Get the free Employee Payroll Records Checklist template

Show details

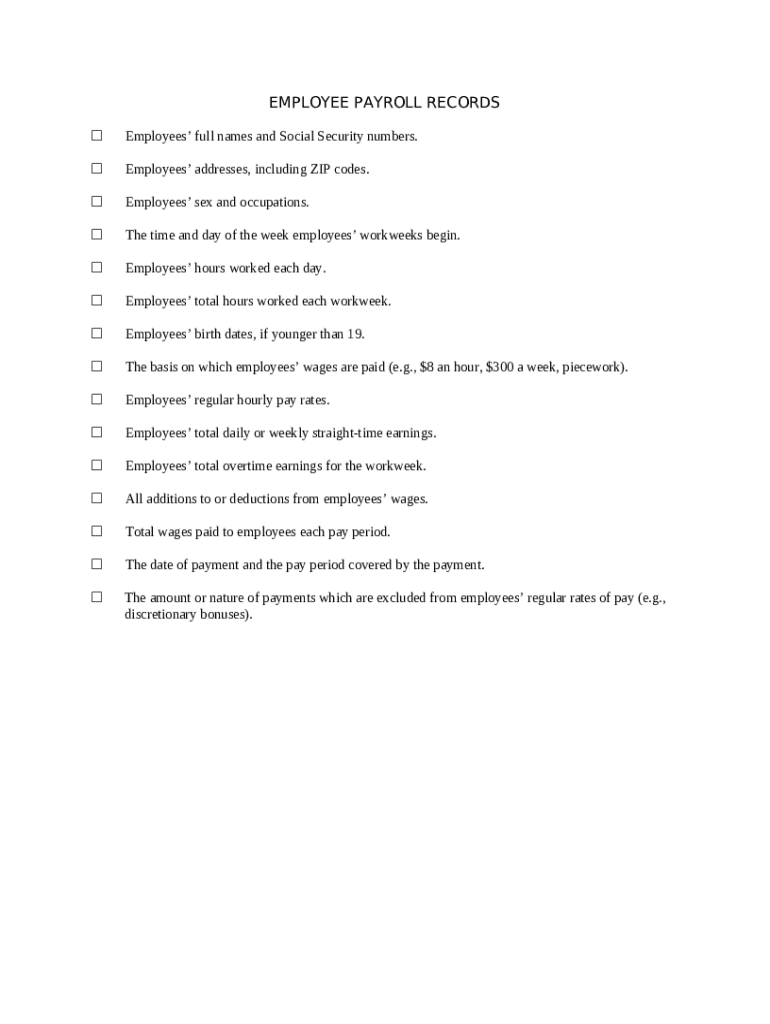

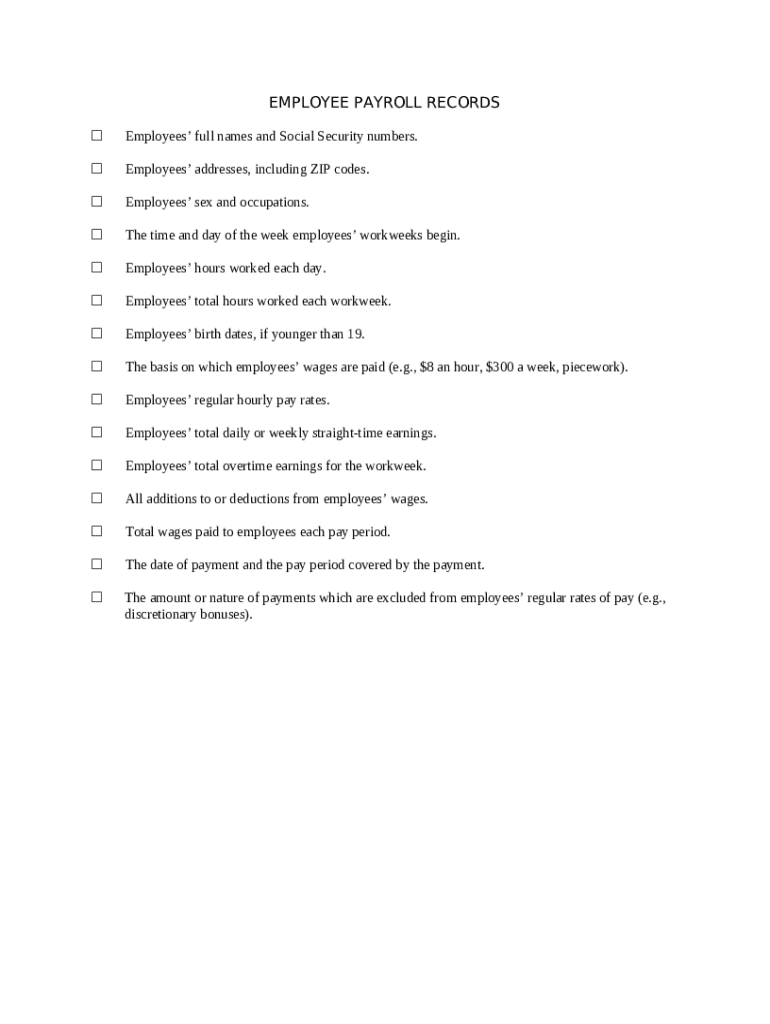

This AHI form is a checklist to help ensure that a company has all of the necessary files from each employee for payroll records.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is employee payroll records checklist

An employee payroll records checklist is a systematic tool used to ensure all necessary payroll information and documentation for each employee is collected and verified.

pdfFiller scores top ratings on review platforms

Got done what I needed although the…

Got done what I needed although the interface was less intuitive than I hoped and instructions via hlp boxes wasnt there.

Excellent app

Excellent app

Good experience

Good experience

Easy & simple to use

Easy & simple to use

Edits fine

Edits fine, but instructions not very clear and takes some practise to get it right

I HAD GOOD EXPERIENCE

I HAD GOOD EXPERIENCE

Who needs employee payroll records checklist?

Explore how professionals across industries use pdfFiller.

How to fill out an employee payroll records checklist form

How can you define employee payroll records?

Employee payroll records are comprehensive documents that detail the compensation and work-related information of employees within a company. These records typically include salary details, hours worked, tax information, and benefits administered, serving as essential documentation for both the employer and the employee.

Keeping accurate payroll records is crucial for maintaining compliance with labor and tax laws. They ensure employees are paid accurately while providing a clear audit trail in case of disputes or investigations.

In [region], legal requirements mandate that payroll records be kept for a certain number of years, and specific formats may be required to ensure compliance with local taxation regulations.

What are the components of a comprehensive payroll checklist?

Having a robust payroll checklist helps employers streamline their payroll processes, ensuring all necessary information is collected and accurately reported. A basic checklist might include items like employee identification, workweek details, and payment amounts.

-

Ensure all employee names and Social Security numbers are collected and updated.

-

Document the start and end of the workweek, along with total hours worked.

-

Record payment amounts, exemption details, and dates of payment to maintain proper records.

Utilizing platforms like pdfFiller can help in managing and editing your payroll checklist efficiently, making it easier to track and maintain these essential records.

What key fields should be included in employee payroll records?

-

Key identifiers for each employee to ensure their records are accurately matched.

-

These details are vital for tax purposes and any potential audits.

-

Accurate tracking of start times and total hours worked provide clarity on payroll calculations.

-

Include hourly pay rates, total earnings, overtime, and deductions for an accurate payroll overview.

-

Document payment dates, amounts, and exemptions relevant to employee taxes.

How do you fill out payroll records effectively?

When filling out an employee payroll records checklist form, organization is key. Utilizing templates available on platforms like pdfFiller can significantly enhance ease and efficiency.

Begin by meticulously entering all required employee details, ensuring accuracy to avoid future discrepancies. Then, properly calculate hours worked and wages, taking advantage of pdfFiller's calculation tools for precise figures.

What are best practices for payroll record maintenance?

-

Consistently audit and update payroll records to reflect personnel changes and ensure accuracy.

-

Utilize secure storage options available on pdfFiller to protect sensitive employee information.

-

Regularly verify that payroll practices comply with local laws to avoid potential penalties.

How can pdfFiller enhance document collaboration?

pdfFiller offers various collaboration features to improve how teams manage employee payroll records. With interactive tools designed specifically for payroll processes, teams can work simultaneously, reducing time and major errors.

A cloud-based platform allows for flexibility as documents can be accessed from anywhere, fostering a more cohesive and informed payroll management experience.

What compliance and accuracy measures should you adopt?

To ensure compliance with payroll laws in [region], it's essential to stay informed on local legal changes that might impact payroll processes. Adjustments to payroll records, such as tax updates, should be made in real time.

Using pdfFiller can be a proactive way to track compliance updates and ensure that all records are kept current and accurate, preventing discrepancies that could lead to fines.

How can payroll processes adapt to team needs?

-

Take advantage of customization options in pdfFiller to tailor your payroll records according to various employment types.

-

Address unique payroll challenges by adapting your records to meet specific needs of temporary employees.

What does the future hold for payroll management with pdfFiller?

As payroll processing continues to evolve, pdfFiller remains at the forefront of offering progressive solutions. Emerging trends in payroll handling, such as automation and advanced data analytics, provide organizations with tools to enhance efficiency and accuracy.

Looking ahead, pdfFiller is committed to developing features that will further streamline payroll record management, making it easier for organizations to maintain compliance and accuracy at all times.

How to fill out the employee payroll records checklist

-

1.Open your PDF filler and upload the employee payroll records checklist template.

-

2.Review the checklist to understand the required information such as employee name, ID, and pay rate.

-

3.Begin filling in the employee's personal information in the designated fields.

-

4.Input the employment details including hire date, job title, and department accurately.

-

5.Ensure to add the relevant tax information and banking details for direct deposits.

-

6.Check for any required signatures or approvals that may need to be included.

-

7.After filling out all sections, review the checklist for completeness and accuracy.

-

8.Save your completed document and export it to your desired format or email it directly to relevant stakeholders.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.