Get the free Triple Net Lease for Industrial Property template

Show details

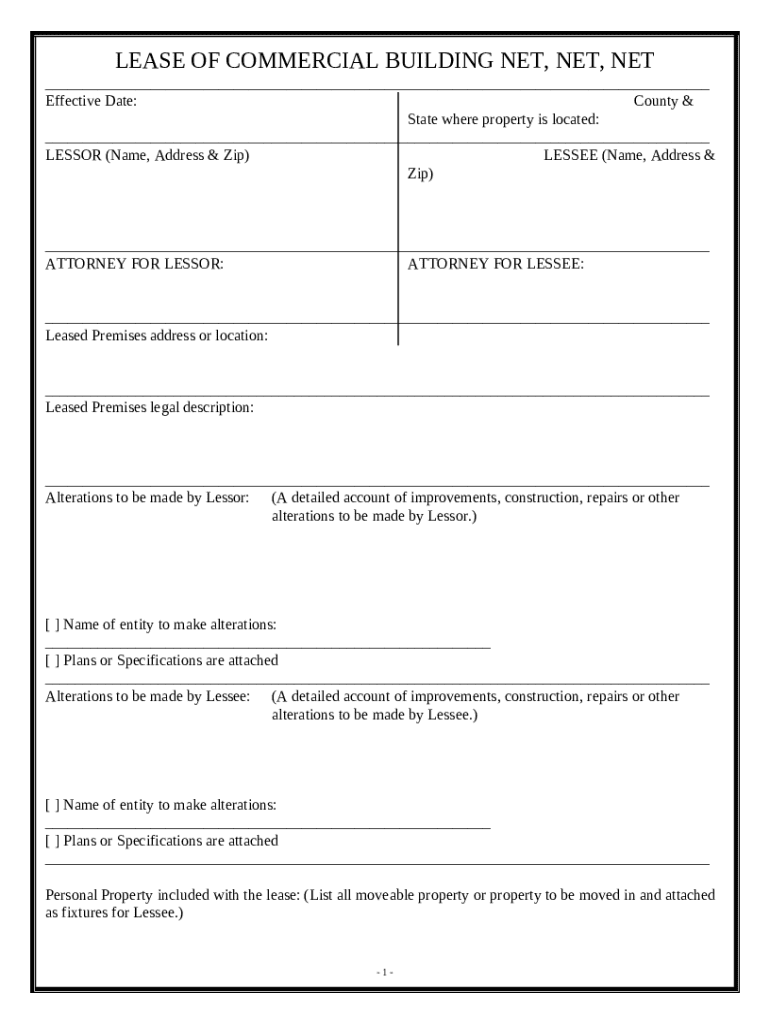

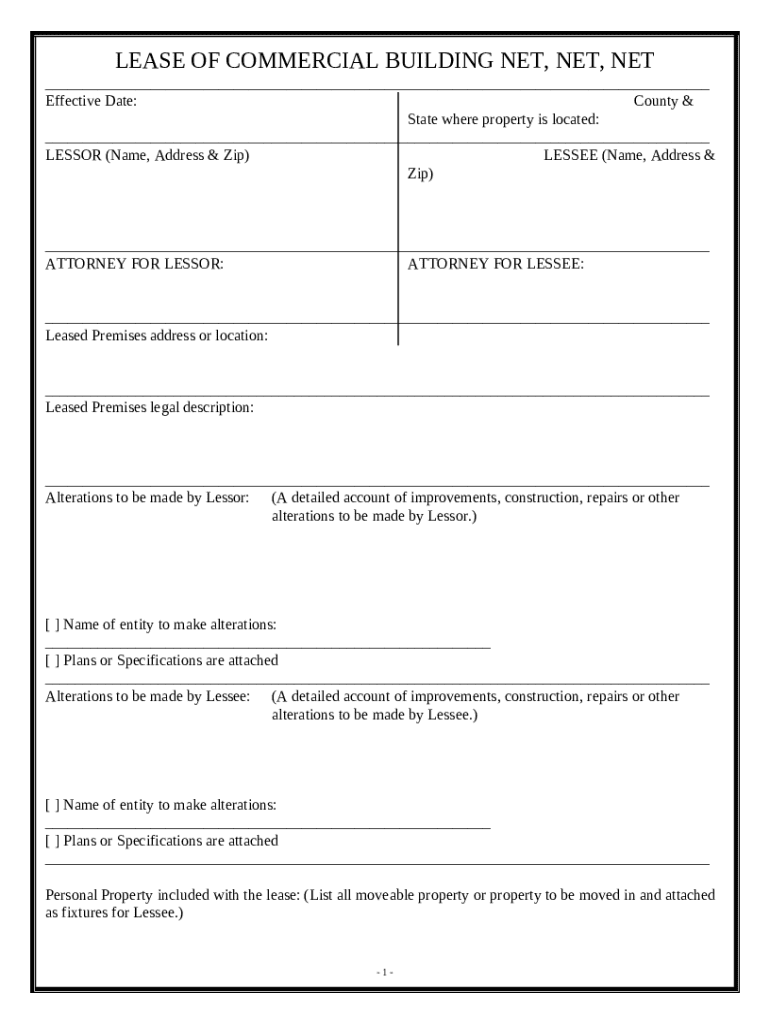

This form is for the lease of a commercial building. The document also provides that this lease will in all respects be treated as a triple net lease with all costs and expenses paid for by the lessee,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is triple net lease for

A triple net lease is a rental agreement where the tenant is responsible for property expenses, including taxes, insurance, and maintenance, in addition to rent.

pdfFiller scores top ratings on review platforms

Sure would be nice if one could right justify number columns.

REO schedule is good, however I need it to be expandable for additional properties on one page.

super efficient. Sent an email about a fillable form I could not find and within minutes it was emailed to me. Thank you

It was good other than the price. I signed up for the wrong service. Paid way to much!!!

Absolutely the most powerful and user-friendly PDF editor in the world

I have only used to fill and print out a 1099-misc. After reading the general instructions of how to report my DE 542 information and what I needed to understand. I was sold on PDFffiller.com

I am a little confused on the detail of how and what I want to do etc.

Once I have some practice getting around my PDFfiller site I'll answer you follow up survey. P.S. * I am an old lady and I don't really know my way around a computer. Thinking about it. I felt your site was elder friendly. It is importune to keep it simple now that older senior citizens are force to get online to bank etc. Thank You

Who needs triple net lease for?

Explore how professionals across industries use pdfFiller.

Understanding triple net lease agreements

Understanding how to fill out a triple net lease agreement form is crucial for both landlords and tenants. A triple net lease, often abbreviated as NNN, places the financial responsibilities of property expenses such as property taxes, insurance, and maintenance on the tenant, while the landlord receives a reliable income stream.

What is a triple net lease?

A triple net lease is a lease agreement where the tenant is responsible for paying all the ongoing expenses related to the property, which are the three nets: property taxes, insurance, and maintenance. This type of lease differs from gross leases, where landlords cover these costs, and modified gross leases, which involve a compromise on expense responsibilities.

-

Triple net leases are frequently used in commercial real estate for single-tenant buildings and retail spaces, allowing landlords to secure predictable income.

-

While tenants enjoy lower base rents, they face potential financial unpredictability due to fluctuating property costs.

Benefits of a triple net lease

One significant advantage of a triple net lease is the predictable returns it offers landlords. Since tenants cover property expenses, landlords can better forecast their income without worrying about fluctuating costs.

-

Tenants might benefit from lower base rent compared to gross leases, making this an attractive option for businesses aiming to manage cash flow prudently.

-

Lessee and lessor can negotiate favorable lease terms, which may include custom provisions specific to their needs.

Key components of a triple net lease agreement

A comprehensive lease agreement must include several critical components. The effective date is vital as it marks the beginning of the lease term. Location details such as county, state, and specific address are necessary for legal clarity.

-

Clearly delineating what responsibilities belong to the lessor versus the lessee can mitigate potential disputes.

-

Additional clauses regarding alterations and tenant improvements should also be discussed in detail.

Filling out your triple net lease agreement form

Filling out the triple net lease agreement form requires attention to detail. Start with crucial sections that define the lease's specifics, including the effective date and rental amount.

-

Clarify what alterations can be made by both the lessor and the lessee to maintain property integrity.

-

Include a list of personal property that is part of the lease to avoid misunderstandings.

Lease specific provisions to note

Understanding and acknowledging lease-specific provisions is critical. Consideration terms define what each party agrees to as compensation and responsibilities.

-

Establishing effective periods can help both parties understand the duration of their obligations.

-

A breakdown of how rent is calculated, including base rent versus percentage rent, provides transparency.

Legal considerations in triple net leases

Engaging with legal counsel can ensure compliance with local real estate regulations, as specific laws may vary by jurisdiction. Understanding these regulations is essential to mitigate risks associated with the lease.

-

Having terms reviewed can identify potential pitfalls or ambiguities in the lease.

-

pdfFiller provides tools to create and manage legally-compliant documentation, streamlining the process.

Utilizing pdfFiller for your lease management

pdfFiller offers seamless editing features and customizable templates for lease forms, ensuring users can adapt documents to their needs effectively.

-

Users can electronically sign agreements, saving time and improving efficiency.

-

With pdfFiller, managing lease documents from a cloud-based platform simplifies collaboration among parties.

How to fill out the triple net lease for

-

1.Begin by accessing the triple net lease template on pdfFiller.

-

2.Select the option to fill out the document online.

-

3.Enter the landlord's legal name and contact information in the designated fields.

-

4.Fill in the tenant's details, including their business name and address.

-

5.Specify the property address and include any relevant descriptions as needed.

-

6.Indicate the lease term, specifying the start and end dates.

-

7.Detail the rent amount and payment terms, including due date and acceptable payment methods.

-

8.List the designated expenses that the tenant will be responsible for, such as taxes, insurance, and maintenance.

-

9.Review all entered information for accuracy, ensuring no details are missed.

-

10.Save the completed document, and optionally, share it with involved parties for review and signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.