Get the free Specific Guaranty template

Show details

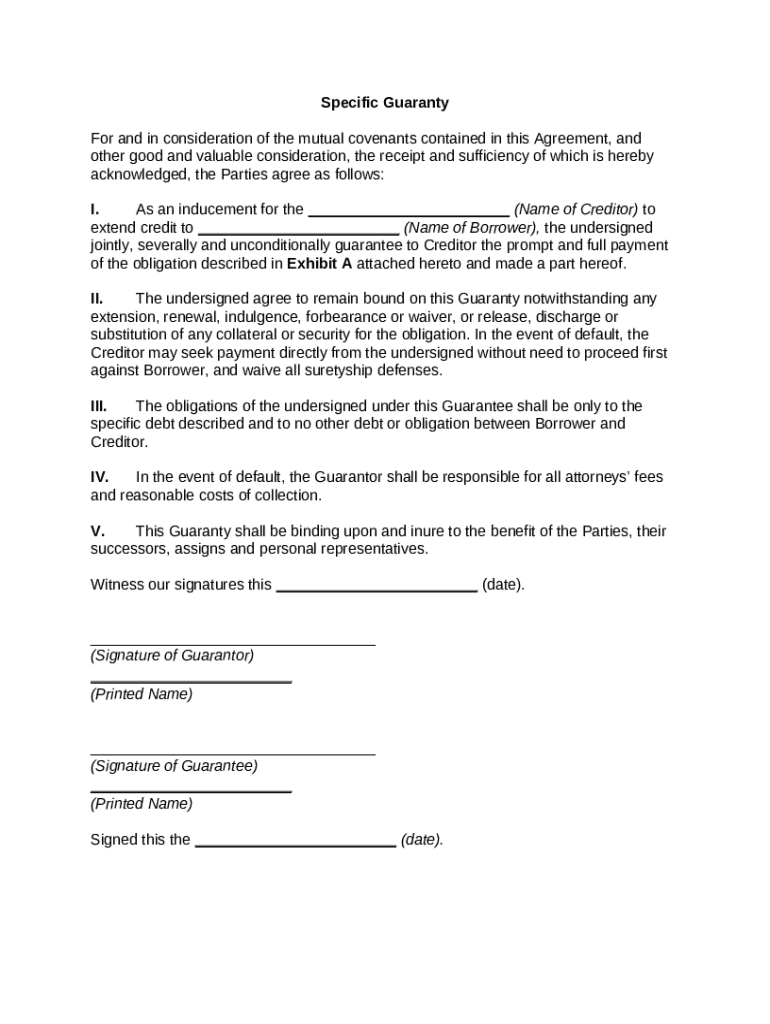

This form is a Specific Guaranty.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is specific guaranty

A specific guaranty is a legal document where a guarantor agrees to take responsibility for a specific obligation of a debtor under certain conditions.

pdfFiller scores top ratings on review platforms

Just an easier GUI than any other I have used.... which is why i paid for Annual...

Too many controls involved in printing a page

I had a problem that I needed help with. I got a response and answer to my questions within minutes. Thanks for the help!

So far so good, still very new to using it.

very convenient and easy to use. Makes finding forms very quick!!!

It's taken a little doing, to become clear about using my account so I don't end up with 2 subscriptions but it has become clear in that respect.

Who needs specific guaranty template?

Explore how professionals across industries use pdfFiller.

How to fill out a specific guaranty form: A comprehensive guide

Understanding the specific guaranty form

A specific guaranty form serves as a crucial document in various financial agreements, ensuring that obligations are met. By defining the responsibilities of the guarantor, this form provides legal backing for creditors. It's essential to understand when to use this form to safeguard transactions and clarify liabilities.

-

It refers to a document where one party agrees to be responsible for the debt of another.

-

This form provides a legal assurance to creditors, often influencing lending decisions.

-

Typically used in lending arrangements, leases, and other financial obligations.

What are the key components of the specific guaranty form?

Filling out a specific guaranty form accurately is paramount. Each component signifies essential details that play a part in the enforceability and clarity of the agreement.

-

Filling out the creditor's name and details ensures the party responsible for enforcing the guaranty is clearly identified.

-

Including the borrower's details helps specify who the guaranty is applied to, preventing any potential mix-ups.

-

Exhibit A usually details the specific obligations associated with the guaranty, outlining what exactly is guaranteed.

How can you fill out the specific guaranty form?

Filling out the specific guaranty form requires attention to detail. An accurate completion of each field can significantly affect the legal validity of the document.

-

Begin with the correct titles and move through the fields logically, verifying information as you go.

-

Inaccurate information can lead to disputes or render the document unenforceable in court.

-

Avoid leaving fields blank; ensure all names and figures are spelled correctly to reduce legal risks.

What is involved in signing and witnessing the specific guaranty?

The signing and witnessing process for a specific guaranty is crucial to validate the document legally. Having the right signatures ensures the agreement is enforceable.

-

Both the Guarantor and the guarantee must sign to validate their intent and agreement.

-

Witnesses confirm that the signatures were made in their presence, adding another layer of legitimacy.

-

Sign in blue ink and ensure all parties have copies for their records to avoid issues down the line.

What obligations and responsibilities does a guarantor have?

Obligations under a specific guaranty are binding, and understanding them is crucial for the guarantor. Failure to meet these obligations carries significant consequences.

-

The guaranty typically holds the guarantor legally accountable for the borrower's obligations.

-

If the borrower defaults, the guarantor may face financial consequences, including potential lawsuits.

-

The form clearly outlines the extent of liability, which is fundamental for both parties involved.

Are modifications and amendments to the guaranty permissible?

Modifications to a specific guaranty can occur under certain conditions. Documenting these changes correctly is vital to maintain the document's validity.

-

Changes in financial circumstances or terms of the agreement may necessitate amendments.

-

All amendments should be documented clearly, following legal guidance to avoid disputes.

-

Consultation with legal professionals is advised when modifying any document to maintain compliance.

How can you use pdfFiller for your specific guaranty form needs?

pdfFiller is designed to streamline the process of editing, signing, and managing your specific guaranty form. Its collaborative features enhance teamwork, making document management efficient.

-

Utilize pdfFiller's tools to easily edit any fields in your specific guaranty form directly.

-

pdfFiller allows users to eSign documents quickly, retaining a digital trail for security.

-

Teams can work together on pdfFiller, ensuring that input and concerns are addressed in real-time.

What compliance and legal considerations should you keep in mind?

Understanding compliance is critical when handling specific guaranty forms. Legal regulations can vary significantly by region, impacting how these documents must be formatted and executed.

-

Be aware of local laws governing guaranty agreements to ensure enforceability.

-

Certain industries may have unique rules that affect the language and requirements of your guaranty form.

-

Regularly consult legal resources to keep abreast of legislative changes that could affect your agreements.

How to fill out the specific guaranty template

-

1.Open pdfFiller and upload your specific guaranty document.

-

2.Select the 'Fill' option to begin entering information.

-

3.Start with the guarantor's details; enter full name, address, and contact information.

-

4.Next, input the debtor's information including name and address.

-

5.Specify the exact obligation being guaranteed, such as a loan amount or other financial responsibilities.

-

6.Ensure all relevant terms and conditions are clearly stated in the provided fields.

-

7.Review the document thoroughly for accuracy before finalizing.

-

8.Once completed, proceed to save and download the filled document or share it directly via email.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.