Last updated on Feb 17, 2026

Get the free Revenue Sharing Agreement to Income from the Licensing and Custom Modification of th...

Show details

This sample form is for use in the software industry.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is revenue sharing agreement to

A revenue sharing agreement is a contractual arrangement where two or more parties agree to share the earnings generated from a specific venture or service.

pdfFiller scores top ratings on review platforms

Just subscribed but my first form was excellently done. Intuitive and easy to negotiate the Dashboard. I really liked the alignment lines that assist to keep things neat when typing data into the field. Look forward to learning more about the capabilities. Thanks

This program is a wonderful tool for those in need of completing documents with step by step instructions & returning later if need be. I appreciate those who assist with making this free program. It is a real Blessing also to those such as myself who cannot afford an attorney with knowing that forms are up to date & accurate. Thank you

Overall the format is excellent -- the clearest, fastest and most accessible set of URL instructions I've ever used -- EXCEPT haven't yer succeeded in getting a doc e-signed! Maybe we were missing a step. The doc got e-sent to the signer, but all he ever got was the sample doc to fill out -- but it wouldn't let him fill it out. and just kept popping up the sample doc. Even tho ' it side we'd successfully down loaded the doc - but it appears it kept downloading the same sample doc and not the one I'd sent him to sign,

I had an issue at first, and the customer service rep was patient and figured it out with me.

So far so good. I have done three documents in about 15 or so work minutes and the process has been pretty painless.

Great tool. makes it easy to sign documents online and relatively inexpensive.

Who needs revenue sharing agreement to?

Explore how professionals across industries use pdfFiller.

Revenue sharing agreement to form form: A comprehensive guide

How does a revenue sharing agreement work?

Revenue sharing agreements are collaborative contracts between parties where they agree to share revenue generated from a specific project or initiative. They are particularly significant in business transactions, as they clarify how earnings will be distributed, ensuring transparency and motivation among involved parties. This agreement can be crucial for startups and small businesses that leverage partnerships to scale their operations.

What are the key components of a revenue sharing agreement?

-

Clearly define all relevant terms to avoid ambiguity.

-

Outline how revenue will be generated and shared among parties.

-

Specify the responsibilities of each party, including payment terms and timeline.

-

Ensure adherence to local tax and regulatory requirements.

What differentiates revenue sharing from profit sharing?

While both revenue sharing and profit sharing involve the distribution of financial rewards, they differ fundamentally. Revenue sharing is based entirely on the total income generated, whereas profit sharing takes into account the expenses incurred, thus focusing on the net profit. This distinction makes revenue sharing useful in scenarios where tracking costs is complex, such as collaborative software ventures.

What are some examples of revenue sharing in the software industry?

-

Companies can share revenue based on sales generated through affiliate links.

-

Software platforms might partner with developers to share revenue on app sales.

What should consider for local compliance?

It’s critical to factor in local laws that apply to revenue sharing. Compliance can include understanding tax implications, service regulations, and industry-specific requirements that dictate how revenue can be shared. Consulting with local legal experts ensures that your agreement adheres to all necessary guidelines.

How to structure your revenue sharing agreement?

Structuring an effective revenue sharing agreement involves careful planning and clear communication. It’s essential to identify the parties involved—typically referred to as the purchaser and sellers—and outline key terms such as the payment structure, duration, and obligations.

-

Clearly state who the parties are in your agreement.

-

Include details about how revenue will be split, when payments are due, and the extent of each party's obligations.

-

Define the responsibilities of each party in relation to software development and licensing.

-

Allow room for future modifications and enhancements to the software involved.

Why is tracking revenue important?

Tracking revenue generated under an agreement is vital for both parties to ensure fairness and transparency. Using tools such as those offered by pdfFiller helps keep comprehensive records of all transactions related to the revenue sharing agreement. Moreover, having accurate insights not only aids compliance but also enables businesses to make informed strategic decisions.

What metrics should you monitor for long-term success?

-

Monitor the total revenue generated to understand overall profitability.

-

Measure changes in revenue over time to assess growth.

-

Track how long customers remain engaged to maintain consistent revenue.

How to evaluate revenue sharing partners?

Selecting the right partners is critical to the success of a revenue sharing agreement. Evaluating potential partners based on clear criteria can minimize risks associated with collaboration. Compatibility in terms of business goals, project vision, and operational practices is essential.

What are the expectations and outcomes from a revenue sharing agreement?

Both parties should have clear expectations from a revenue sharing deal: effective revenue growth, enhanced cooperation over time, and possibly shared successes in product development. However, potential challenges might arise, requiring proactive communication and strategizing to address them effectively.

What common mistakes should you avoid in revenue sharing agreements?

-

Ambiguity can lead to conflicts; define all terms from the outset.

-

Adhere to local regulations to avoid legal ramifications.

-

Regularly monitor revenue to maintain informed strategic decisions.

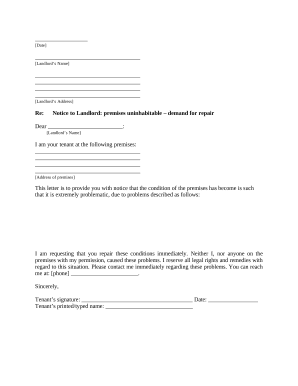

How to fill out the revenue sharing agreement to

-

1.Open pdfFiller and select 'Create New Document' to start from a template or upload your revenue sharing agreement.

-

2.Fill in the relevant details at the top section, including the date and names of the parties involved.

-

3.Provide a detailed description of the revenues to be shared, specifying the percentages and conditions.

-

4.Outline the duration of the agreement, stating how long the revenue sharing will last and any renewal clauses.

-

5.Include any specific obligations for each party, ensuring clear responsibilities are defined.

-

6.Add sections for dispute resolution and modifications to the agreement if necessary.

-

7.Review the filled document for accuracy and completeness, ensuring all necessary terms are included.

-

8.Save the completed agreement and share it with all parties involved for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.