Get the free Invoice with sales tax template

Show details

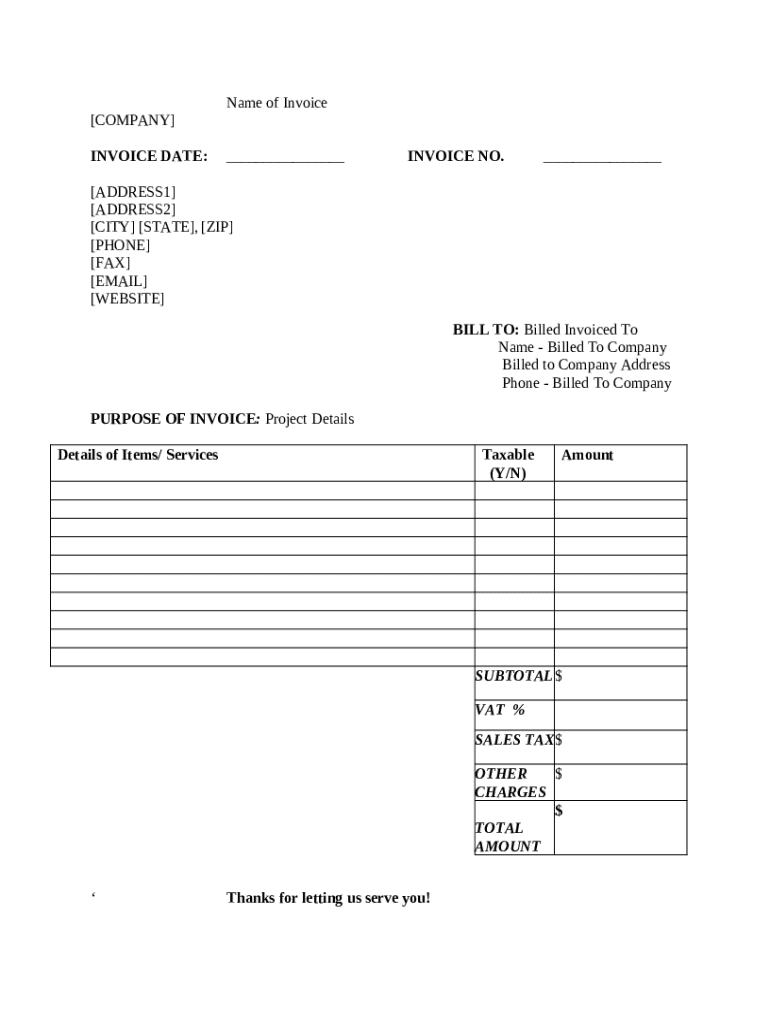

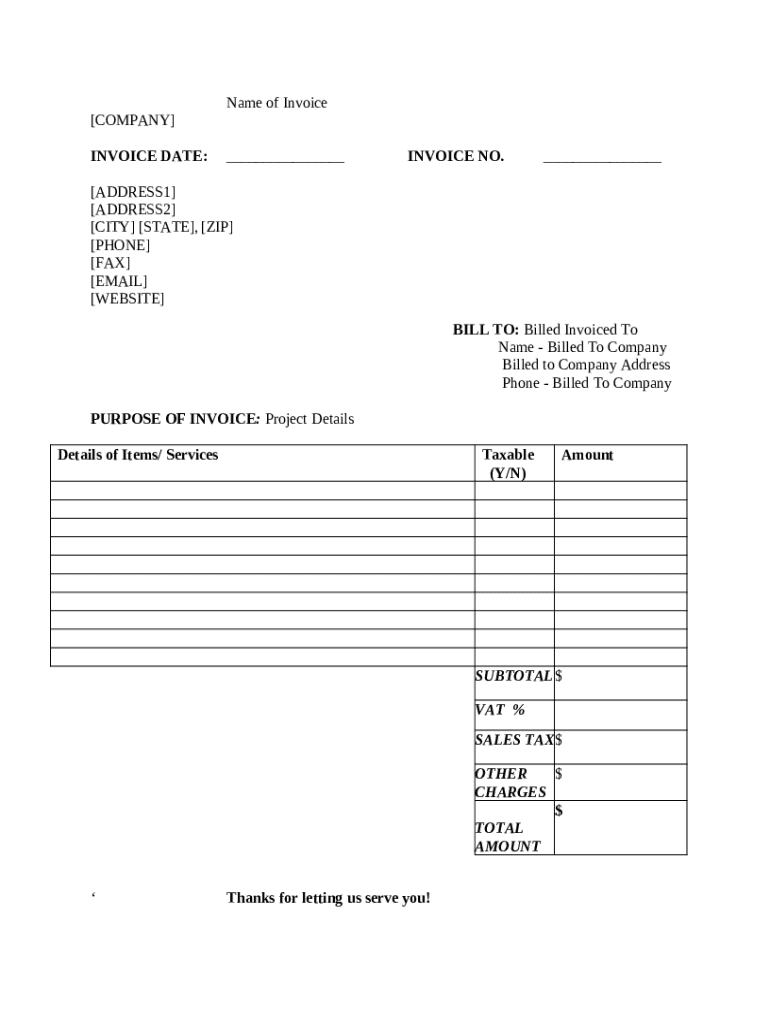

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is invoice with sales tax

An invoice with sales tax is a commercial document that itemizes a sale transaction and includes the applicable sales tax amount.

pdfFiller scores top ratings on review platforms

Good

It was nice Experience using PDF filler. It was easy to use

bruh

great experience

Thank you I appreciate the service

Thank you I appreciate the service

So Far, So Good!

So far everything I've needed I was able to do with the platform. I'm hoping to do more to get the full experience of this site.

I did what I needed to do and it works…

I did what I needed to do and it works 100%

Easy to Use!

Love that I can erase on pages, delete pages./reorder etc. Easy to use

Who needs invoice with sales tax?

Explore how professionals across industries use pdfFiller.

Crafting an Invoice with Sales Tax Form

Creating an invoice with sales tax requires careful attention to detail to ensure compliance and clarity. This guide will walk you through the essential elements of drafting an effective invoice that includes sales tax, including how to calculate the amount accurately and what information needs to be included.

What is the structure of an invoice?

An invoice serves as a crucial document in financial transactions, illustrating the goods or services provided and their associated costs. Its primary components include the invoice date, invoice number, and company details, which all play a significant role in the billing process.

-

The invoice’s main purpose is to request payment for products or services rendered.

-

These include the invoice date, unique invoice number, and the seller's and buyer's details.

-

A clear 'Bill To' section is critical for ensuring the invoice reaches the correct recipient.

What fields are essential in the invoice form?

An effective invoice contains several key fields that must be filled out correctly to ensure clarity and professionalism. The invoice should include precise company details, invoice date, and a detailed breakdown of services rendered.

-

Include the company name, address, and contact information for easy reference.

-

These details aid in tracking payments and serve as reference points for both seller and buyer.

-

Itemized charges give transparency into what the customer is paying for, including service descriptions and costs.

How do you itemize charges?

Correctly itemizing charges distinguishes between taxable and non-taxable items or services. Knowing which items require sales tax is crucial to avoid penalties and ensure compliance.

-

Determine which goods or services fall under taxable status. This requires an understanding of tax laws relevant to your location.

-

Accurately calculate tax for services by referencing the applicable sales tax rates.

-

Incorrectly categorizing taxable items may result in financial discrepancies and legal issues.

How is the sales tax amount calculated?

Understanding local sales tax rates is essential for accurate calculations. Follow specific steps to ensure you include the appropriate tax amounts in total invoices.

-

Obtain the local sales tax rate applicable in your jurisdiction for accurate calculations.

-

Multiply the cost of taxable goods/services by the applicable sales tax rate to derive the total tax amount.

-

Along with the sales tax, be sure to include VAT or other relevant charges in the total amount due.

What are the steps to complete the invoice?

Finalizing the invoice requires a review for accuracy and possibly electronic submission for convenience. Using tools such as pdfFiller can streamline this process effectively.

-

Ensure all information is correct to prevent issues during payment collection.

-

Consider using pdfFiller for electronic invoicing, which includes eSigning capabilities for expedience.

-

Utilize pdfFiller’s collaboration tools to manage invoices effectively with your team.

What common mistakes should be avoided?

Common pitfalls when creating an invoice can lead to payment delays or compliance issues. Recognizing these errors can help businesses maintain professionalism.

-

Always confirm and note any tax exemption status that may apply to the customer to avoid unnecessary tax charges.

-

Complete billing information is essential to ensure the invoice reaches the correct party.

-

Errors in listing items can cause confusion and dissatisfaction for clients.

How do templates improve efficiency?

Utilizing pre-designed templates for invoices can significantly enhance both speed and accuracy. Many platforms, like pdfFiller, allow customization to match the needs of various businesses.

-

Templates provide a structured format that ensures all necessary information is included consistently.

-

Tailor templates to blend with your company branding and operational requirements.

-

Reduce manual errors by using automated calculations included in some PDF forms.

What compliance considerations exist?

Understanding local legislation surrounding sales tax compliance is vital for businesses. Leveraging resources and tools can aid in maintaining compliance.

-

Familiarize yourself with sales tax requirements specific to your industry in your location.

-

Utilize industry resources to stay current with changes in tax regulations.

-

Use pdfFiller's tools to keep your invoicing compliant with up-to-date sales tax guidelines.

How to fill out the invoice with sales tax

-

1.Open pdfFiller and upload your invoice template.

-

2.Select the field that requires the customer's information; fill in their name, address, and contact details.

-

3.Locate the itemized list section and enter details of the products or services rendered, including description, quantity, unit price, and total for each item.

-

4.Next, calculate the sales tax percentage based on your state or country's regulations and enter that percentage in the designated field.

-

5.Multiply the item total by the sales tax rate to compute the total tax due, and add this to the subtotal.

-

6.Clearly display the total amount due on the invoice, including items, tax, and any discounts, in a prominent position.

-

7.Review all entered information for accuracy and completeness before saving.

-

8.Finally, download the completed invoice as a PDF or send it directly to the customer from pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.