Get the free Transfer Tax Affidavit template

Show details

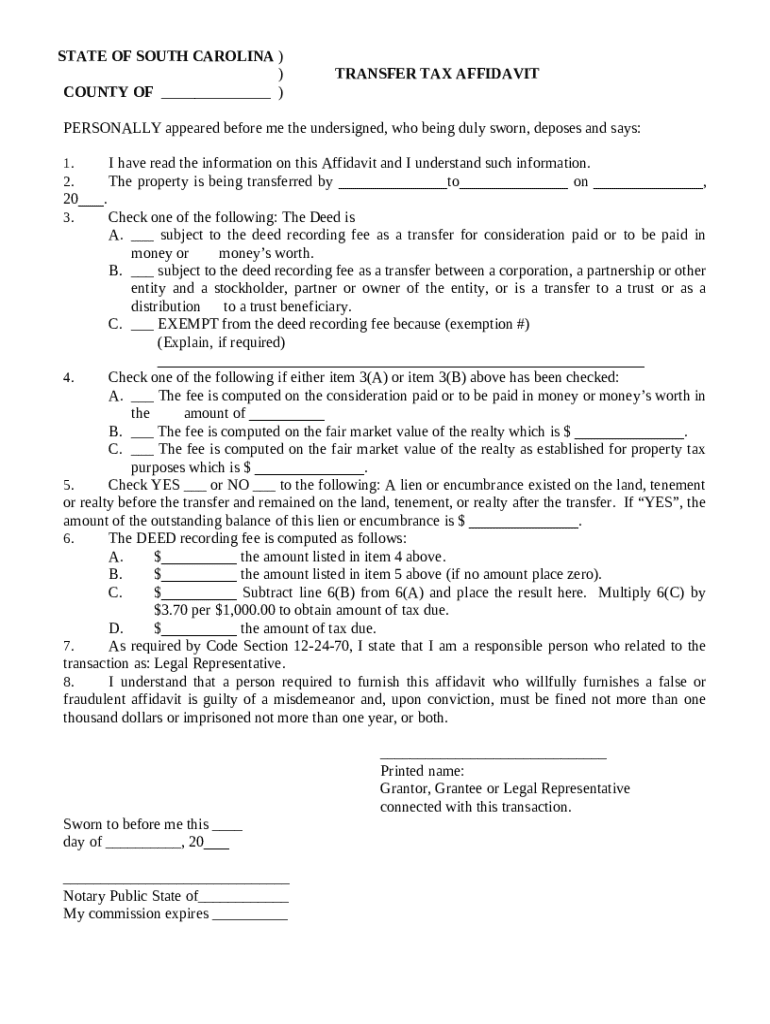

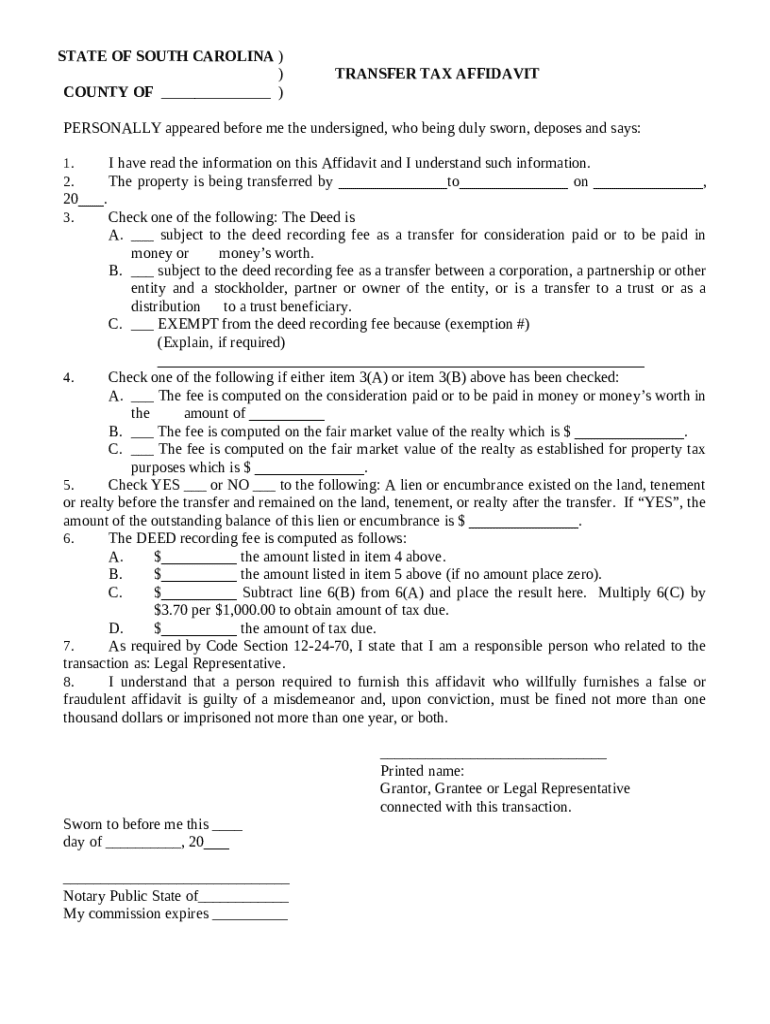

The purpose of this form is to explain the nature of the transaction and to determine if the transfer is taxable.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer tax affidavit

A transfer tax affidavit is a legal document used to declare the transfer of real property, detailing the transaction for taxation purposes.

pdfFiller scores top ratings on review platforms

I needed some tax forms that I could not find anywhere else, and PDFfiller save the day :-)

There is no back, or undo button, otherwise I would have given 5 stars.

Just started using it, but so far so good. Seems to be capable of doing what I need. Thank you

Had a few problems, but overall was very great to have

Straight-forward software with useful tools. Auto-saver is great!

The PDFfiller service was very comprehensive and easy to use. I really appreciate the options for document delivery and would recommend this service to colleagues who could benefit from this service.

Who needs transfer tax affidavit template?

Explore how professionals across industries use pdfFiller.

Transfer Tax Affidavit Form Guide

How do you understand the Transfer Tax Affidavit?

A Transfer Tax Affidavit is a legal document required during property transactions to report the transfer of real estate. Filing this affidavit ensures compliance with state laws, particularly in South Carolina, where specific regulations govern property transfers. Understanding the importance of this form helps protect both buyers and sellers from future disputes regarding taxes.

-

It is a document that provides the state with information about property transfers and is critical for tax assessment.

-

Filing ensures that transfer taxes are accurately assessed and paid, helping to avoid legal complications.

-

South Carolina mandates specific details in the affidavit, including the identification of the parties and the property involved.

What are the core components of the affidavit?

The affidavit consists of several essential components that clarify the transfer process. Accurately identifying the parties involved and selecting the correct deed category are critical in preventing future misunderstandings.

-

This includes the buyer and seller's names and addresses to establish a clear transfer record.

-

Choose between different categories based on the nature of the transfer.

-

Certain transfers may qualify for exemptions; clearly detailing them can lessen tax burdens.

How is the transfer tax calculated?

Calculating the transfer tax can be complex, depending on various factors such as the consideration paid and the fair market value of the property. Accurate assessment is vital to avoid underpayment or overpayment of taxes.

-

Understanding the basis for tax calculation, including consideration and property value, will ensure accuracy.

-

This value is determined by recent sales and assessments and directly impacts tax amounts.

-

Knowing the property’s lien status is necessary as it can affect transfer legality.

What are the steps to complete the form thoroughly?

Completing the Transfer Tax Affidavit requires careful attention to detail in various sections. Following a structured process can minimize errors and ensure compliance.

-

Collect comprehensive details about the property and the involved parties to fill out the affidavit accurately.

-

Ensure each section is completed with precision, including the declaration and lien details.

How can pdfFiller assist with your affidavit needs?

pdfFiller offers an intuitive platform to create, edit, and manage your Transfer Tax Affidavit efficiently. With its electronic signature capabilities, users can complete the process smoothly without requiring physical paperwork.

-

Simply visit pdfFiller’s website to find a wide array of editing functions designed for your affidavit.

-

Follow the prompted steps on the platform to ensure your document is ready for submission.

What are common errors and how can you avoid them?

Properly completing the Transfer Tax Affidavit requires an understanding of common pitfalls. Avoiding these errors can lead to smoother transactions and save you time.

-

Make sure property details are precise to avoid future legal issues.

-

Double-check all calculations for accuracy to prevent underpayment or penalties.

-

Perform a thorough review before submission to correct any potential mistakes.

What state-specific compliance considerations should you know?

Each state governs property transactions differently, making it essential to understand local requirements. South Carolina, for example, has specific regulations that affect the Transfer Tax Affidavit.

-

Be aware of the local laws that impact property transfers to ensure compliance.

-

Certain exemptions may apply; knowing these can save on taxes.

-

Create a checklist of required documentation to streamline the submission process.

How to fill out the transfer tax affidavit template

-

1.Visit the pdfFiller website and log in to your account.

-

2.Locate the search bar and enter 'transfer tax affidavit' to find a template.

-

3.Select the appropriate state-specific form and click 'Fill Out'.

-

4.Begin filling in the affiant's personal information including name, address, and contact details.

-

5.Provide the property details such as address, legal description, and parcel number.

-

6.Indicate the type of transaction (i.e., sale, gift, inheritance).

-

7.Fill in the sale price or appraised value of the property.

-

8.Review the specific tax information required by your jurisdiction, ensuring all applicable taxes are included.

-

9.Add any additional notes or special provisions that relate to the transaction.

-

10.Once completed, double-check all information for accuracy and completeness.

-

11.Save the completed form, and then download or print it as required for submission.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.