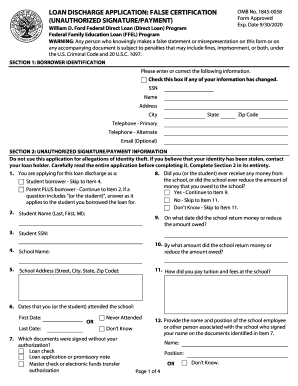

ED Loan Discharge Application: False Certification (Unauthorized Signature/Payment) 2015 free printable template

Show details

Form Approved. Exp. Date 08/31/2017 ... Submit this form with documentation of your signature to the loan holder in Section 7. ... I hereby assign and transfer to the U.S. Department of Education

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ED Loan Discharge Application False Certification

Edit your ED Loan Discharge Application False Certification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ED Loan Discharge Application False Certification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ED Loan Discharge Application False Certification online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ED Loan Discharge Application False Certification. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ED Loan Discharge Application: False Certification (Unauthorized Signature/Payment) Form Versions

Version

Form Popularity

Fillable & printabley

4.2 Satisfied (38 Votes)

4.3 Satisfied (47 Votes)

How to fill out ED Loan Discharge Application False Certification

How to fill out ED Loan Discharge Application: False Certification (Unauthorized

01

Obtain the ED Loan Discharge Application form from the Federal Student Aid website or your loan servicer.

02

Fill out your personal information, including your name, address, and Social Security number.

03

Specify the type of loan you are applying for discharge (e.g., Direct Loan, FFEL Loan).

04

Provide details about the school from which you received the loan, including the school's name and address.

05

Indicate the reasons for the discharge application, specifying that it is based on false certification (unauthorized).

06

Gather supporting documents that demonstrate your claims, such as official school records or correspondence.

07

Sign and date the application form, certifying that all information provided is true and accurate.

08

Submit the completed application and supporting documents to your loan servicer or the address provided in the application instructions.

Who needs ED Loan Discharge Application: False Certification (Unauthorized?

01

Individuals who believe that their federal student loans were falsely certified by their school because they did not meet the eligibility requirements, such as not having the appropriate high school diploma or equivalent.

02

Borrowers who have been misled by their educational institutions regarding their enrollment status or eligibility for federal student aid.

Fill

form

: Try Risk Free

People Also Ask about

What is a discharge Acknowledgement form?

This form serves to reestablish your eligibility for Federal Student Loan Programs when prior loans have been discharged due to total and permanent disability. Completion of this form does not guarantee that you will qualify for the Federal Student Loan Programs.

What happens when your student loan is discharged?

you no longer have further obligation to repay the loan, you will receive a reimbursement of payments made voluntarily or through forced collection, and. the discharge will be reported to credit bureaus to delete any adverse credit history associated with the loan.

How long does it take for a student loan to be discharged?

Both federal and private student loans fall off your credit report about seven years after your last payment or date of default. You default after nine months of nonpayment for federal student loans, and you're not in deferment or forbearance.

Do I qualify for loan discharge?

You may be eligible for discharge of your federal student loans based on borrower defense to repayment if you took out the loans to attend a school and the school did something or failed to do something related to your loan or to the educational services that the loan was intended to pay for.

What is a loan discharge application?

Loan discharge is the removal of your obligation to repay your loan under certain circumstances. There are certain eligibility requirements to qualify for a closed school loan discharge; you must apply to get a discharge.

How to fill out borrowers defense application?

You'll need the following information: Your name, address, date of birth, Social Security number, and other contact information. The name and address of the school you attended. Any relevant documents, such as: Transcripts. Enrollment agreements. Promotional materials from your school.

Who qualifies for loan discharge?

Your loan can be discharged only under specific circumstances, such as school closure, a school's false certification of your eligibility to receive a loan, a school's failure to pay a required loan refund, or because of total and permanent disability, bankruptcy, or death.

How do you discharge a loan?

How do I discharge a mortgage? Notify your lender: Reach out to your lender and discuss your plans to release the mortgage with them. Complete and return the Discharge Authority form: Register your discharge and Certificate of Title:

How do I discharge a private loan?

To have your private student loans discharged you will need to prove that your loan was a qualified education loan and that paying off the loan would cause you “undue hardship.” You prove undue hardship as part of an adversary proceeding. This is an additional proceeding on top of your bankruptcy case.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in ED Loan Discharge Application False Certification?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your ED Loan Discharge Application False Certification to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I edit ED Loan Discharge Application False Certification on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute ED Loan Discharge Application False Certification from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete ED Loan Discharge Application False Certification on an Android device?

On an Android device, use the pdfFiller mobile app to finish your ED Loan Discharge Application False Certification. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is ED Loan Discharge Application: False Certification (Unauthorized)?

The ED Loan Discharge Application: False Certification (Unauthorized) is a form that borrowers can use to request the discharge of their federal student loans if they believe they were falsely certified for the loan due to unauthorized signatures or fraud by the school.

Who is required to file ED Loan Discharge Application: False Certification (Unauthorized)?

Borrowers who have federal student loans that were obtained through false certification by an institution of higher education, where the borrower did not have the required credentials or was not enrolled, are required to file this application.

How to fill out ED Loan Discharge Application: False Certification (Unauthorized)?

To fill out the ED Loan Discharge Application, borrowers should provide their personal information, loan details, and a detailed explanation of the circumstances surrounding the false certification. It is also important to include any supporting documentation that may be relevant.

What is the purpose of ED Loan Discharge Application: False Certification (Unauthorized)?

The purpose of the ED Loan Discharge Application: False Certification (Unauthorized) is to allow borrowers to seek forgiveness of their federal student loans if they can prove that the loans were obtained through fraudulent means or without their authorization.

What information must be reported on ED Loan Discharge Application: False Certification (Unauthorized)?

The application must report the borrower's identification details, loan information, reasons for discharge request, and any evidence of false certification or unauthorized signatures, including relevant dates and events.

Fill out your ED Loan Discharge Application False Certification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ED Loan Discharge Application False Certification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.