Get the free Accredited Investor Certification template

Show details

Under SEC law, a company that offers its own securities must register these investments with the SEC before it can sell them unless it meets an exception. One of those exceptions is selling unregistered

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

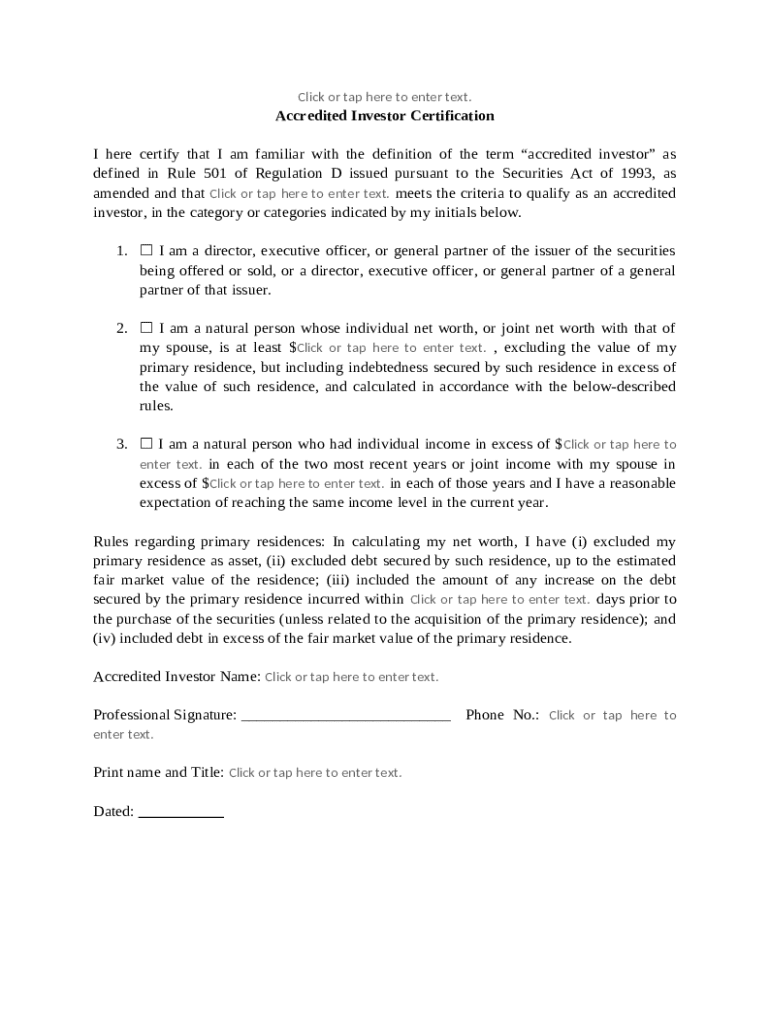

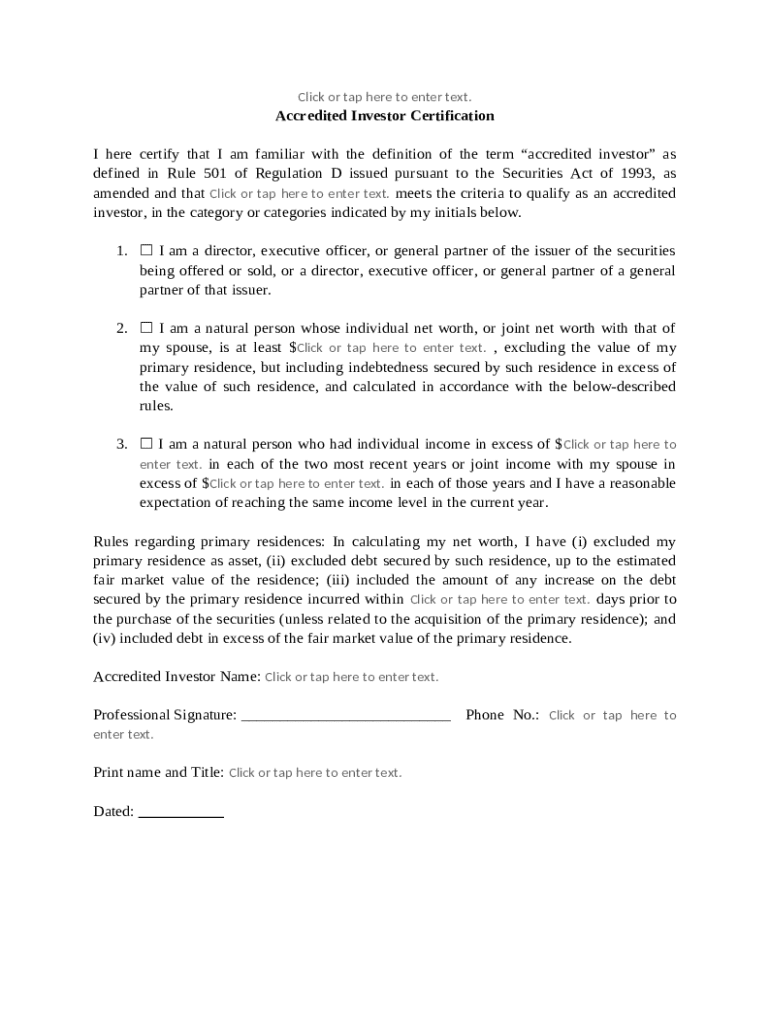

What is accredited investor certification

An accredited investor certification is a document that verifies an individual's or entity's eligibility to participate in certain high-risk investments, defined by specific income or net worth criteria.

pdfFiller scores top ratings on review platforms

good to use

good to use. but it has a watermark alongside my digital signature. don't know why.

AWESOME & EASY

it is a good website

IT IS EASY TO WORK WITH

It is a much needed service and PDFfiller.

Special, super

Who needs accredited investor certification template?

Explore how professionals across industries use pdfFiller.

Accredited Investor Certification Form Guide

What is the accredited investor status?

An accredited investor is defined under Regulation D of the Securities Act as an individual or entity that meets certain financial criteria. These criteria allow them access to investment opportunities usually not available to the general public, thus qualifying them to participate in various private investment offerings.

-

An accredited investor, according to Regulation D, is typically someone with a net worth exceeding $1 million excluding their primary residence.

-

To qualify, an individual must either have a net income of at least $200,000 in each of the last two years, or $300,000 together with a spouse. Entities, such as partnerships or corporations, may also qualify based on their total assets.

-

Accredited investors can be categorized based on income, net worth, or their status, such as being a bank, insurance company, or registered investment company.

What are the eligibility criteria for accredited investors?

Understanding the specific eligibility criteria is essential for anyone seeking accredited investor status. Meeting these criteria can provide you with access to diverse investment opportunities.

-

Your personal net worth must exceed $1 million, excluding the value of your primary residence. This calculation often involves considering all of your liquid and illiquid assets.

-

You must document an income of at least $200,000 over the previous two years. If including a spouse, your combined income must be at least $300,000.

-

The value of your primary residence is not counted towards your net worth; however, any debt against it does subtract from your net assets.

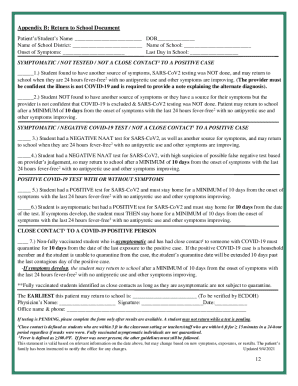

How do you navigate the accredited investor certification form?

Filling out the accredited investor certification form can be straightforward if approached systematically. This process ensures that you provide all necessary information accurately.

-

Begin by collecting all required financial documents, such as tax returns and bank statements, before starting the form.

-

The form generally asks for personal details, your annual income, net worth calculations, and investment experience.

-

Double-checking all calculations and ensuring consistent data entries helps prevent frequent errors experienced in form submissions.

How to edit and sign your certification form?

Using pdfFiller, you can easily edit and sign your accredited investor certification form. This capability simplifies document management and enhances compliance.

-

pdfFiller provides extensive editing tools that allow you to fill in the form, annotate as necessary, and make corrections.

-

You can securely add electronic signatures to your form, ensuring that compliance with legal requirements is met.

-

The platform facilitates collaboration, enabling multiple users to review and handle the document simultaneously.

What are the compliance and legal considerations?

Completing the accredited investor certification form accurately is vital for compliance with legal standards. Misrepresentation can lead to significant legal consequences.

-

Accurate disclosures in your certification can protect you from legal repercussions and preserve investment eligibility.

-

Misrepresenting your financial status can result in disqualification and potential legal actions from regulatory bodies.

-

Familiarizing yourself with relevant laws, such as SEC regulations, is crucial for adhering to the required standards.

How to maintain records and manage your documents?

Proper document management is essential for keeping your accredited investor certification form easily accessible and compliant. Utilizing cloud solutions can enhance your efficiency.

-

Using pdfFiller allows you to securely store and easily retrieve your certification form whenever you need it.

-

Implementing organized folder structures and regularly updating your documents ensures they remain relevant and compliant.

-

Maintain records of your documentation methods, as this can be crucial during compliance audits and can influence your credibility.

What are the current market insights for accredited investors?

Staying informed about market trends is key for accredited investors. Market insights can guide your investment strategies, helping you make informed decisions.

-

Emerging industries, such as technology and renewable energy, are showing promising growth and investment opportunities.

-

Regulatory changes can influence investment landscapes, so staying updated can help you navigate potential challenges.

-

Exploring venture capital and private equity can yield significant returns, especially alongside foundational knowledge about compliance.

How to fill out the accredited investor certification template

-

1.Access PDFfiller and upload the accredited investor certification form.

-

2.Begin by entering your personal details, including your name, address, and contact information.

-

3.Fill in the financial eligibility section, providing details of your net worth, income, or assets based on your status as an accredited investor.

-

4.Ensure you have the supporting documentation ready, such as tax returns or bank statements, if needed for verification.

-

5.Review all entered information for accuracy before submission.

-

6.Submit the form electronically through PDFfiller, ensuring you receive a confirmation for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.