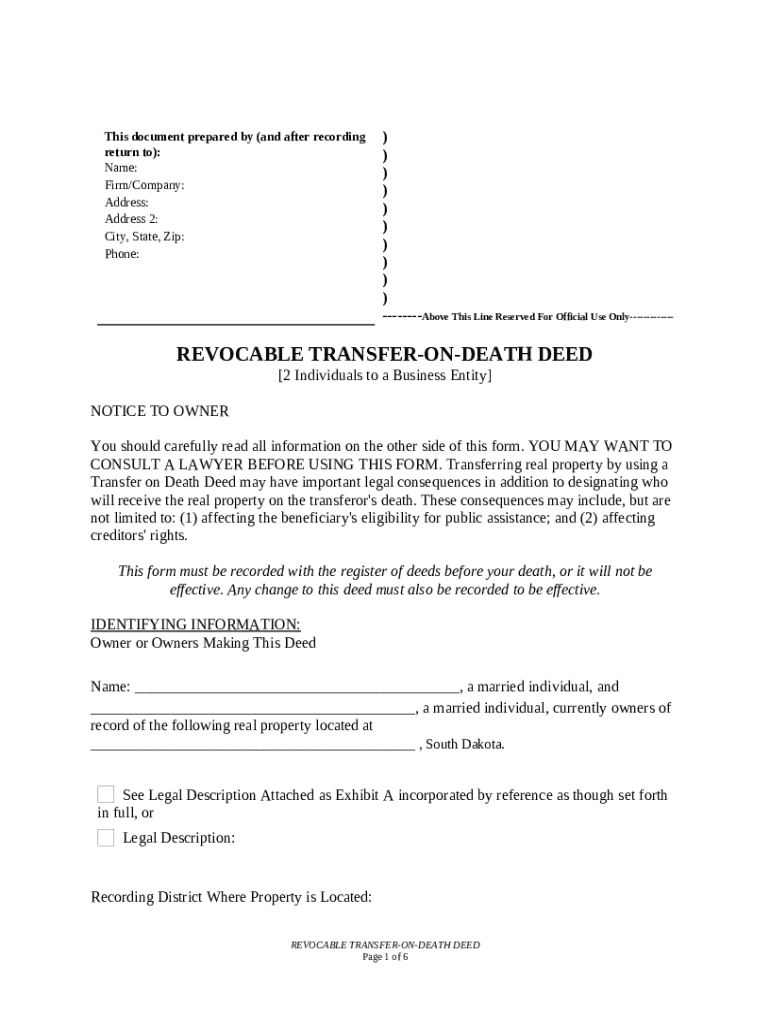

Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Bu...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows a property owner to designate a beneficiary to receive the property upon their death without going through probate.

pdfFiller scores top ratings on review platforms

I love the program, would be easier to fill dates on my form if I could type the date without the scrolling box. I also wish it was a smoother flow to save/print and back.

I needed to update a PDF document to look neat and clean and PDF filler was quick and easy to use and easy to get to because it is web base. I love it

I didn't realize how many things I have to fill out. This makes my work so much easier!

My experience with the PDFfiller has been great.

Very helpful with filling out forms in a quick and easy way.

IT WAS GREAT EXPERIENCE WORKING WITH PDF FILLER

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Transfer on Death Deed Form on pdfFiller

Understanding how to fill out a transfer on death deed form is crucial for estate planning. This form allows for the transfer of property to beneficiaries upon the owner's death, avoiding probate. In this guide, you'll find step-by-step instructions and useful insights into the considerations and processes involved.

What is a Transfer on Death Deed?

A Transfer on Death Deed (TODD) is a legal document that allows individuals to designate one or more beneficiaries to receive their real property after their death. The primary purpose of this form is to enable property transfer without the need for a will or probate court proceedings.

-

It simplifies the transfer of property, ensuring a timely and clear conveyance to loved ones.

-

Benefits include avoiding probate, enhancing privacy, and minimizing legal expenses.

-

Failure to properly execute a Transfer on Death Deed can result in the property being distributed through probate, potentially leading to delays and additional costs.

What should you consider before filling out the form?

-

Legal advice is essential to ensure the TODD aligns with your overall estate plan and adheres to state laws.

-

If you have older deeds or wills, it’s vital to revoke them formally to prevent conflicts about property distribution.

-

Consider implications of public assistance and creditor claims that may affect the designated beneficiaries.

How do you fill out the Transfer on Death Deed Form?

-

Provide your full name and other identifying details to establish ownership.

-

Accurately describe the property, including address and legal description as per existing records.

-

List complete names and contact information of all beneficiaries you wish to designate.

-

Decide if the beneficiaries must survive you by a specific time, affecting how the deed is executed.

-

Sign and date the document in front of a notary public, as required by state law to validate the deed.

How to navigate the pdfFiller interface for form management?

pdfFiller offers a user-friendly interface to facilitate the filling and management of your Transfer on Death Deed Form. The platform is designed for easy access and provides features that improve your document handling experience.

-

The platform allows you to upload, fill, and edit your forms with ease.

-

Follow a precise step-by-step process for electronically signing your documents from any device.

-

Share your document with team members for collective editing and review.

What are the recording requirements in South Dakota?

Recording your Transfer on Death Deed is essential in South Dakota to ensure it is legally recognized. It's crucial to understand where and how to file the document.

-

Visit your local register of deeds office to submit your deed for recording.

-

Make sure to record the deed before your death to validate the beneficiary's rights.

-

If changes to the deed are necessary after recording, follow the legal procedures for amending a deed.

What are the final steps after completing the transfer?

Once the deed is completed and recorded, it’s important to take a few final steps to ensure everything is in order for your beneficiaries.

-

Check with the register of deeds to confirm that your deed has been successfully recorded.

-

Make sure your beneficiaries are informed about the deed, their rights, and what steps they need to take.

-

Keep copies of the Transfer on Death Deed for your records and provide them to your beneficiaries.

Additional insights for understanding Transfer on Death Deeds

Understanding the nuances of the Transfer on Death Deed can help you avoid common pitfalls. Many individuals misunderstand the implications of property transfer and beneficiary rights.

-

Frequently arise about how the deed works, especially concerning beneficiary rights.

-

Clarify misunderstandings that could lead to legal disputes or complications during property transfer.

-

Utilize available resources through pdfFiller for further learning and assistance regarding property transfer.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.