AU DHS SA330 2014 free printable template

Show details

Details of income stream product Purpose of this form asks your income stream provider or trustee of a Self Managed Superannuation Fund (SMS) or Small APA Fund (SAF) to provide information about your

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AU DHS SA330

Edit your AU DHS SA330 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU DHS SA330 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AU DHS SA330 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AU DHS SA330. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU DHS SA330 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU DHS SA330

How to fill out AU DHS SA330

01

Obtain a copy of the AU DHS SA330 form from the official AU DHS website or your local office.

02

Start by filling out your personal details at the top of the form, including your full name, address, and contact information.

03

Follow the instructions to complete the section related to your household composition, detailing the number of occupants and their relationship to you.

04

Provide information about your income sources, including pay slips, government benefits, or any other financial support.

05

Ensure you indicate any additional information required, such as property ownership or other assets.

06

Double-check all entries for accuracy and completeness before signing the form.

07

Submit the completed form as per the instructions provided, either online or in person.

Who needs AU DHS SA330?

01

Individuals or families applying for financial assistance or support from the AU Department of Human Services.

02

Those undergoing a reassessment of their financial situation for benefits eligibility.

03

People seeking to provide updated information regarding household income or composition for welfare or assistance programs.

Fill

form

: Try Risk Free

People Also Ask about

What is a superannuation account?

What is superannuation? Superannuation, or 'super', is money put aside by your employer over your working life for you to live on when you retire from work. Super is important for you, because the more you save, the more money you will have for your retirement.

Do you receive income from an account based income stream?

An Account Based Income Stream (ABIS) is a means of creating a regular income, comprising capital and earnings, payable directly from money held in a personal superannuation fund.

Does superannuation income stream affect pension?

Taking money out of superannuation doesn't affect payments from us. But what you do with the money may. For instance we'll count it in your income and assets tests if you either: use it to buy an income stream.

When can I start an income stream?

You may be eligible to open a HESTA Retirement Income Stream if you've: reached your preservation age and fully retired, or. ceased an employment arrangement on or after age 60, or. reached age 65, or.

What is a sa330 form?

This form asks your income stream provider or trustee/administrator of a Self Managed Superannuation Fund (SMSF) or Small Australian Prudential Regulation Authority (APRA) Fund (SAF) to provide information about your income stream. This information is used to calculate your (and/or your partner's) Centrelink payment.

What is superannuation account-based income streams?

An account-based income stream (also known as an allocated pension or transition to retirement pension) is a retirement income stream product purchased with superannuation money. Unlike other annuities and superannuation pensions, most investors have full access to their capital.

What is an account based income stream?

An account-based income stream (also known as an allocated pension or transition to retirement pension) is a retirement income stream product purchased with superannuation money. Unlike other annuities and superannuation pensions, most investors have full access to their capital.

How much super can you have before it affects the pension?

As a single person you can have up to $609,250 and still get the pension if you are a homeowner and $833,750 if you are a non-homeowner.

What is an income stream product form?

Centrelink's 'Details of income stream product' form (SA330) is used by Centrelink to calculate your eligibility to receive a payment. You may be asked to provide the form when applying for a government pension or providing information on your income.

What is the benefit of income stream?

An income stream is simply a way of receiving a regular income, and it's how many retirees access the money that they have built up in their super fund. The regular income is like getting a salary but better because super income streams are tax-free for people over 60 years of age.

What is income stream a 330?

Income Stream Product form (SA330) The SA330 form asks your income stream provider or trustee of a Self Managed Superannuation Fund (SMSF) or Small APRA Fund (SAF) to provide information about your income.

What are superannuation income streams?

These are regular payments made from your superannuation fund, or purchased using either superannuation money or savings.

How does an income stream work?

An income stream is a series of regular payments from accumulated superannuation contributions. You can also purchase income streams using superannuation or other funds.

What is a pension income stream?

An income stream is a series of periodic benefit payments to a member. Income streams from an SMSF are usually account-based, which means the amount supporting the pension is allocated to a member's account.

Is an income stream classed as an asset?

If you purchase the income stream with savings, we treat the income stream as a financial asset until assessment day. As a financial asset, deeming rules will apply. Once your payments start we'll assess 60% of the gross payments from your lifetime income stream as income.

Does income stream affect pension?

We don't count you or your partner's superannuation in the income and assets tests, if your fund isn't paying you a superannuation pension. If your fund is paying you a superannuation pension, it is assessable as an income stream. How it is assessed depends on the type of income stream.

What is the difference between an income stream and an annuity?

An annuity allows you to convert money into an income stream. It is a product which provides you with a regular income over an agreed period of time in exchange for a lump sum payment. Annuities can be purchased either with non-super money or with super money and can be used to meet or supplement your income needs.

What affects your pension?

A common question for people nearing or in retirement is 'How much money can I have before it affects my pension? '. The answer lies in the total value of your savings and other assets and your income from various sources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AU DHS SA330 for eSignature?

AU DHS SA330 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out the AU DHS SA330 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign AU DHS SA330 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit AU DHS SA330 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute AU DHS SA330 from anywhere with an internet connection. Take use of the app's mobile capabilities.

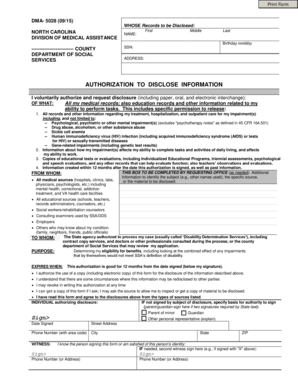

What is AU DHS SA330?

AU DHS SA330 is a specific form used by the Australian Department of Human Services which facilitates the reporting of certain types of financial information related to income and assets for individuals seeking government support.

Who is required to file AU DHS SA330?

Individuals who are applying for or receiving specific forms of government assistance and need to report their income and asset information are required to file AU DHS SA330.

How to fill out AU DHS SA330?

To fill out AU DHS SA330, individuals should follow the instructions provided with the form, which typically include gathering necessary financial documents, accurately reporting income and asset details, and submitting the form by the specified deadline.

What is the purpose of AU DHS SA330?

The purpose of AU DHS SA330 is to ensure that the Australian government has accurate and up-to-date financial information from individuals applying for assistance to determine their eligibility for benefits.

What information must be reported on AU DHS SA330?

AU DHS SA330 requires reporting of various types of financial information including income from employment, other sources of income, details of assets such as property and savings, and any other relevant financial data that could affect eligibility for assistance.

Fill out your AU DHS SA330 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU DHS sa330 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.