Get the free Approval of Restricted Stock Award Plan for Coca-Cola Enterprises, Inc. template

Show details

This is a multi-state form covering the subject matter of the title.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

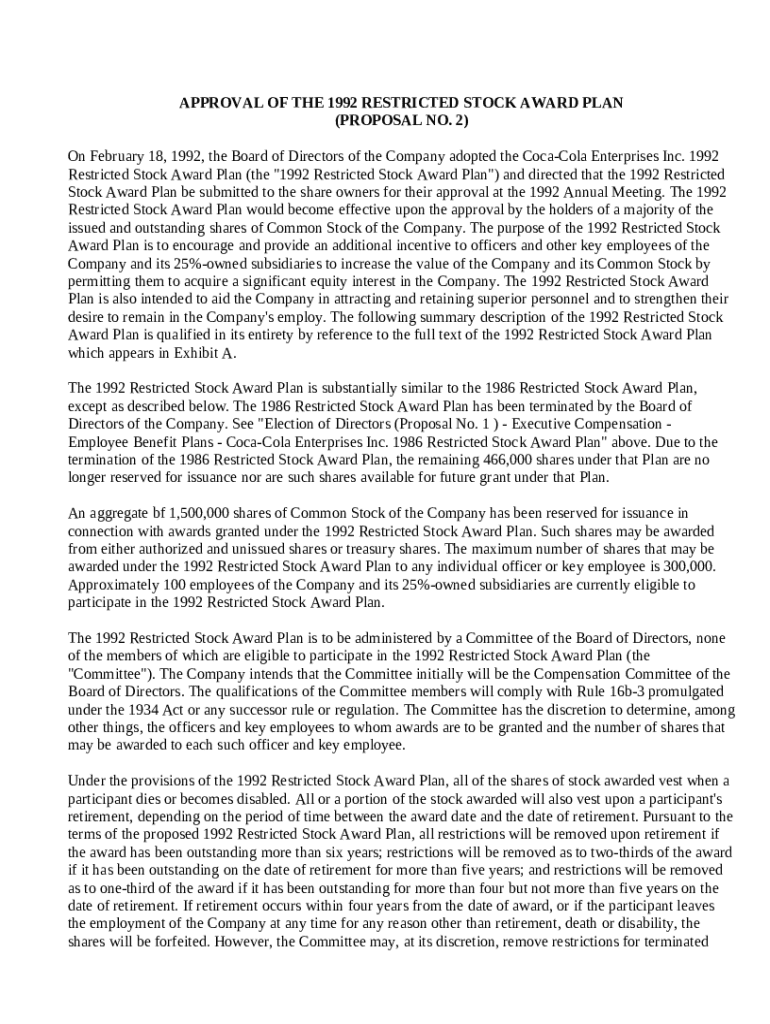

What is approval of restricted stock

The approval of restricted stock is a formal document granting permission to issue stock that has certain restrictions on transferability and sale.

pdfFiller scores top ratings on review platforms

I love the program. The smart folder...not a fan. Do not like that we have to "tag" them and I would prefer to just make and name my own folders and move PDF docs into them as I wish (like windows mail).

Works perfectly; I can easily fill-in any PDF forms. This is especially handy for IRS tax forms.

Need an option to rotate the PDF like simple cropping functions on picture apps.

I like using the program the only downfall for me is unless I pay more for the subscription I'm not allowed to use the premier options. That is my opinion It's already expensive for me since I really only use it for tax returns.

Fastastic to be able to upload a form and fill it in on the screen. I like the fact that I can save it and go back to were I left off.

PDF fillers is easy to use. I can get signatures when I am away from my desk at any hours.

Who needs approval of restricted stock?

Explore how professionals across industries use pdfFiller.

Detailed Guide for Approval of Restricted Stock Award Form

Navigating the approval of a restricted stock award form can seem daunting, but it's an essential process for aligning employee interests with company success. This guide covers everything you need to know about restricted stock awards, from understanding their purpose to ensuring compliance and managing forms effectively.

What are restricted stock awards?

Restricted Stock Awards (RSAs) are company shares given to employees as part of their compensation package, but with specific restrictions. These shares serve as an incentive for employees, particularly key figures in the organization, to align their objectives with company goals. When employees have a stake in their company's growth, performance often improves, fostering a culture of ownership and accountability.

-

Restricted Stock Awards are shares granted to employees that come with limitations for a specified period.

-

These awards motivate employees to contribute to the company's long-term success.

-

Share ownership encourages employees to take an active role in advocating for the company's performance.

What are the key components of the restricted stock award plan?

The Board of Directors plays a critical role in establishing the restricted stock award plan. Their decisions directly impact how the plan is structured, including the incentives it offers to key employees. Additionally, a majority vote from shareholders is often required to approve such plans, emphasizing the importance of aligning the awards with stakeholder interests.

-

The Board must outline the goals and benefits of the award plan.

-

A majority approval is generally needed to validate the plan.

-

Incentives should cater to the objectives of both employers and employees.

How do you approve the restricted stock award plan?

Approving a restricted stock award plan involves a clear process of submission to shareholders. This typically takes place during the Annual Meeting, where stakeholders can voice concerns and vote. Being aware of the voting requirements and how to participate in this process is essential for successful plan approval.

-

Plan details must be distributed to shareholders ahead of time.

-

Shareholders will discuss the plan and the expected impacts.

-

Check state laws for necessary voting thresholds.

What compliance and legal considerations should companies keep in mind?

Companies must adhere to various regulations that govern Restricted Stock Awards to avoid legal pitfalls. Understanding the required legal documentation is paramount, as it can affect the approval process significantly. Compliance checks are also a necessary step for ensuring that all conditions are met before finalizing the award process.

-

Familiarize yourself with IRS and SEC regulations impacting stock awards.

-

Draft proper agreements defining the conditions of the RSAs.

-

Conduct assessments to ensure adherence to all legal standards.

How to manage and edit the restricted stock award form with pdfFiller?

Managing the restricted stock award form is streamlined with pdfFiller, which allows users to edit and eSign forms seamlessly. By utilizing pdfFiller’s collaborative features, teams can work together on adjustments in real time, making document management both efficient and effective. The cloud-based capabilities ensure that documents are accessible from anywhere.

-

Log in to pdfFiller and locate the restricted stock award form.

-

Use tools to modify the document as needed.

-

Facilitate electronic signing for swift approvals.

What are common issues and their solutions when filing the restricted stock form?

It's common to encounter errors when completing the restricted stock form. Recognizing these issues early can save time and frustration during the approval process. Having solutions at hand, along with known contact points for assistance, can help resolve potential disputes swiftly.

-

Errors can range from incomplete information to incorrect signatures.

-

Double-check all entries and provide supporting documentation.

-

Keep a list of legal or administrative contacts for guidance.

What is the future of restricted stock awards in corporate governance?

The landscape for Restricted Stock Awards is evolving, influenced by trends in employee equity and regulatory changes. As shareholder expectations shift, organizations are encouraged to embrace adaptive strategies that incorporate employee equity to foster a strong corporate culture. Staying abreast of these trends is crucial for effective governance.

-

Companies are increasingly adopting flexible award structures.

-

New regulations may alter how stock awards are structured.

-

Employee equity is crucial for cultivating a motivating workplace.

How to fill out the approval of restricted stock

-

1.Open the pdfFiller application and log into your account.

-

2.Locate the 'Approval of Restricted Stock' document template in your saved documents or search for it in the template library.

-

3.Once you have opened the template, review the pre-filled details for accuracy. If any sections require updates, click the text fields to enter or modify the information as necessary.

-

4.Confirm the recipient's name, the number of shares being approved, and any associated terms or conditions relevant to the restricted stock.

-

5.Check any additional fields that may involve the signature of managers or compliance officers and ensure that these are correctly filled out.

-

6.After filling in all the required fields, review the entire document for completeness and accuracy.

-

7.Once satisfied with the entries, click on the 'Sign' button if a signature is required, and follow the prompts to either draw or upload your signature.

-

8.Finally, save your completed document and select the option to either print or send it via email, ensuring that all relevant parties receive their copies.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.