Get the free Import Compliance and Records Review Due Diligence template

Show details

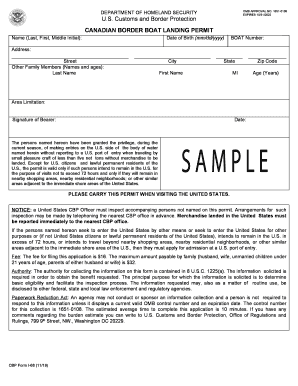

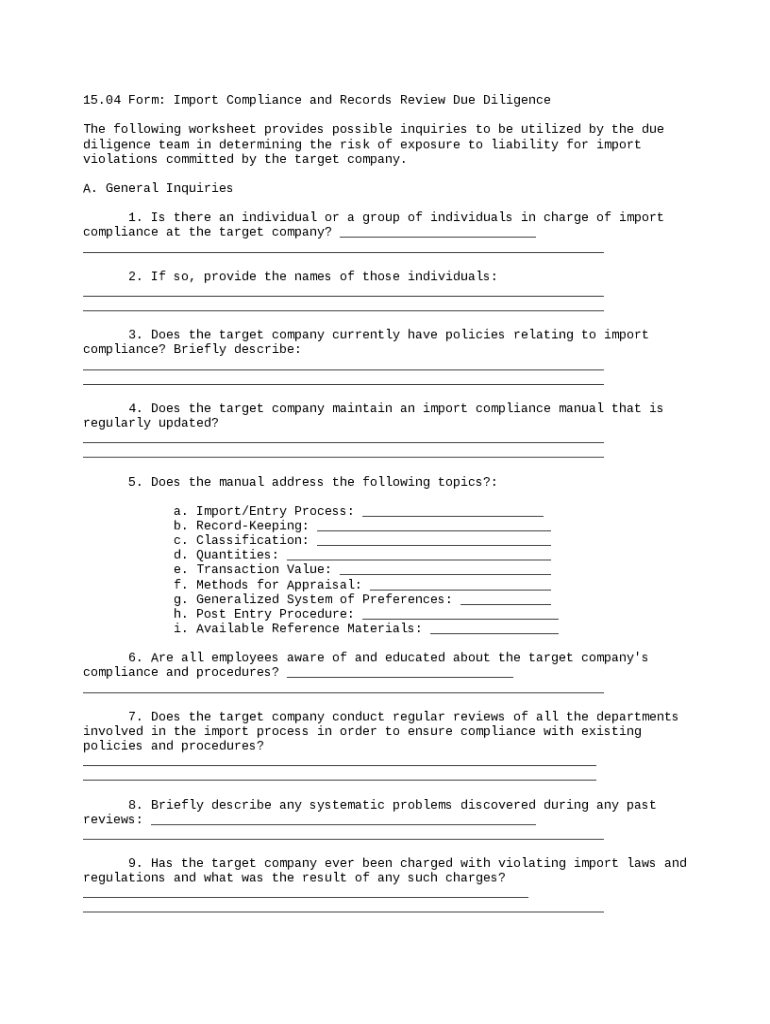

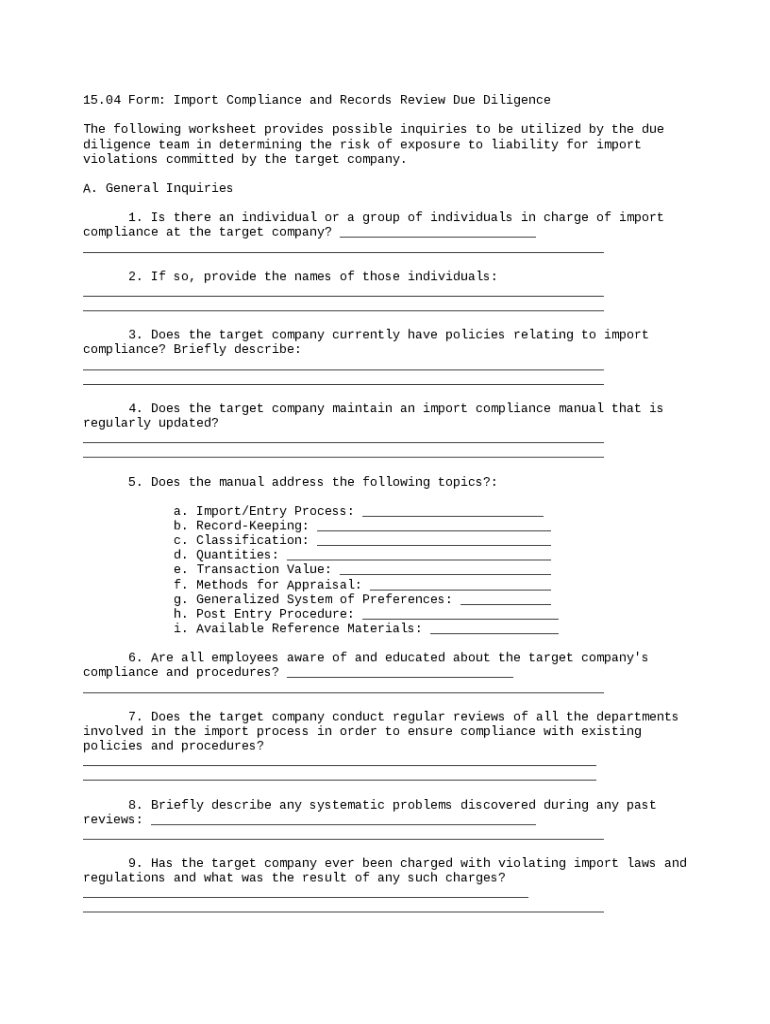

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is import compliance and records

Import compliance and records refer to the documentation and practices required to ensure adherence to international trade laws and regulations during the importation process.

pdfFiller scores top ratings on review platforms

It's great!

great

It's been awesome! Not sure why when I click some lines it makes the texts smaller, then I have to make the larger to fit the rest of the doc. But it's an amazing tool!

its amazing with all the different features in one app

Easy to use.

Good

Who needs import compliance and records?

Explore how professionals across industries use pdfFiller.

Understanding Import Compliance and Records Form: A Comprehensive Guide

Filling out an import compliance and records form is crucial for any business involved in international trade. This process ensures adherence to various import regulations, reduces the risk of penalties, and fosters smoother operations.

What is import compliance?

Import compliance encompasses a set of regulations that businesses must follow to ensure that their imported goods meet all necessary legal standards. It is vital in international trade as it minimizes legal risks and ensures favorable trading relationships.

-

Ensures businesses adhere to local and international laws, avoiding costly fines and penalties.

-

Includes laws that govern the importation of goods, particularly those requiring specific record-keeping.

What are the key components of an import compliance and records form?

The Import Compliance and Records Review Due Diligence form consists of various essential elements that ensure adherence to compliance requirements. By understanding each component, organizations can navigate the complexities of international trade more effectively.

-

Information about the company facilitating the import, including contact details and legal entity.

-

Specifics about the type of goods being imported, including Harmonized Tariff Schedule (HTS) codes.

-

Accurate declaration of transaction values, which is fundamental for duty calculations.

What inquiries should due diligence teams make?

Due diligence teams play a critical role in compliance checks. They should pose significant inquiries that pinpoint responsibility and gaps in the compliance process.

-

Identify who in the organization oversees import compliance.

-

Assess if there are documented policies governing import compliance.

-

Ensure employees are adequately trained on import compliance processes.

-

Investigate any past compliance issues to understand areas for improvement.

How to maintain import compliance policies?

Maintaining a comprehensive import compliance manual is vital for companies involved in international trade. This document should encompass all crucial compliance policies and be updated regularly to reflect any regulatory changes.

-

Outlines necessary steps for bringing goods into the country, from shipment arrival to final clearance.

-

Details must be retained for a prescribed period to demonstrate compliance during reviews.

-

Requires detailing the category of goods and their quantities for accurate reporting.

-

Discusses how to determine the value of goods and applicable appraisal methods.

-

Includes guides and resources that help in understanding compliance requirements.

What documentation is required under U.S. law?

In the U.S., specific documentation is needed for product entry, each varying by product type. Familiarity with these documents ensures smooth importation and compliance with customs regulations.

-

This form is critical for submitting to U.S. Customs and Border Protection (CBP) for entry.

-

Required for products that need quicker customs processing.

-

Be aware that different products may necessitate distinct documentation.

How to conduct regular compliance reviews?

Conducting regular compliance reviews is imperative for maintaining adherence to import regulations. These reviews help identify systematic issues and provide a framework for continuous improvement in compliance practices.

-

Perform routine checks of departments involved in the import process.

-

Analyze any potential issues in the import process that could lead to compliance failures.

-

Keep records of previous audits and their findings for ongoing reference.

How to overcome compliance challenges?

Addressing compliance challenges can be daunting, but providing resources and tools to compliance teams can lead to more efficient operations. Strategies to mitigate common obstacles can significantly enhance the import process.

-

Offer technology solutions that enable easier tracking and document management.

-

Implement practices based on experiences and lessons learned in the field.

-

Facilitate continuous training for staff to keep them updated on compliance requirements.

How to fill out the import compliance and records

-

1.Begin by visiting the pdfFiller website and log in to your account or create one if you don't have it.

-

2.Navigate to the forms section and search for 'import compliance and records' in the search bar.

-

3.Select the correct form from the search results to start filling it out.

-

4.Review each required field carefully and prepare all necessary information and documentation related to your imports.

-

5.Fill in your company details such as name, address, and contact information in the designated fields.

-

6.Input the relevant import details, including product descriptions, HS codes, invoice amounts, and country of origin.

-

7.Attach any supporting documents like purchase orders, customs declarations, and shipping invoices by using the upload feature.

-

8.Check for any specific sections or certifications required for your imports and ensure all information is accurate.

-

9.Once all fields have been filled out, review the completed form for accuracy and completeness.

-

10.Save your work periodically and finalize the form when ready, then download or print for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.