Get the free Proposed issuance of common stock template

Show details

This sample form, a detailed Proposed Issuance of Common Stock document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is proposed issuance of common

The 'proposed issuance of common' is a document that outlines a company's plan to issue common stock to raise capital.

pdfFiller scores top ratings on review platforms

Excellent, easy to use, navigate,and understand!

It rocks! I like it better than docusign & adobe cause it's cheaper than both of them

Good, but some documents are hard to get lined up properly or size correctly.

This software is just what I needed to complete a customized form for my company. Excellent!

I am new to PDFFiller but so far I am enjoying the ability to fill information online avoiding excessive use of paper.

My first time on this site--unsure of some entries.

Who needs proposed issuance of common?

Explore how professionals across industries use pdfFiller.

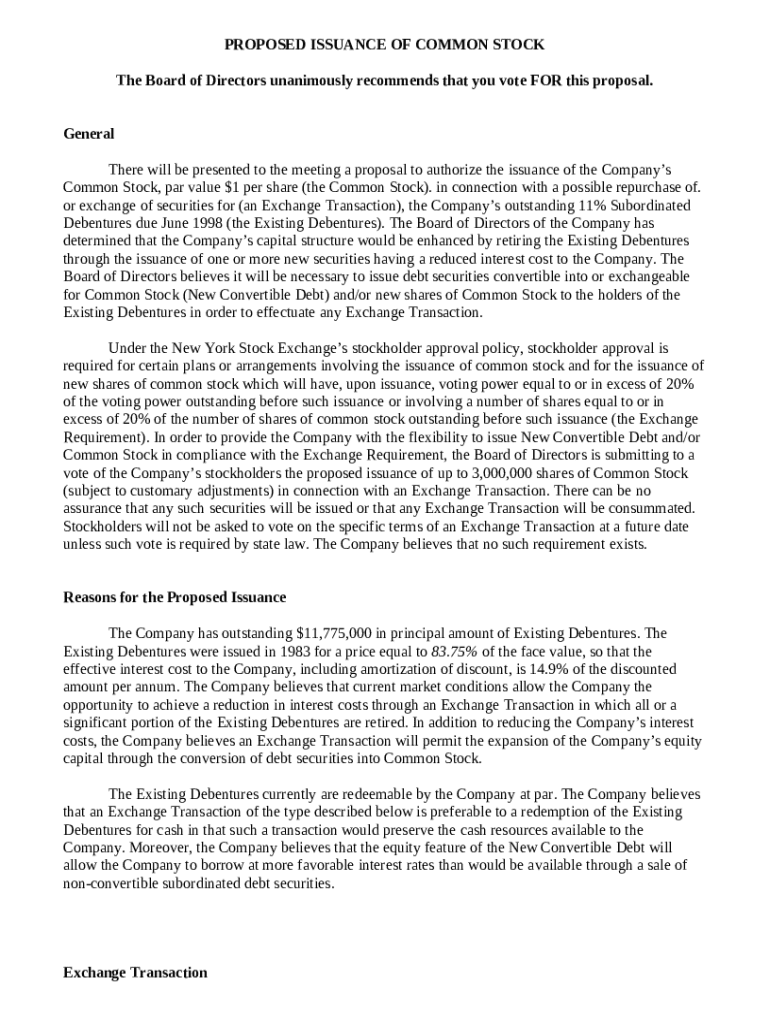

Proposed Issuance of Common Form

Understanding the proposed issuance of common form form allows stockholders to engage with the process effectively. This guide will walk you through all critical aspects, including dates, benefits, requirements, and more. With a focus on enhancing capital structure and compliance with NYSE policies, this document provides a comprehensive overview.

What are the key dates and deadlines?

-

The company will announce the date and time of the proposal meeting, where stockholders can discuss details and voice their opinions.

-

It is crucial for stockholders to vote before the stipulated deadline to ensure their voices are counted.

-

Post-approval, the anticipated timeline for implementing the stock issuance will be outlined, guiding stockholders on what to expect.

What related announcements should stockholders be aware of?

-

Keep an eye on announcements related to changes in the company’s capital, which could impact stockholder value.

-

Meetings will be scheduled to discuss the proposal in-depth, offering stockholders the chance to ask questions and raise concerns.

-

Stockholders should consider how this issuance might affect their current shares and overall investment strategy.

What is the overview of the issuance proposal?

The proposed issuance of common stock involves offering shares to raise capital. This initiative aims to bolster the company’s financial health and growth trajectory.

-

The specifics include the number of shares to be issued and the pricing strategies associated with this transaction.

-

Issuing additional stock can provide necessary funding for expansion, research, or debt repayment, thus enhancing the company's competitiveness.

-

This issuance might also be linked with converting debt instruments into equity, improving the financial framework.

Why is compliance with NYSE policy important?

-

A stronger capital foundation provides stability and can lead to growth and higher stock valuations.

-

Utilizing convertible debts allows the company to manage risks while providing options for stockholders to convert debt into equity.

-

Adhering to NYSE guidelines enables the company to pivot its financial strategies proactively as market conditions change.

What are the requirements for stockholder approval?

-

NYSE mandates that certain equity issuances require voting, ensuring stockholder engagement in significant decisions.

-

Stockholders must meet specific criteria to participate in the voting process, which may include ownership duration or the number of shares held.

-

The outcome of the stockholder vote could significantly influence the company’s direction and its market perception.

What are the summary of changes to the PAPPG?

-

Recent regulatory changes affect how companies can issue new stock and must be understood by stockholders and management.

-

Modifications to policies concerning stock issuance might become necessary due to evolving market conditions and corporate strategies.

-

Stakeholders must be aware of how such changes might impact their investments and the company's operational framework.

Contact information for inquiries

-

Contact information should be readily available for stockholders wishing to discuss the proposal or seek clarification.

-

Stockholders are encouraged to document their queries succinctly to facilitate effective communication.

-

Typically, inquiries should be addressed within a specified timeframe, giving stockholders the information they need promptly.

Necessary links and resources

-

Important financial documents related to the proposed issuance should be accessible for stockholders reviewing their options.

-

Archived meeting minutes provide valuable insights into previous discussions and decision-making processes pertaining to the company’s capital structure.

-

Understanding rights empowers stockholders to navigate the voting process effectively, ensuring their interests are represented.

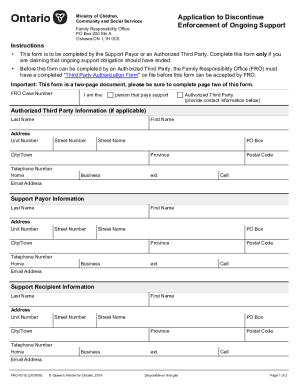

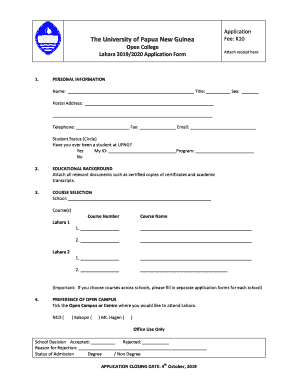

How to fill out the proposed issuance of common

-

1.Download the 'proposed issuance of common' template from pdfFiller's library.

-

2.Open the document in pdfFiller and review the sections that require your input.

-

3.Begin with the company details; fill in the name, address, and contact information accurately.

-

4.Next, specify the number of shares you plan to issue and detail the price per share.

-

5.Provide a clear purpose for the stock issuance, explaining how the funds will be utilized.

-

6.If applicable, include information on any underwriters or financial institutions involved.

-

7.Review the document for completeness and accuracy, ensuring all fields are filled out.

-

8.Use the 'Save' feature to keep your work or 'Download' the document once finished.

-

9.Consider sharing with stakeholders for review before finalizing your submission.

-

10.Once ready, submit the document as required to your governing body or investors.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.