Get the free Loan Agreement for Vehicle template

Show details

A Loan Agreement is entered into by two parties. It lists the duties, obligations and liabilities of each party when entering into the loan agreement.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is loan agreement for vehicle

A loan agreement for a vehicle is a legal document outlining the terms and conditions under which a lender provides financing for purchasing a vehicle.

pdfFiller scores top ratings on review platforms

very intuituve. quick and easy to learn. i operate mobily so i like the fact that i can use it on any of my 4 computers any where in the world. Very easy to drop text in. I like the erase and highlight feature. I tried at least 6 other platfroms and they were too dificult to use.

PDFfiller has allowed me access to several important work documents that I would otherwise not know how to edit. So far, great program!

If you need to type on a PDF this is the tool to use. Makes it very easy, worth the price.

AN ECELLENT SERVICE, FORMS & CLEARED INSTRUCTIONS.. THANK YOU ..

easy to follow, encode details & print. User friendly

Was very easy to navigate and went smoothly.

Who needs loan agreement for vehicle?

Explore how professionals across industries use pdfFiller.

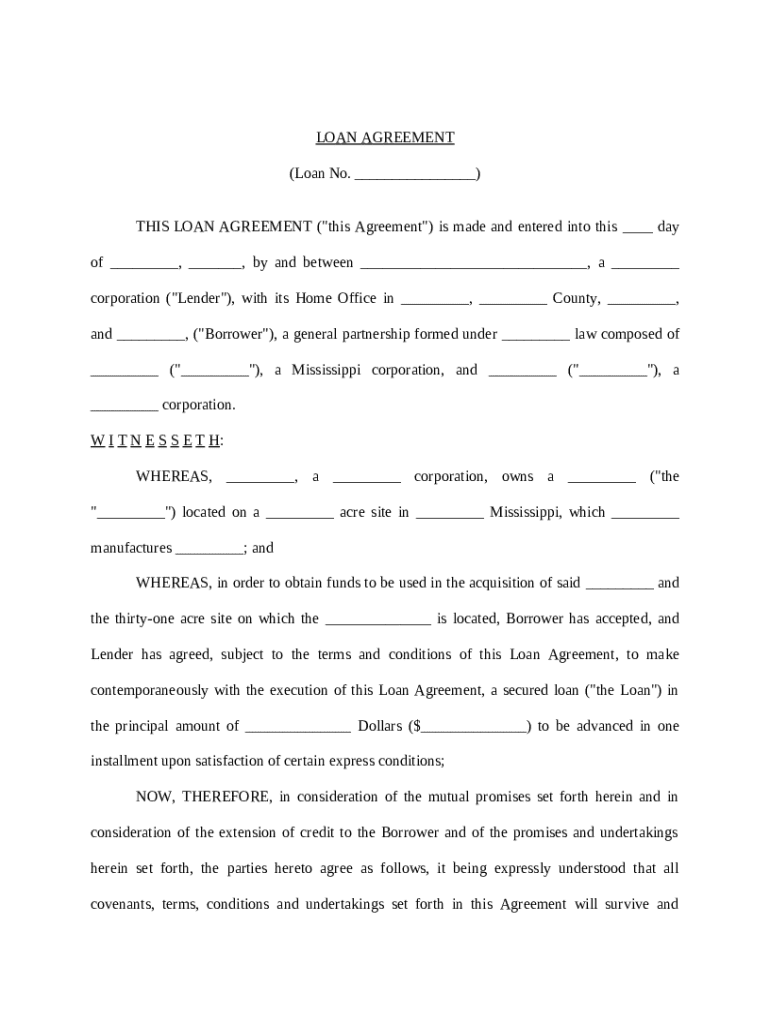

Comprehensive Guide to the Vehicle Loan Agreement Form

How do understand the basics of a loan agreement?

A loan agreement is a formal document outlining the conditions under which a lender provides funds to a borrower for a specific purpose, such as purchasing a vehicle. It is significant because it protects the rights of both parties, ensuring clarity on repayment terms and obligations.

-

The entity providing the funds, often a bank or financial institution.

-

The individual or entity receiving the loan to purchase the vehicle.

-

Commonly used for financing cars, trucks, or motorcycles.

What components are included in a vehicle loan agreement?

A well-structured vehicle loan agreement contains several crucial components that clarify expectations between the lender and the borrower. These details ensure that all parties understand their rights and obligations concerning the loan.

-

An identifier that helps in tracking the loan throughout its term.

-

Specifies the total amount borrowed and the percentage charged as interest.

-

Describes how and when repayments will be made.

-

Outlines repercussions if the borrower fails to make repayment on time.

-

Both parties must sign and date the agreement to validate it.

How do fill out the vehicle loan agreement form?

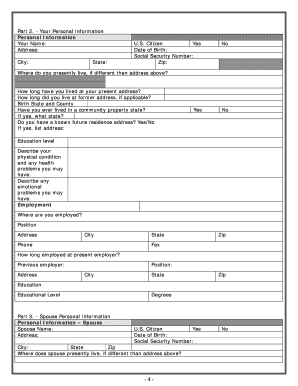

To complete a vehicle loan agreement form, gather necessary personal and financial documentation first, as these will be required throughout the process. Follow the specific instructions for each section carefully to ensure accuracy, as errors could lead to future disputes.

-

Gather personal details like income and existing debts.

-

Carefully adhere to the guidance provided for form completion.

-

Utilize online tools like pdfFiller for a smoother filling and editing experience.

-

Ensure all information is correct to prevent conflicts or legal issues later.

Can customize my loan agreement?

Yes, customization is a critical step in personalizing your vehicle loan agreement to fit your needs. You can modify existing templates using pdfFiller, which allows users to tailor the document to specific circumstances.

-

Easily adjust standard contract templates to suit your unique terms.

-

Include any additional clauses that are specific to your agreement.

-

Save your document in the cloud for easy future access or sharing.

What legal considerations should keep in mind?

Legal compliance is paramount when drafting a vehicle loan agreement. Understanding regional laws ensures that your agreement meets local regulations, especially in Mississippi, where specific rules may apply.

-

Familiarize yourself with local regulations regarding vehicle loans.

-

Ensure compliance to avoid legal repercussions or invalid agreements.

-

Be cautious of common mistakes that could render your agreement ineffective.

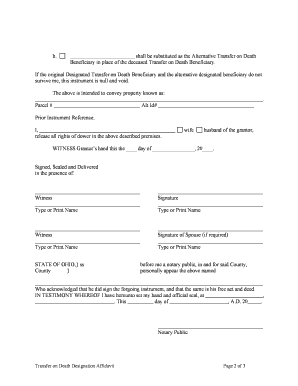

How do finalize my vehicle loan agreement?

Finalizing a loan agreement typically involves signing the document electronically or manually. Utilizing e-signing options through platforms like pdfFiller can facilitate a more efficient process.

-

Explore options for e-signing your agreement to speed up the process.

-

Understand the differences and legal validity between digital and physical signatures.

-

Learn how to safely share or print your finalized loan agreement.

What should do after signing the agreement?

After signing your vehicle loan agreement, it’s important to manage the loan effectively. This includes tracking payments and understanding your responsibilities as a borrower to maintain good standing with the lender.

-

Use tools like pdfFiller to monitor your payments and outstanding balance.

-

Be aware of your commitments to ensure timely payments.

-

Explore options for refinancing or renegotiating the terms if conditions change.

How to fill out the loan agreement for vehicle

-

1.Open the loan agreement template on pdfFiller.

-

2.Enter the date of the agreement at the top of the document.

-

3.Fill in the borrower's full name and contact information in the designated fields.

-

4.Input the lender's information, including name and address, in the corresponding sections.

-

5.Describe the vehicle being financed, including make, model, year, and VIN (Vehicle Identification Number).

-

6.Specify the loan amount being borrowed for the vehicle purchase.

-

7.Detail the interest rate and repayment schedule, including payment frequency and total loan duration.

-

8.Fill in any additional fees or costs associated with the loan, such as processing fees or late fees.

-

9.Carefully review all entries for accuracy before signing.

-

10.Sign and date the agreement at the indicated location.

-

11.Share a copy of the signed agreement with the lender and keep one for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.