Get the free Insurance Policy Summary Ination Worksheet template

Show details

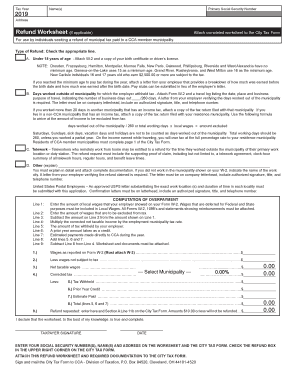

This due diligence worksheet is used to summarize the analysis of insurance policies regarding business transactions.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

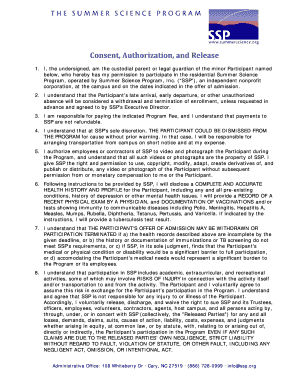

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is insurance policy summary information

An insurance policy summary information document provides a concise overview of the terms, coverage, and obligations of an insurance policy.

pdfFiller scores top ratings on review platforms

Excellent, fast, quick and efficient!!!!

Extremely efficient and economical manner to manage your business documentation needs.

It was basically a good experience. It was quite self-explanatory and easy to use.

What an amazing program!! It is wonderful to be able to fill in my documents without contemplating having to get a typewriter!

Fairly easy to use, only issue is occasionally locating the document I need.

Works Great for Filling in PDF Forms. Wish I could do more with it like work on documents

Who needs insurance policy summary ination?

Explore how professionals across industries use pdfFiller.

How to fill out an insurance policy summary information form

What is an insurance policy summary?

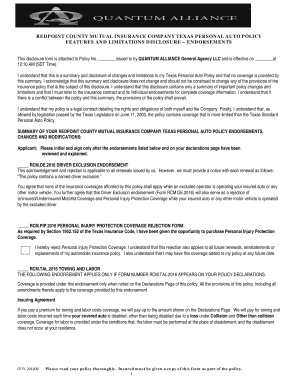

An insurance policy summary is a concise document that encapsulates crucial elements of an insurance contract, such as coverage details, policy limits, and contact information for your insurance agent. This summary acts as a quick reference guide for policyholders, facilitating easier understanding of their insurance coverage.

Having a clear summary is critical for policyholders because it allows them to quickly grasp the key points of their insurance without wading through pages of legal jargon. With tools like pdfFiller, managing and creating these summaries becomes more streamlined, making it easy for users to stay informed about their coverage.

What key components should you look for?

-

The policy number is unique to your insurance and is essential for filing claims or inquiries.

-

This indicates when your insurance coverage started, affecting claims processes and account status.

-

The underwriter plays a critical role in assessing risk and ensuring appropriate coverage levels.

-

Having your agent's contact details easily accessible is essential for timely discussions and clarifications.

Who is considered the named insured?

The 'named insured' is the individual or entity clearly identified in your insurance policy. Understanding who is included as a named insured—such as individuals, corporations, or partnerships—has significant implications on coverage and liability.

Clarifying relationships among policyholders and insured persons helps prevent misunderstandings during claim processing, ensuring that parties entitled to benefits are explicitly named.

What types of claims are usually covered?

-

Most policies cover various claims, ranging from property damage to liability issues.

-

Understanding exclusions is critical, as they outline what is not covered by your policy.

-

Using pdfFiller to keep thorough records can improve your chances of successful claims processing.

What is coinsurance and how does it work?

Coinsurance is a provision in your policy that specifies the percentage of costs you are responsible for in the event of a claim. For example, a coinsurance requirement of 20% means you pay that percentage of the total covered risk, while the insurer pays the remaining 80%.

Understanding your coinsurance obligations helps in effective financial planning and risk management, allowing you to use your summary to keep track of these requirements.

What should you know about your discovery period?

The discovery period is a critical timeframe during which claims can be filed under your policy after an incident occurs. Understanding how this period influences your claims process ensures you are aware of timelines that can affect claim validity.

Concrete examples of discovery periods may vary by policy type, but being informed allows you to navigate the claims landscape effectively.

How can you read your insurance policy strategically?

Strategically reading your insurance policy involves careful review of key sections, particularly the declarations page, where essential details are summarized. This page serves as a roadmap, guiding you through the policy's terms.

Utilizing tools available on pdfFiller can enhance your understanding, allowing for easy navigation through document sections.

What questions should you ask your agent?

-

Ask specific questions regarding what is covered and what is excluded from your policy.

-

Don't hesitate to seek clarification on confusing terms or conditions.

Maintaining a record of these questions and responses using pdfFiller tools can promote clarity and assure you have documentation for future reference.

How can pdfFiller enhance your insurance management?

pdfFiller provides a comprehensive platform for collaborative editing and signing of important documents. Securely storing and managing your insurance summary and related paperwork makes it accessible whenever and wherever needed.

The platform’s capabilities align perfectly with pdfFiller's mission of empowering users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform.

How to fill out the insurance policy summary ination

-

1.Open the pdfFiller site and log into your account.

-

2.Upload the insurance policy document you want to summarize.

-

3.Select 'Fill' from the toolbar and highlight essential sections like coverage limits, deductibles, and exclusions.

-

4.Use the text tool to add notes summarizing critical information for each section.

-

5.Ensure that contact details and policy numbers are clearly indicated for reference.

-

6.Review the filled document for accuracy and completeness.

-

7.Once satisfied, save the summary as a new document or download it in your preferred format.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.