Get the free Limitation of Liability for Gratuitous Bailments template

Show details

A gratuitous bailment is a type of bailment in which the bailee receives no compensation. An example would be borrowing a friend’s car. A gratuitous bailee is liable for loss of the property only

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is limitation of liability for

A limitation of liability for is a contractual provision that restricts the amount of damages one party can recover from another in the event of a loss or injury.

pdfFiller scores top ratings on review platforms

the efficiency and clarity are five star.

This is exactly what I needed for my home business needs.

Thanks

I used the program and was happy with the software and results. However, due to my own oversight I inadvertently made an annual purchase which I would not be in need of. I noted this in my comments when rating the app. To my surprise and complete satisfaction the service team provided me a credit. They went over and above in addressing my frustration. Based on this integrity and caring service I will use this program if needed in the future and will certainly recommend it to others.

love this product absolutely worth getting

I am very happy with the program and customer service!

Signature area leaves me wondering. I cannot sign reasonable with mouse and the camera image did not seem to take

Who needs limitation of liability for?

Explore how professionals across industries use pdfFiller.

How to fill out a limitation of liability for form form

Understanding the Limitation of Liability Clause

A limitation of liability clause is a critical component in many contracts, designed to clearly define the extent to which a party can be held liable for damages. Its importance lies in managing risks and ensuring that contractual parties understand their responsibilities. Legally, such clauses can protect against unexpected financial repercussions, but they must be carefully drafted to withstand legal scrutiny.

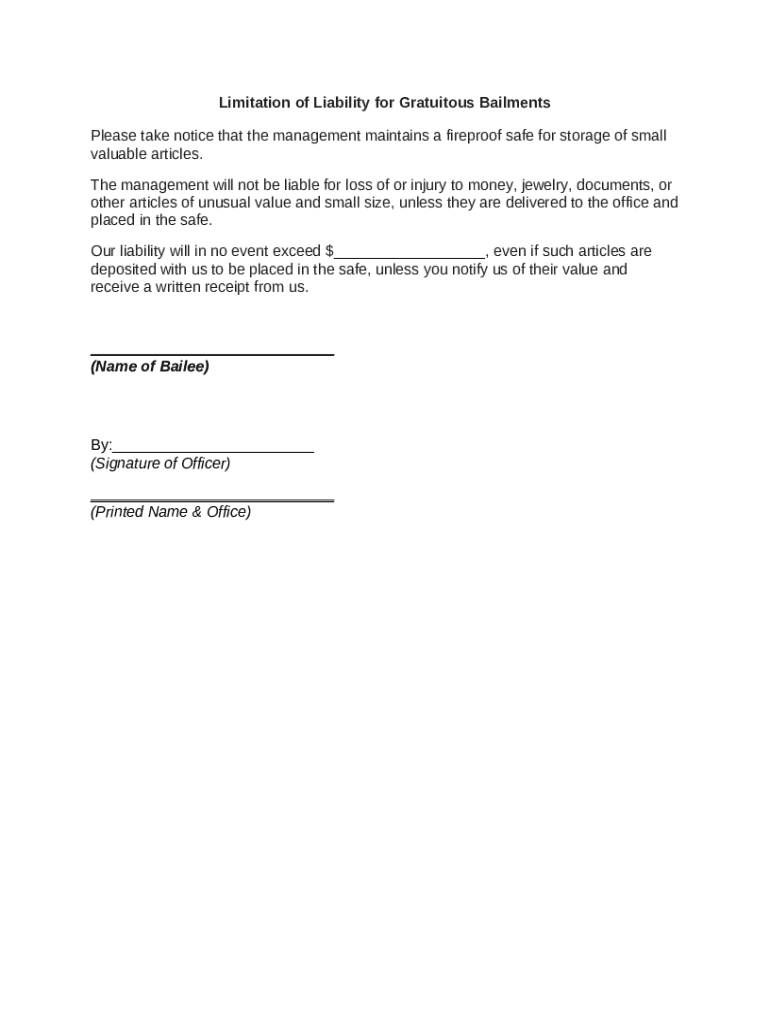

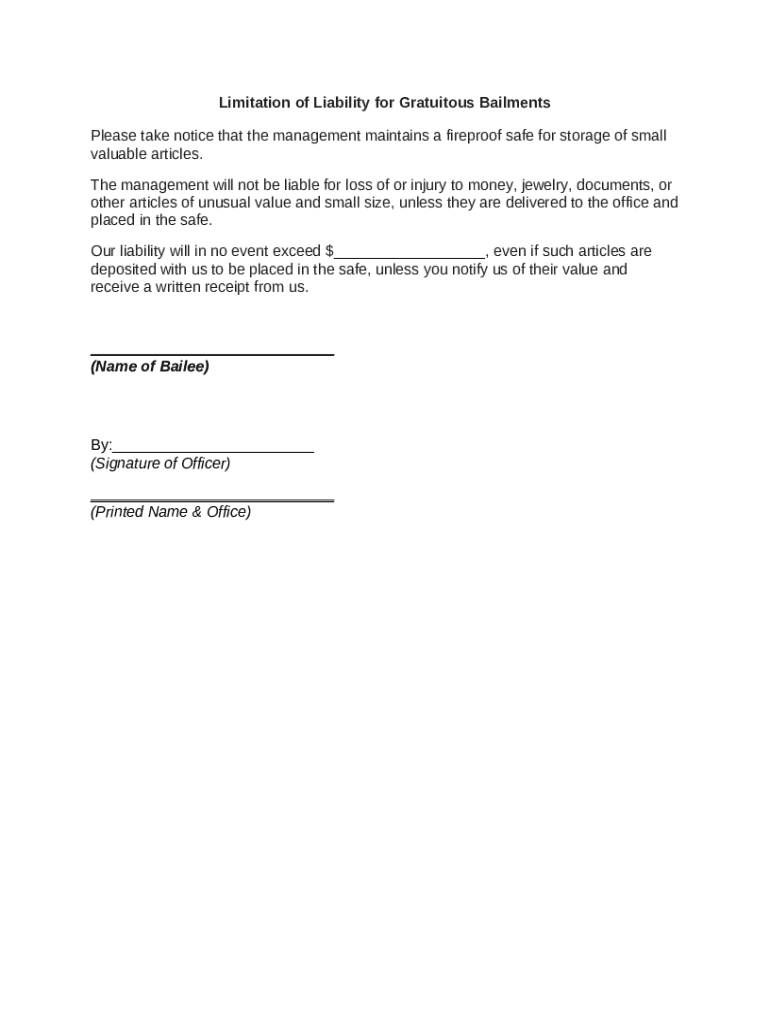

What essential fields should a limitation of liability for gratuitous bailments form include?

-

The form should outline critical sections, such as notices about how goods will be stored, to mitigate misunderstandings.

-

It is essential to specify the maximum amount of liability, offering transparency on potential financial risks.

-

Clear instructions regarding signatures, including roles like that of an Officer, ensure accountability in the agreement.

What types of limitation of liability clauses exist?

Limitation of liability clauses can vary significantly depending on the industry and context. Common variations may include products liability limits, service-related thresholds, or even geographical considerations. Understanding these differences helps in tailoring clauses that meet specific needs and legal standards.

Why should businesses use a limitation of liability clause?

-

A well-defined clause can significantly reduce financial risks for service providers and businesses, providing a safety net in case of unforeseen disputes.

-

By clarifying the expectations around liability, these clauses can foster greater trust between businesses and their clients.

-

Firms can leverage liability limitations when negotiating contracts, potentially leading to more favorable terms.

How can limitation of liability clauses be enforced?

-

Factors like the clarity of the clause, the context in which it is applied, and legal precedents will influence enforceability.

-

Reviewing case studies can shed light on successful enforcement and the common challenges faced in legal disputes.

-

Ensure clauses are drafted clearly and unambiguously to withstand legal scrutiny and enhance enforceability.

What are real-world applications of limitation of liability clauses?

-

In sectors like logistics or hospitality, these clauses minimize exposure during service delivery.

-

Clauses effectively protect companies from liabilities in various scenarios, provided they are well-constructed.

-

Poorly drafted clauses can lead to significant financial exposure, underscoring the importance of careful construction.

How do limitation of liability and indemnification differ?

Indemnification refers to the obligation of one party to compensate another for certain damages or losses. While they may coexist within a contract, limitation of liability specifically caps the potential exposure a party may face. It is best practice to clearly define both in agreements to prevent any overlap or confusion.

What are the consequences of omitting a limitation of liability clause?

-

Without a limitation of liability clause, businesses may face extensive financial repercussions in the event of a claim or dispute.

-

There are numerous cases where companies suffered greatly due to the absence of such clauses, leading to significant losses.

-

Contract drafters must be aware of the critical role this clause plays in protecting organizational interests.

How can contract management software assist with liability clauses?

Using contract management software like pdfFiller can enhance the efficiency of managing limitation of liability clauses. Such tools allow for seamless editing, electronic signatures, and collaborative document handling, which are essential in today’s remote work environment. This streamlining leads to fewer errors and improved compliance with contractual obligations.

How to fill out the limitation of liability for

-

1.Open the PDFfiller platform and log into your account.

-

2.Upload the limitation of liability form you wish to complete.

-

3.Carefully review the sections that need to be filled out, such as parties involved and scope of liability.

-

4.Fill in your name and contact details in the designated fields.

-

5.Specify the maximum liability amount and any relevant terms or conditions related to the limitation.

-

6.Include any necessary dates, signatures, or witness information as required by the document.

-

7.Double-check all entered information for accuracy and completeness.

-

8.Once finalized, save the document and select the option to download or share it as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.