Get the free sa369 form

Fill out, sign, and share forms from a single PDF platform

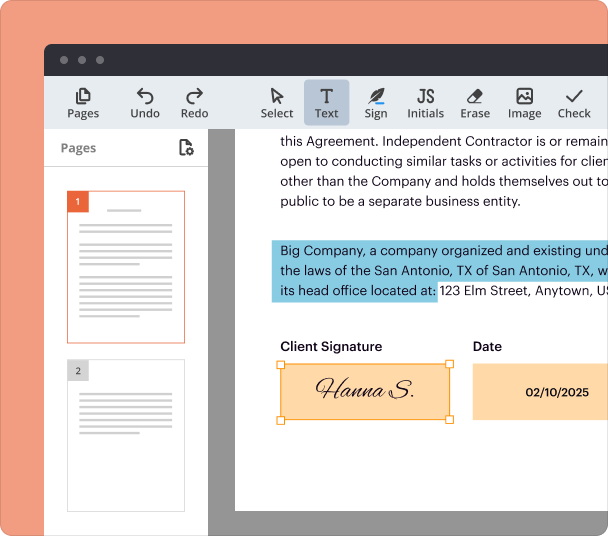

Edit and sign in one place

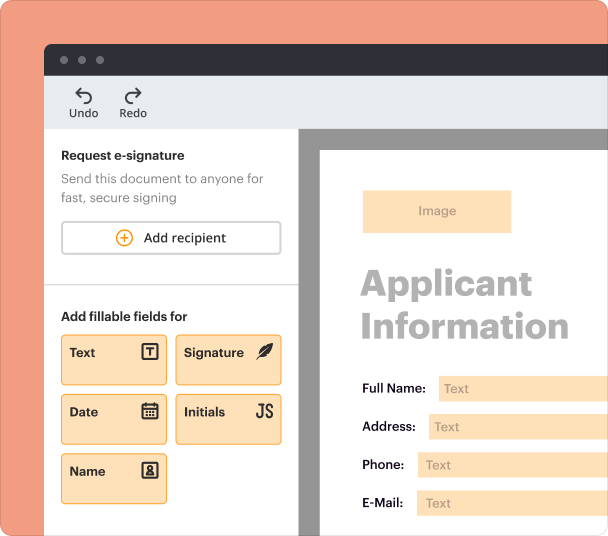

Create professional forms

Simplify data collection

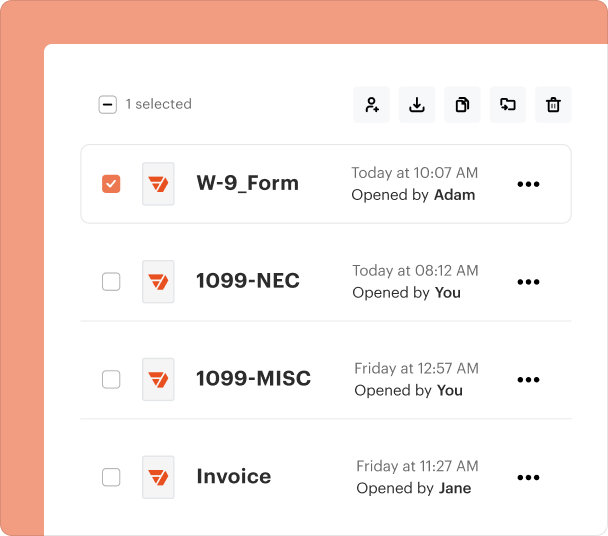

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

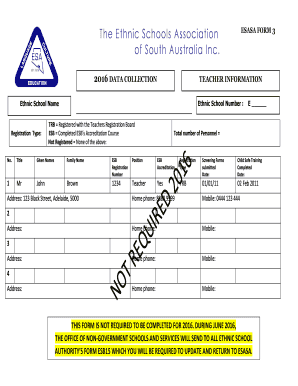

Understanding the SA369 Form

What is the SA369 Form?

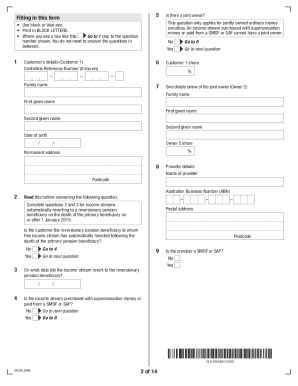

The SA369 form, also known as the Aged Pension Application form, is a crucial document used by individuals in Australia to apply for the age pension. This form collects necessary information about the applicant's income and assets, helping assess eligibility for the pension. Primarily designed for seniors, it serves as a gateway to financial support, ensuring that older citizens can access essential funds for their living expenses.

Key Features of the SA369 Form

The SA369 form includes various sections tailored to capture essential details about applicants' financial situation. Key features of this form include:

-

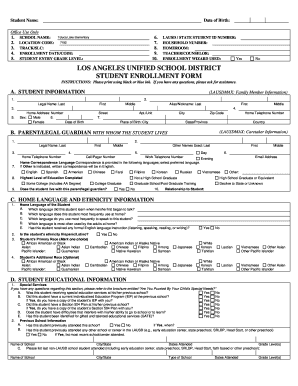

This section requires details such as name, address, and contact information.

-

Here, applicants must provide information about their income sources, including pensions, employment, and investments.

-

Applicants need to list their assets, which may include property, savings, and investments.

-

This may involve further details relevant to the application, such as dependent family members.

Eligibility Criteria for the SA369 Form

To qualify for the age pension through the SA369 form, applicants must meet specific criteria, including:

-

Applicants must be above the qualifying age, which varies based on the birth date.

-

The applicant must be an Australian resident and meet or exceed the residency requirements.

-

Eligibility is determined based on income and asset limits set by the government.

How to Fill the SA369 Form

Filling out the SA369 form requires attention to detail and accuracy. Follow these steps for proper completion:

-

Understand each section's requirements before starting to fill out the form.

-

Collect documents that provide proof of income, assets, and your identity.

-

Provide accurate details in every section, ensuring all required information is included.

-

Before submission, review the completed form for any inaccuracies or missing information.

Common Errors and Troubleshooting

Applicants often encounter a few common errors when completing the SA369 form. Awareness of these can help prevent delays:

-

Missing information can lead to the rejection of the application.

-

Provide accurate and up-to-date figures to avoid discrepancies.

-

Ensure you understand the submission methods available and follow the correct procedure.

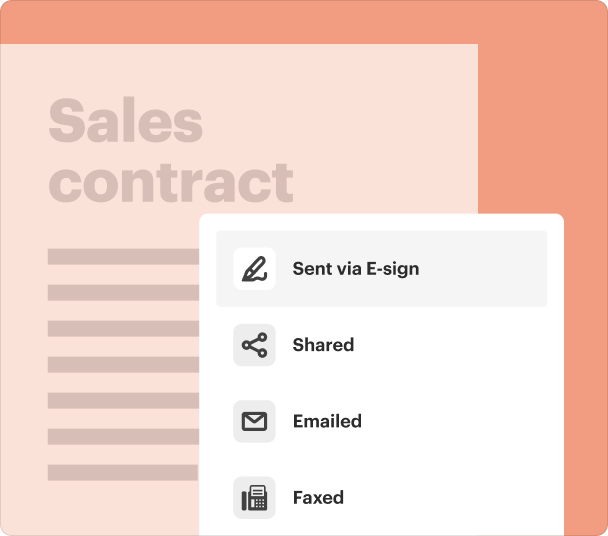

Submission Methods for the SA369 Form

The SA369 form can be submitted through various methods. Applicability of each option may depend on individual circumstances:

-

Submit the form electronically through the official government platforms if available.

-

Print and send the completed form to the specified address through postal services.

-

Visit designated offices to deliver your application in person, where applicable.

Frequently Asked Questions about sa369 form

What documents do I need to submit with the SA369 form?

Documents typically include proof of identity, income statements, and details of assets owned.

Can I fill out the SA369 form online?

Many individuals can complete the SA369 form online, depending on government services available.

How long does the processing of the SA369 form take?

Processing times for the SA369 form can vary, but applicants are usually informed of the status within several weeks.

pdfFiller scores top ratings on review platforms