Get the free Direct Deposit for Employees template

Show details

Direct deposit is a process where someone who is going to be paid on a recurring basis, such as an employee, or a recipient of a government entitlement or benefit program such as social security,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is direct deposit form for

A direct deposit form is a document used to authorize the electronic transfer of funds directly into a bank account.

pdfFiller scores top ratings on review platforms

the draw feature for signing doesn't work

PDF Filler has proven to be an asset so far. I am able to customize the pre-loaded templates to meet my needs.

I´d like to be able to insert a fixed heading

PDFfiller allows me to fill out docs efficiently.

Pretty easy to use. Just wish that it had where I could print to it when trying to make documents pdfs.

It's simply great. Extremely helpful in wetting up my small business.

Who needs direct deposit for employees?

Explore how professionals across industries use pdfFiller.

How to Complete a Direct Deposit Form on pdfFiller

Filling out a direct deposit form is a straightforward process that ensures that your earnings are automatically deposited into your bank account. This guide will provide you with detailed instructions on how to complete this essential document through pdfFiller.

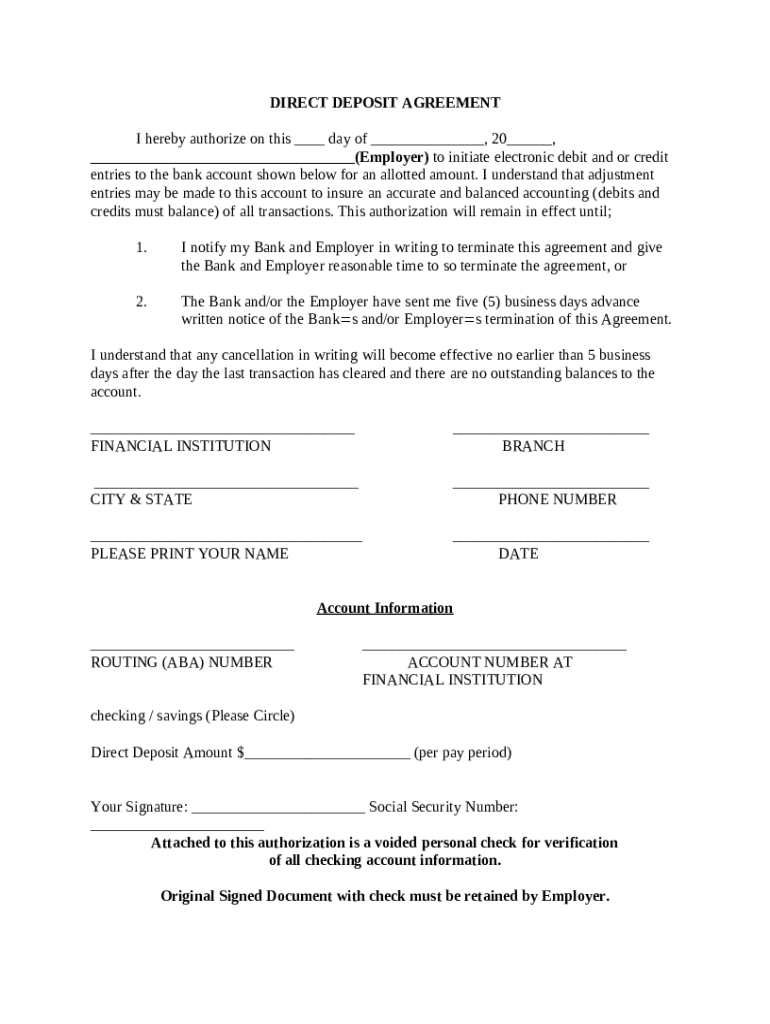

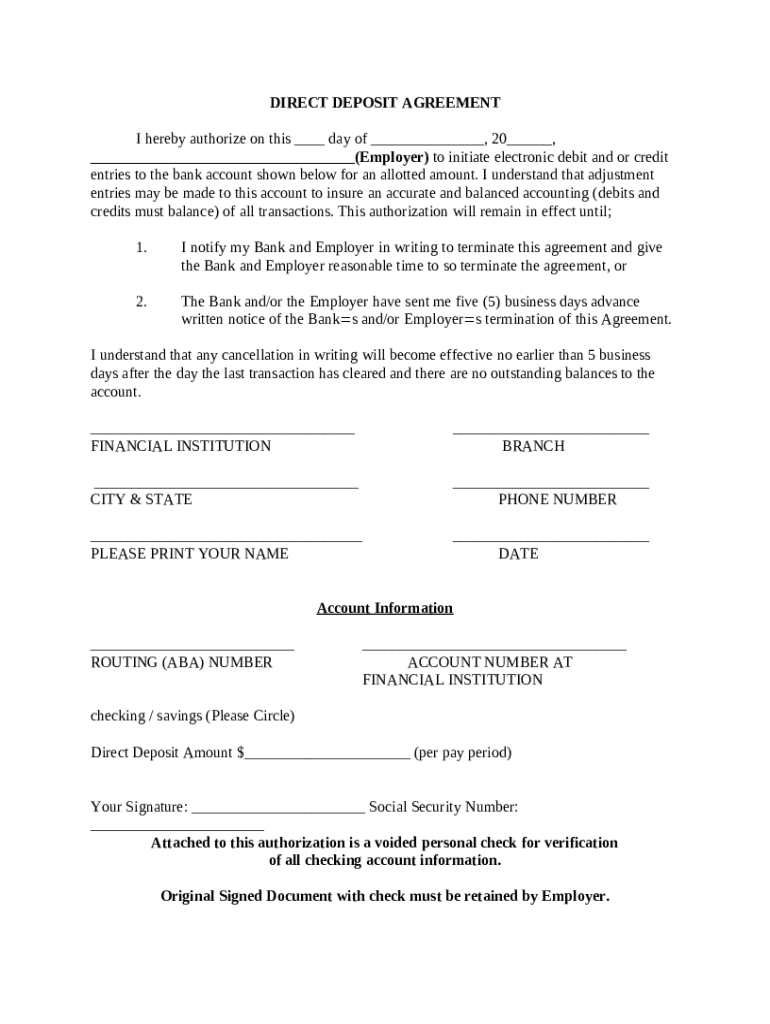

What is a direct deposit agreement?

A Direct Deposit Agreement is a document that authorizes your employer or any payor to deposit your earnings directly into your bank account. This method offers numerous benefits, such as convenience and increased security, eliminating the need to manually cash or deposit checks.

-

Your funds are available to you immediately on payday without the need for a physical check.

-

Your money is safer from theft and fraud as it does not require you to handle checks.

-

Reliable and consistent access to your earnings, making financial planning easier.

Common scenarios that require direct deposit forms include starting a new job, switching bank accounts, or setting up a recurring payment plan for services. Understanding the purpose of these forms allows you to utilize them effectively.

How can you fill out the direct deposit form?

Filling out the direct deposit form involves several key steps, outlined below.

Initiating the agreement

-

Start the form by entering the current date and your employer’s identification, which helps track the specific agreement.

-

Ensure the authorization statement is clearly read and understood, as this grants permission for the direct deposits to be made.

What details to include for bank account?

Accurate bank account details are critical to ensure that deposits are made correctly.

-

Input your bank’s name and address accurately to verify the account.

-

Verify that the routing number (which identifies your bank) and the account number are accurate, as entry errors can lead to failed transactions.

How to specify the direct deposit amount?

Deciding how much to deposit each pay period is important as it can affect your budgeting.

-

Evaluate your expenses and savings goals to determine how much of your income should be deposited.

-

Consider separate deposit amounts if you are paid weekly versus bi-weekly. Adjustments should be made based on your financial commitments.

Why is signature and verification important?

Your signature verifies the accuracy of the information provided and your intent to authorize direct deposits.

-

Ensure that your signature matches the one on file with your bank for seamless transactions.

-

Including a voided check helps your employer confirm your banking details, as it shows the correct account information.

What are compliance and termination notes?

Understanding your rights surrounding the termination of the agreement is crucial.

-

You have the right to cancel the direct deposit, typically requiring written notice.

-

Ensure you are aware of how long the notice must be to avoid complications with your payment schedule.

How to leverage pdfFiller’s functionalities?

Utilizing pdfFiller can significantly streamline your document management process.

-

pdfFiller’s intuitive interface allows you to edit your forms effortlessly, ensuring accuracy and completeness.

-

Easily share your completed forms with team members for collaboration, ensuring all relevant parties have access to necessary documents.

What to do after filling out the form?

Once your direct deposit form is complete, securely submitting it is the next step.

-

Follow your employer’s submission guidelines to ensure that your application is processed promptly.

-

Use pdfFiller's storage features to securely save your completed forms for future reference.

How to fill out the direct deposit for employees

-

1.Open the direct deposit form on pdfFiller.

-

2.Input your personal information, including your name and address, in the designated fields.

-

3.Locate the section requesting your banking details; enter your bank's name, account number, and routing number.

-

4.If applicable, select the type of account (checking or savings) you want the funds deposited into.

-

5.Review the completed information for accuracy, ensuring all details match with your bank records.

-

6.Sign and date the form in the required section to authorize the request for direct deposit.

-

7.Once complete, download or save the filled form as a PDF file for your records.

-

8.Submit the form to your employer or the relevant agency as instructed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.