Get the free Utilization by a REIT of partnership structures in financing five development projec...

Show details

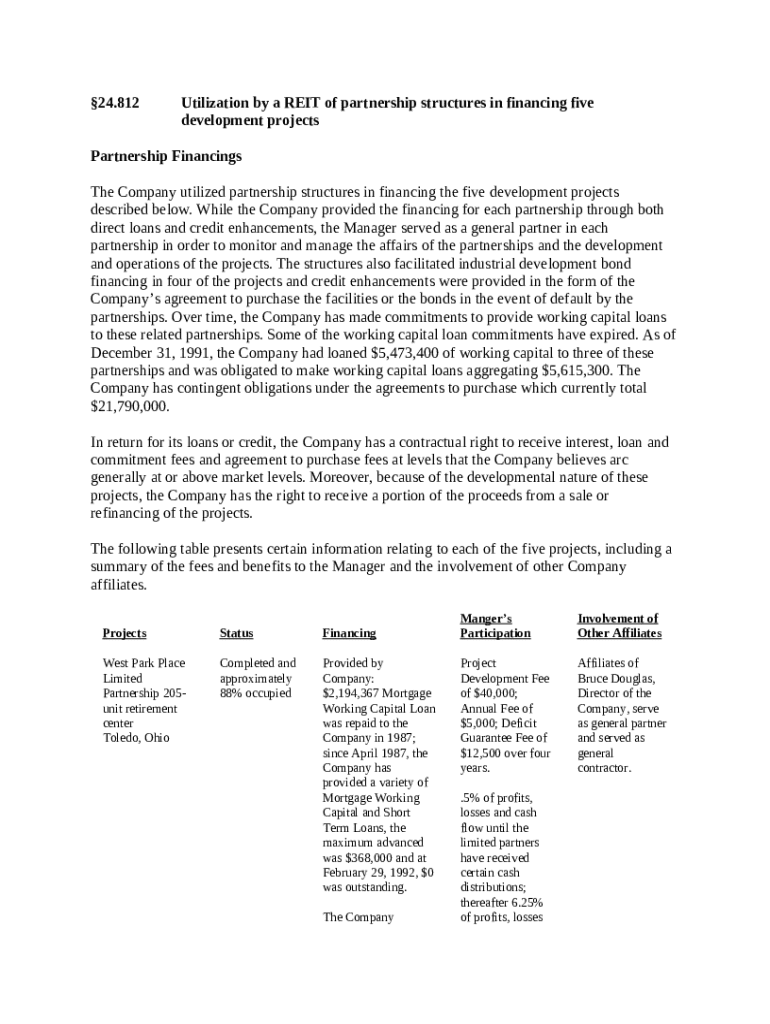

This sample form, a detailed Utilization by a REIT of Partnership Structures in Financing Five Development Projects document, is a model for use in corporate matters. The language is easily adapted

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

pdfFiller scores top ratings on review platforms

EASY TO USE I REALLY RECOMMENDED THIS PROGRAM THANKS

I thought this was supposed to be a free trial and you wanted my credit card information right away.

This has made obtaining my passport so much easier!

This is a very cool and esay to use Soft wear set up. Thanks JC

Could use a comment box that links to a specific string of text.

Need extra capacity to load large documents.

I LOVE THIS PROGRAM. IT ALLOWS ME TO HAVE CLEAN DOCUMENTS.

Utilization by a REIT Form: A Comprehensive Guide

How does understanding REIT utilization structures help?

Real Estate Investment Trusts (REITs) play a vital role in financing by allowing investors to pool their resources for real estate investment. This utilization by a REIT form highlights the different structures available, including partnerships, which can enhance project financing. By understanding these structures, stakeholders can identify their advantages, such as risk sharing and increased capital access.

-

REITs are companies that own, operate, or finance income-producing real estate across a range of property sectors. By law, they must distribute a substantial portion of their taxable income as dividends to shareholders.

-

Partnership structures in project financing allow for shared responsibilities and liabilities, leading to potentially higher returns through collaborative efforts.

-

Utilizing partnership structures benefits both REITs and equity partners by enhancing liquidity and diversifying risk through shared investments.

What is the overview of partnership financing projects?

The five development projects financed by REITs offer a lens into the practical applications of partnership financing. The manager usually takes on the role of a general partner, overseeing project execution and ensuring stakeholder interests are maintained. Understanding how each aspect, especially development bond financing, integrates can optimize investment outcomes.

-

Each project represents a unique opportunity for investment, tailored to market needs and demographic trends.

-

As a general partner, the manager oversees all operational aspects, ensuring adherence to financial guidelines and project timelines.

-

Development bond financing can reduce costs and attract investors by providing lower interest rates compared to traditional loans.

How do financial instruments and enhancements affect REITs?

The choice of financial instruments significantly impacts project viability within the REIT model. Understanding direct loans, credit enhancements, and working capital loans is crucial for any stakeholder involved in financing projects through REITs. These financial tools can stabilize funding and improve the ability of these projects to meet cash flow needs.

-

Direct loans are established agreements where funds are provided directly to finance a project, often at competitive rates.

-

These are risk-reducing measures that can assure creditors of repayment, thus making financing more accessible.

-

These loans provide the necessary cash flow to sustain operations while waiting for project revenue to generate.

What is the current status and future implications of projects?

Keeping abreast of the status of each of the five projects is essential for stakeholders. An overview of geographical market trends and future implications can influence strategic decisions. By aligning project designs with market demand, REITs can maximize occupancy rates and returns on investment.

-

Monitoring the current development stage of each project aids in strategic forecasting and pivoting as necessary.

-

Understanding geographical market trends helps identify potential shifts that may impact project viability.

-

Adapting to changes in market demands can result in innovative project designs that meet future needs.

What are the participatory benefits and obligations?

Engaging in partnership loans comes with specific financial rights and fees. Understanding commitment agreements is essential as they outline the obligations of the REIT and address what contingent obligations and fixed commitments mean for investors. Clarity in these areas lays the groundwork for successful collaboration.

-

Partnership loans entail specific fees that can add value or present challenges, depending on the terms.

-

They define the expectations and responsibilities of involved parties, ensuring alignment and accountability.

-

Understanding the difference between contingent obligations and fixed commitments is vital for managing risks and expectations.

How does a comparative analysis with office REITs reveal insights?

Evaluating competing office REITs can reveal much about their utilization levels. Understanding how return-to-office mandates influence REIT strategies can inform adjustments in operations. This comparative analysis highlights factors that contribute to both geographic resilience and recovery trends in REIT portfolios.

-

Analyzing how other REITs manage their resources offers insights into best practices and areas of improvement.

-

These policies can significantly impact occupancy rates and overall income for office-focused REITs.

-

Understanding how geographic factors influence recovery trends can help shape future investment strategies.

What tools are available for interactive document management?

Employing pdfFiller's cloud-based platform can enhance document management processes. By utilizing its functionalities for editing, eSigning, and document management, partnerships can ensure seamless operations. The benefits of such a comprehensive solution are particularly useful for managing partnership obligations efficiently.

-

pdfFiller offers various features that cater to document creation, modification, and storage.

-

Getting started with pdfFiller is straightforward, allowing users to efficiently manage their documents.

-

A robust document management solution can streamline operations and enhance collaboration among stakeholders.

What are the key takeaways for REIT utilization and management?

Identifying essential strategies for better REIT utilization is critical for all stakeholders. By synthesizing best practices from various projects, partners can avoid common pitfalls and enhance their investment outcome. Engaging proactively with tools like pdfFiller for document needs will ensure smoother operations in partnership management.

-

Implementing strategic plans that leverage REIT characteristics can optimize results.

-

Learning from past projects can inform improvements and efficiency.

-

Utilizing platforms like pdfFiller enhances communication and document flow.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.