ED Loan Discharge Application: False Certification (Unauthorized

01

Obtain the ED Loan Discharge Application form specifically for False Certification (Unauthorized).

02

Fill out your personal information, including your name, address, and social security number.

03

Specify the type of loan you are seeking to discharge.

04

Provide details about the institution that falsely certified your eligibility for the loan.

05

Attach any relevant documents that support your claim, such as correspondence with the institution or any legal notices.

06

Review the application for accuracy and completeness.

07

Sign and date the form at the designated areas.

08

Submit the application to the designated address as provided in the form instructions.

Who needs ED Loan Discharge Application: False Certification (Unauthorized?

01

Borrowers who have been falsely certified for eligibility to receive federal student loans.

02

Individuals who did not meet the educational requirements for federal student aid but were incorrectly certified by an educational institution.

03

Those who are experiencing financial hardship due to the repayment of loans based on the false certification.

Fill

form

: Try Risk Free

People Also Ask about

What is a discharge Acknowledgement form?

This form serves to reestablish your eligibility for Federal Student Loan Programs when prior loans have been discharged due to total and permanent disability. Completion of this form does not guarantee that you will qualify for the Federal Student Loan Programs.

What happens when your student loan is discharged?

you no longer have further obligation to repay the loan, you will receive a reimbursement of payments made voluntarily or through forced collection, and. the discharge will be reported to credit bureaus to delete any adverse credit history associated with the loan.

How long does it take for a student loan to be discharged?

Both federal and private student loans fall off your credit report about seven years after your last payment or date of default. You default after nine months of nonpayment for federal student loans, and you're not in deferment or forbearance.

Do I qualify for loan discharge?

You may be eligible for discharge of your federal student loans based on borrower defense to repayment if you took out the loans to attend a school and the school did something or failed to do something related to your loan or to the educational services that the loan was intended to pay for.

What is a loan discharge application?

Loan discharge is the removal of your obligation to repay your loan under certain circumstances. There are certain eligibility requirements to qualify for a closed school loan discharge; you must apply to get a discharge.

How to fill out borrowers defense application?

You'll need the following information: Your name, address, date of birth, Social Security number, and other contact information. The name and address of the school you attended. Any relevant documents, such as: Transcripts. Enrollment agreements. Promotional materials from your school.

Who qualifies for loan discharge?

Your loan can be discharged only under specific circumstances, such as school closure, a school's false certification of your eligibility to receive a loan, a school's failure to pay a required loan refund, or because of total and permanent disability, bankruptcy, or death.

How do you discharge a loan?

How do I discharge a mortgage? Notify your lender: Reach out to your lender and discuss your plans to release the mortgage with them. Complete and return the Discharge Authority form: Register your discharge and Certificate of Title:

How do I discharge a private loan?

To have your private student loans discharged you will need to prove that your loan was a qualified education loan and that paying off the loan would cause you “undue hardship.” You prove undue hardship as part of an adversary proceeding. This is an additional proceeding on top of your bankruptcy case.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ED Loan Discharge Application False Certification online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your ED Loan Discharge Application False Certification to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the ED Loan Discharge Application False Certification electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your ED Loan Discharge Application False Certification in minutes.

How do I edit ED Loan Discharge Application False Certification on an Android device?

You can make any changes to PDF files, such as ED Loan Discharge Application False Certification, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is ED Loan Discharge Application: False Certification (Unauthorized)?

The ED Loan Discharge Application: False Certification (Unauthorized) is a process through which borrowers can apply to have their federal student loans discharged if they were falsely certified for loans by an unauthorized individual or institution.

Who is required to file ED Loan Discharge Application: False Certification (Unauthorized)?

Borrowers who believe they were falsely certified for federal student loans by an unauthorized person or institution are required to file this application.

How to fill out ED Loan Discharge Application: False Certification (Unauthorized)?

To fill out the application, borrowers need to provide personal information, details about the loans they are seeking to discharge, and any supporting documentation that proves the unauthorized certification.

What is the purpose of ED Loan Discharge Application: False Certification (Unauthorized)?

The purpose of the application is to allow borrowers to have their federal student loans discharged when it is determined that they were falsely certified for those loans by an unauthorized entity.

What information must be reported on ED Loan Discharge Application: False Certification (Unauthorized)?

The application must report the borrower's identification information, loan details, the circumstances of the false certification, and any relevant supporting documents that substantiate the claim.

Fill out your ED Loan Discharge Application False Certification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ED Loan Discharge Application False Certification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.