AU DHS SA330 2020 free printable template

Show details

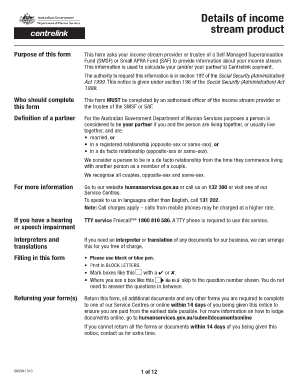

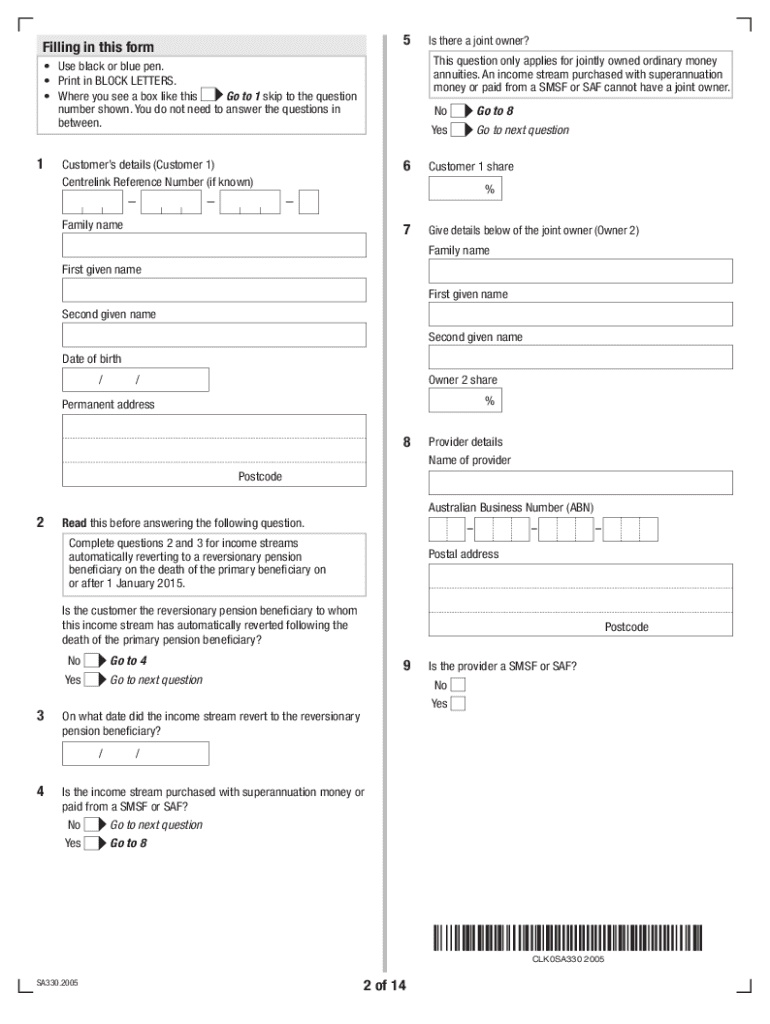

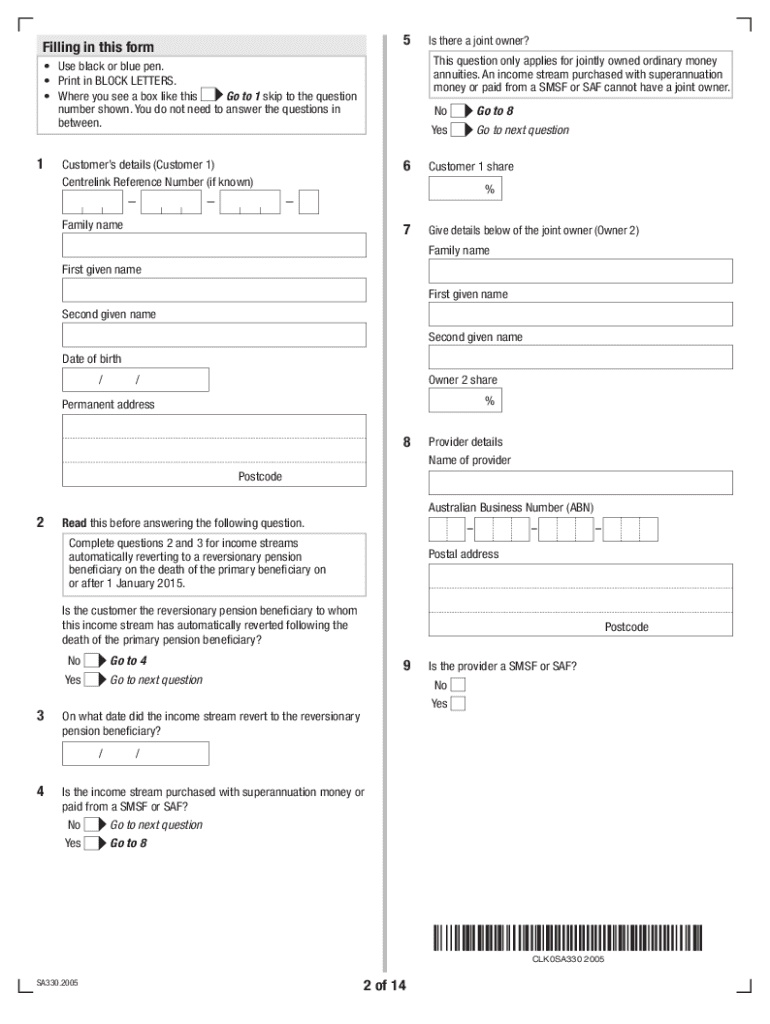

InstructionsDetails of income stream product

(SA330)Purpose of this forms form asks your income stream provider or trustee/administrator of a Self Managed

Superannuation Fund (SMS) or Small Australian

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign AU DHS SA330

Edit your AU DHS SA330 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU DHS SA330 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU DHS SA330 online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AU DHS SA330. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU DHS SA330 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU DHS SA330

How to fill out AU DHS SA330

01

Obtain the AU DHS SA330 form from the official Department of Human Services website or your local service center.

02

Read the instructions provided with the form carefully to understand the requirements and information needed.

03

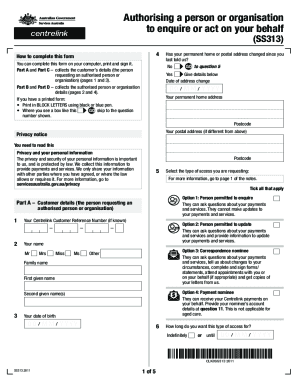

Fill out the personal details section, including your name, address, date of birth, and contact information.

04

Provide relevant information regarding your income, assets, and any other financial information as requested.

05

Complete any additional sections that are applicable to your situation, such as medical or family details.

06

Review the filled form for accuracy and ensure all required documents are attached.

07

Submit the completed form to the appropriate department, either online or by mail, as specified in the instructions.

Who needs AU DHS SA330?

01

Individuals applying for government financial assistance or support services in Australia.

02

Those who require a reassessment of their current support status due to changes in financial circumstances.

03

People seeking to establish eligibility for certain social welfare programs.

Fill

form

: Try Risk Free

People Also Ask about

What is a superannuation account?

What is superannuation? Superannuation, or 'super', is money put aside by your employer over your working life for you to live on when you retire from work. Super is important for you, because the more you save, the more money you will have for your retirement.

Do you receive income from an account based income stream?

An Account Based Income Stream (ABIS) is a means of creating a regular income, comprising capital and earnings, payable directly from money held in a personal superannuation fund.

Does superannuation income stream affect pension?

Taking money out of superannuation doesn't affect payments from us. But what you do with the money may. For instance we'll count it in your income and assets tests if you either: use it to buy an income stream.

When can I start an income stream?

You may be eligible to open a HESTA Retirement Income Stream if you've: reached your preservation age and fully retired, or. ceased an employment arrangement on or after age 60, or. reached age 65, or.

What is a sa330 form?

This form asks your income stream provider or trustee/administrator of a Self Managed Superannuation Fund (SMSF) or Small Australian Prudential Regulation Authority (APRA) Fund (SAF) to provide information about your income stream. This information is used to calculate your (and/or your partner's) Centrelink payment.

What is superannuation account-based income streams?

An account-based income stream (also known as an allocated pension or transition to retirement pension) is a retirement income stream product purchased with superannuation money. Unlike other annuities and superannuation pensions, most investors have full access to their capital.

What is an account based income stream?

An account-based income stream (also known as an allocated pension or transition to retirement pension) is a retirement income stream product purchased with superannuation money. Unlike other annuities and superannuation pensions, most investors have full access to their capital.

How much super can you have before it affects the pension?

As a single person you can have up to $609,250 and still get the pension if you are a homeowner and $833,750 if you are a non-homeowner.

What is an income stream product form?

Centrelink's 'Details of income stream product' form (SA330) is used by Centrelink to calculate your eligibility to receive a payment. You may be asked to provide the form when applying for a government pension or providing information on your income.

What is the benefit of income stream?

An income stream is simply a way of receiving a regular income, and it's how many retirees access the money that they have built up in their super fund. The regular income is like getting a salary but better because super income streams are tax-free for people over 60 years of age.

What is income stream a 330?

Income Stream Product form (SA330) The SA330 form asks your income stream provider or trustee of a Self Managed Superannuation Fund (SMSF) or Small APRA Fund (SAF) to provide information about your income.

What are superannuation income streams?

These are regular payments made from your superannuation fund, or purchased using either superannuation money or savings.

How does an income stream work?

An income stream is a series of regular payments from accumulated superannuation contributions. You can also purchase income streams using superannuation or other funds.

What is a pension income stream?

An income stream is a series of periodic benefit payments to a member. Income streams from an SMSF are usually account-based, which means the amount supporting the pension is allocated to a member's account.

Is an income stream classed as an asset?

If you purchase the income stream with savings, we treat the income stream as a financial asset until assessment day. As a financial asset, deeming rules will apply. Once your payments start we'll assess 60% of the gross payments from your lifetime income stream as income.

Does income stream affect pension?

We don't count you or your partner's superannuation in the income and assets tests, if your fund isn't paying you a superannuation pension. If your fund is paying you a superannuation pension, it is assessable as an income stream. How it is assessed depends on the type of income stream.

What is the difference between an income stream and an annuity?

An annuity allows you to convert money into an income stream. It is a product which provides you with a regular income over an agreed period of time in exchange for a lump sum payment. Annuities can be purchased either with non-super money or with super money and can be used to meet or supplement your income needs.

What affects your pension?

A common question for people nearing or in retirement is 'How much money can I have before it affects my pension? '. The answer lies in the total value of your savings and other assets and your income from various sources.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit AU DHS SA330 online?

With pdfFiller, it's easy to make changes. Open your AU DHS SA330 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out the AU DHS SA330 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign AU DHS SA330. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit AU DHS SA330 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign AU DHS SA330 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is AU DHS SA330?

AU DHS SA330 is a specific form related to the Australian Department of Human Services, used for reporting income and financial information for individuals seeking government assistance.

Who is required to file AU DHS SA330?

Individuals who are applying for or receiving certain forms of income support or government assistance from the Australian Department of Human Services are required to file AU DHS SA330.

How to fill out AU DHS SA330?

To fill out AU DHS SA330, applicants need to provide personal details, income information, and any relevant financial circumstances as required by the form. It's important to follow the instructions carefully and ensure all information is accurate.

What is the purpose of AU DHS SA330?

The purpose of AU DHS SA330 is to collect necessary financial information to assess an individual's eligibility for government assistance and ensure the correct amount of support is provided.

What information must be reported on AU DHS SA330?

AU DHS SA330 requires reporting of personal identification details, income sources, amounts earned, assets, family composition, and any other relevant financial circumstances impacting eligibility for assistance.

Fill out your AU DHS SA330 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU DHS sa330 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.