Get the free Security Agreement Covering Inventory, Accounts Receivable and Equipment template

Show details

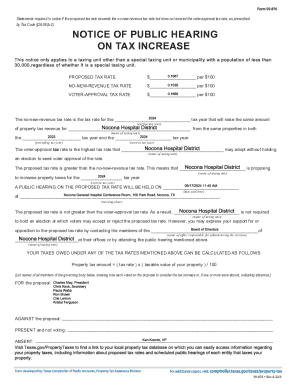

A secured transaction is created by means of a security agreement in which a lender (the secured party) may take specified collateral owned by the borrower if he or she should default on the loan.

We are not affiliated with any brand or entity on this form

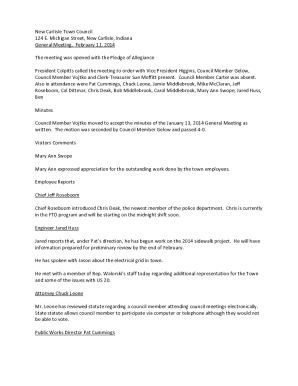

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is security agreement covering inventory

A security agreement covering inventory is a legal document that grants a lender a security interest in a borrower's inventory as collateral for a loan.

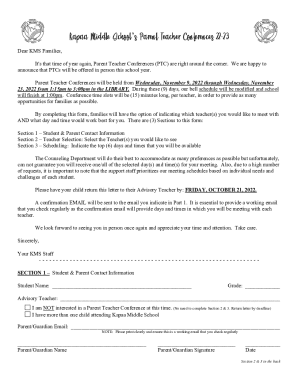

pdfFiller scores top ratings on review platforms

It is a good user friendly, useful software with very good features.

This tool provides professional documents. Highly recommended.

0.0FAJSHIOFNSAJKOFXZNJKMCHJI0OQWRNFMQLNGTQLWJOKPSDAJZFNLK

It was quick and convenient. The only problem I had is that the updated form was not the correct one sent to the email. It continued to send and older version.

Its a good overall program although I had issues uploading my pdf assignment for school, and when I submitted it online, the pdf was completely blank. Not sure why this program did that.

Best PDF Documents Ever, and user friendly. Immediately opens documents into PDF and EDIT ready.

Who needs security agreement covering inventory?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Security Agreement Covering Inventory

To fill out a security agreement covering inventory form, ensure that you understand the structure of the agreement, identify the relevant collateral, and provide complete information about the debtor and secured party. This comprehensive guide will assist you in effectively navigating each step of the process.

What is a security agreement?

A security agreement is a legal document that outlines the terms under which a borrower pledges collateral to secure a debt. It plays a critical role in business financing, as it protects the lender's interests by providing a claim on specific assets, such as inventory and accounts receivable, should the borrower default.

-

Definition of a security agreement and its significance in business financing.

-

Importance of covering inventory and accounts receivable in security agreements.

What are the key components of a security agreement?

A well-structured security agreement comprises various key components that establish the responsibilities and rights of both the debtor and the secured party.

-

This involves the debtor granting a security interest to the secured party. This relationship is essential for clarifying the obligations of both parties.

-

Collateral must be explicitly identified, which includes inventory, accounts receivable, and equipment relevant to the loan.

-

Clarification of additional property included in the agreement, like parts and appliances, can further protect the lender.

How to fill out the security agreement?

Filling out the security agreement form correctly is crucial for the validity of your document. Each section should be completed thoroughly and accurately.

-

Enter accurate information for both the debtor and secured party, including legal names and addresses.

-

Specify the collateral being pledged, ensuring clarity and detail to prevent disputes.

-

Review the completed form to ensure that every section is thoroughly filled out before signing.

What are the debtor's obligations and responsibilities?

Understanding the debtor's obligations is essential in a security agreement. Payment obligations and warranties must be clearly defined.

-

Details about payment terms should be outlined in the promissory note, specifying amounts and deadlines.

-

The debtor must ensure compliance with warranties regarding the clear title to the collateral, thus protecting the secured party's interests.

What are the enforcement options of a security agreement?

In the event of default, the secured party has various legal options for enforcing the security agreement.

-

Taking legal action against the debtor is a primary recourse for enforcing the security interests defined in the agreement.

-

Establishing clear procedures for managing defaults ensures a swift response by the secured party to mitigate losses.

How can pdfFiller assist with document management?

PdfFiller simplifies the management of security agreements with features that enhance usability and document collaboration.

-

Users can easily edit the security agreement forms, ensuring that all details are up-to-date.

-

The eSignature function allows for easy and secure signing directly on the platform, streamlining the transaction processes.

What state-specific considerations should you be aware of?

Security agreements can vary significantly based on state laws, making it crucial to be aware of the specific requirements in your jurisdiction.

-

Each state may have unique provisions and variations in security agreement rules that must be adhered to.

-

Ensuring compliance with your locality's regulations can prevent potential legal issues in the future.

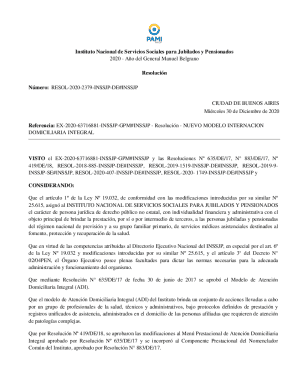

How to fill out the security agreement covering inventory

-

1.Start by opening your pdfFiller account and uploading the security agreement template.

-

2.Review the document to locate sections that require your input.

-

3.In the 'Debtor' section, enter the legal name and address of the borrower.

-

4.In the 'Secured Party' section, fill in the lender's name and address.

-

5.Specify the type of inventory covered by the agreement in the designated area.

-

6.Indicate the loan amount that the inventory will secure.

-

7.Check the terms of the agreement, ensuring they reflect your negotiations.

-

8.Include any additional provisions or clauses as needed, ensuring clarity and mutual agreement.

-

9.Once completed, review the document for any errors or omissions.

-

10.Finally, save the document and await necessary signatures from both parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.