Last updated on Feb 17, 2026

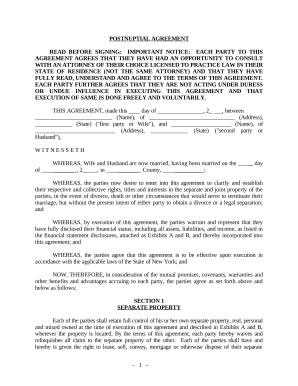

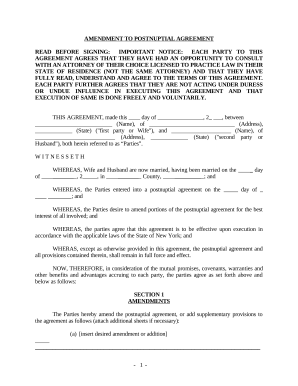

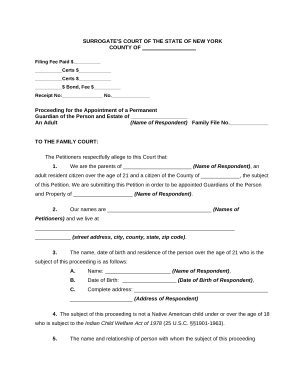

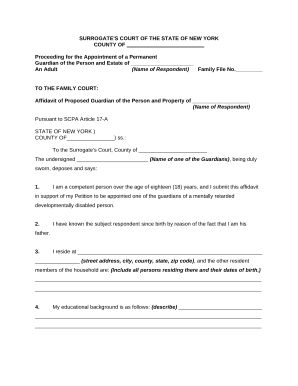

Get the free Indemnity Agreement between corporation and directors and / or officers template

Show details

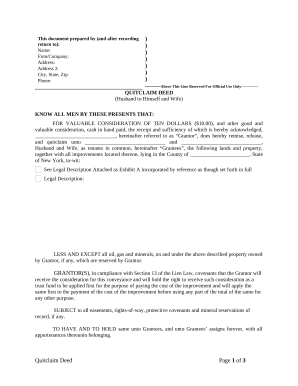

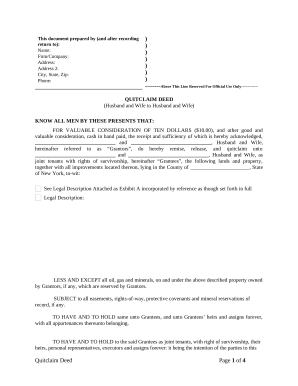

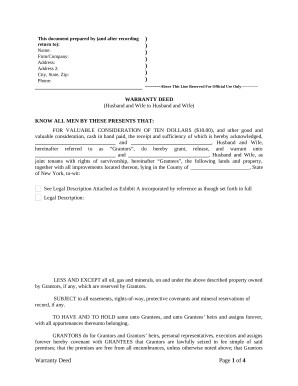

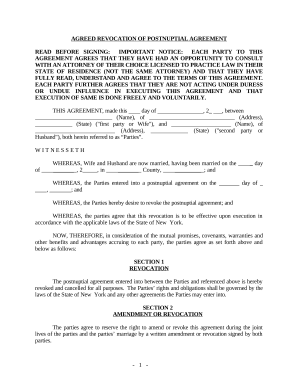

This sample form, a detailed Indemnity Agreement, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several standard formats.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is indemnity agreement between corporation

An indemnity agreement between a corporation is a legally binding contract that outlines the responsibilities of one party to compensate another for any losses or damages that may occur.

pdfFiller scores top ratings on review platforms

Easy to use and the 30 day trial is…

Easy to use and the 30 day trial is great!

Form CH120

Worked very good for the form I needed

Easy to use

Easy to use. No problem editing PDF documents. Recommended.

eally good

really good, however it should be free

Perfect

Perfect. Really understanding, great tools. Nothing bad to say.

THE BEST ONLINE DOCUMENT FILLING WEBSITE THAT YOU WILL FIND!!

PDFfiller is the website for all your "form filling" necessities. It is comfortable and efficient and does all your work like a pro. It have some amazing features and the subscription fee is absolutely worth it! From the time you begin using PDFfiller, you will begin to praise the app for its amazingly talented editing features and efficiency. If you don't believe me, go and experience all that this website has got to offer!-A thankful customer and user.

Who needs indemnity agreement between corporation?

Explore how professionals across industries use pdfFiller.

Complete guide to an indemnity agreement between corporation forms

Filling out an indemnity agreement between corporate forms requires attention to detail. This guide outlines components including legal implications, key definitions, and actionable steps to help individuals and teams effectively create and manage these agreements.

What is an indemnity agreement?

An indemnity agreement is a legally binding contract in which one party agrees to protect another party from financial loss or legal liability. In the context of corporations, these agreements can significantly impact how liabilities are handled. They serve to safeguard the company and its executives against certain risks under Delaware law, enhancing confidence in corporate governance.

-

A formal agreement ensuring that one party will take responsibility for certain damages or legal claims made against another party.

-

These agreements are crucial for protecting organizational leaders and encouraging decisive action without the fear of personal financial loss.

-

Delaware law provides specific guidelines for indemnity agreements that corporate entities must adhere to, ensuring fairness and legal compliance.

How do you outline the key components of an indemnity agreement?

Understanding the key components of an indemnity agreement is vital for corporate legal teams. These components detail the responsibilities and rights of each involved party.

-

Typically, the corporate entity (the indemnifying party) agrees to indemnify the individual acting on its behalf (the indemnitee) against specific liabilities.

-

The agreement may replace or supplement the statutory indemnification rights provided under state law, offering greater protection tailored to corporate needs.

-

Common indemnifiable actions often involve legal costs, damages from lawsuits, and other liabilities resulting from the indemnitee's corporate role.

What steps are involved in filling out an indemnity agreement?

Filling out the indemnity agreement accurately ensures protection for the corporation and its representatives. The following steps provide a clear process to follow.

-

Specify the start date to anchor the legal document's effectiveness.

-

Utilize pdfFiller's platform to input the necessary company details, ensuring accuracy and professionalism.

-

Clearly outline the names and roles of those being indemnified to avoid any ambiguity.

What insurance considerations should you keep in mind?

Indemnity agreements often call for accompanying insurance to cover potential liabilities. It's essential to navigate the varieties and terms of indemnity insurance.

-

Several insurance products, like directors and officers (D&O) insurance, provide critical coverage for claims against corporate leaders.

-

Many policies contain exclusions, prompting a careful review before selection to ensure adequate protection.

-

Evaluate the potential costs of litigation against the premiums of indemnity insurance to make informed financial decisions.

What are the common types of indemnity agreements?

Various types of indemnity agreements exist, each tailored for different corporate needs. Recognizing these types can help in drafting tailored agreements.

-

Corporate indemnification focuses on protecting corporate officers, while personal indemnity agreements can protect individuals outside the organization.

-

Clauses may define specific risks, such as environmental liabilities or financial misconduct, tailored to the company's industry.

-

Delaware law favors broad indemnity clauses, offering more substantial protections than many states, making it the preferred jurisdiction for incorporation.

What are the legal implications of indemnity agreements?

The legal landscape surrounding indemnity agreements can be intricate. Understanding these implications is essential for compliance and risk management.

-

Disputes may arise regarding the enforceability of indemnity clauses, demanding a proactive legal strategy.

-

Failing to adhere to Delaware's specific indemnification statutes can lead to significant penalties, including personal liability for directors.

-

Indemnity provisions must meet specific standards to be considered enforceable in court, highlighting the importance of precise language.

What resources are available for creating an indemnity agreement?

Utilizing modern tools can streamline the process of drafting and managing indemnity agreements. Platforms like pdfFiller provide essential features.

-

Start with a customizable template to meet your specific needs efficiently.

-

The platform offers user-friendly tools for editing, signing, and sharing documents online.

-

Effortlessly collaborate with team members and obtain necessary signatures within the same digital workspace.

What disclaimers should you be aware of?

When navigating indemnity matters, understanding the associated disclaimers is crucial. They help set clear expectations around the legal scope of advice.

-

General industry practices, while helpful, cannot replace tailored legal advice for specific situations.

-

Legal interpretations can vary based on jurisdiction, making it essential to consult with legal professionals familiar with Delaware law.

-

Consider legal counsel whenever drafting or modifying an indemnity agreement to ensure compliance with current regulations.

How to fill out the indemnity agreement between corporation

-

1.Begin by accessing the indemnity agreement template on pdfFiller.

-

2.Select the appropriate fields to fill out, usually beginning with the names of the parties involved, including the corporation and the indemnified party.

-

3.Fill in the details of the indemnification, specifying the scope of coverage and any relevant conditions or exclusions.

-

4.Include the duration of the agreement, indicating how long the indemnity will be in effect.

-

5.Add any specific payment terms or limitations that apply to the indemnity.

-

6.Review the document to ensure all the required fields are completed accurately.

-

7.Once all information is filled in, use the 'save' or 'download' options to keep a copy of the agreement for your records.

-

8.Ensure that both parties sign the document to finalize the agreement, if applicable.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.