Get the free Clauses Relating to Capital Withdrawals, Interest on Capital template

Show details

This sample form, containing Clauses Relating to Capital Withdrawls, Interest on Capital document, is usable for corporate/business matters. The language is easily adaptable to fit your circumstances.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is clauses relating to capital

Clauses relating to capital are legal provisions that govern the ownership, distribution, and management of capital assets in a business entity.

pdfFiller scores top ratings on review platforms

I'm still learning about it but its helping alot understand how things are stored and how I can open them faster and saved my documents I thought I lost it was here so yes I want to learn everything I can about it I'm new at this thanks so much

easy to use

easy and amazing

mm m ,

Working Experience With PdfFiller

i am using this software for about 8 to 9 months. the best thing i found in this software was its feature to send the file online without makuing sure to save first and then send. other feature i liked the most is that i can easily edit the pdf format by using this software. it is really very favorable feature to avoid the conversing to word file for editing.

in my opinion, there must be improvement with the font size of editing text to make it more compatible with text. i face a problem to make the ediding in the same font size . Althorugh, it is same as that of text but it seams different. it makes the file less professional.

PDFFiller: A Convenient and User-Friendly PDF Editing Solution

I have been using PDFFiller for several months now and I am impressed with its functionality and ease of use. The software allows me to easily edit and sign PDF documents, saving me a lot of time and hassle. The interface is user-friendly and the features are comprehensive, making it easy to use for people of all skill levels. The mobile app is also very convenient and allows me to access and update my PDFs on the go.

The software is very user-friendly and easy to navigate. It allows me to easily edit and sign PDF documents. The mobile app is also very convenient and allows me to access and update my PDFs on the go.

I did not encounter any major cons while using the software, however, I would like to see more customization options for the templates.

Who needs clauses relating to capital?

Explore how professionals across industries use pdfFiller.

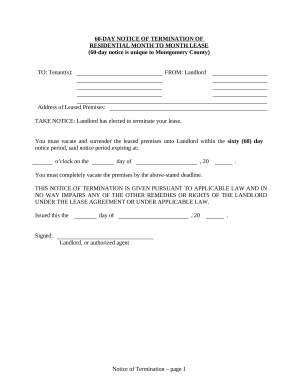

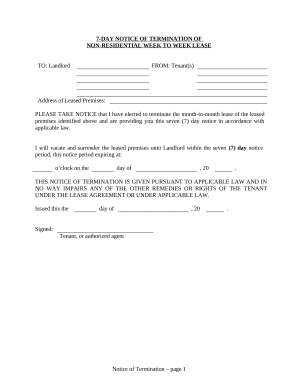

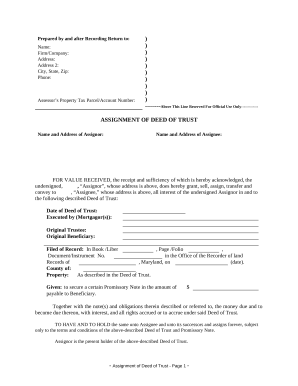

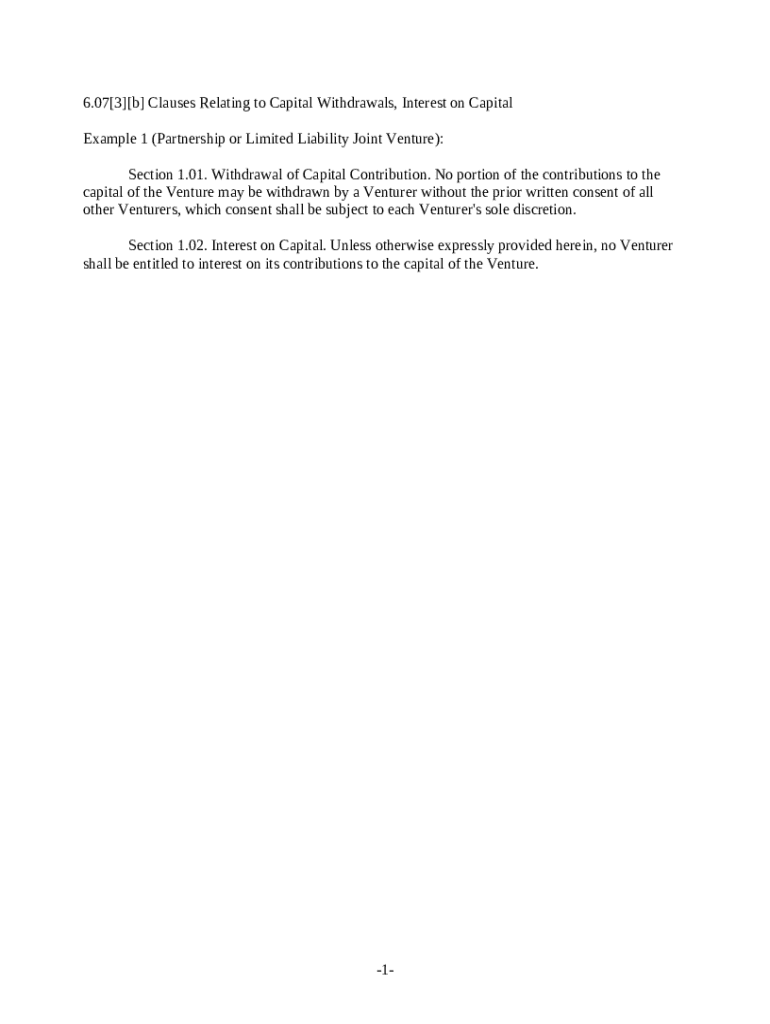

Exploring Clauses Relating to Capital Withdrawals and Interest on Capital

Understanding how to navigate clauses relating to capital form form is essential for businesses looking to stabilize their financial contributions. This guide provides detailed insights and practical steps to ensure compliance and effective management of capital-related documents.

What are capital contributions?

Capital contributions are funds that business owners and shareholders invest in the company to support its operational and strategic goals. They are crucial for business stability, serving as the financial foundation that allows operations to run smoothly.

-

Includes money, property, or resources that a business partner puts into the entity.

-

Essential for ensuring that a business has sufficient resources to manage its affairs and grow.

-

Typically includes initial investments when starting a business or additional investments made during times of need.

How to manage the withdrawal of capital contributions?

Section 1.01 of many operating agreements outlines specific protocols for the withdrawal of capital contributions. It's mandatory that all Venturers give prior written consent to avoid complications that may disrupt business operations.

-

Ensure all members are informed and agree before capital can be withdrawn.

-

Unauthorized withdrawals can lead to significant disruptions and potential legal disputes.

-

Can impact trust among partners and adversely affect the financial health of the business.

What are the requirements for consent among Venturers?

Consent among Venturers is critical when it comes to capital withdrawals. Such consent usually hinges on established criteria within the operating agreement, which ideally spell out conditions under which withdrawals may be granted.

-

Must be explicitly laid out in the agreement to prevent any misunderstandings.

-

Typically includes stipulations that address timing, amounts, and purposes of withdrawal.

-

Maintaining complete records is vital for transparency and accountability.

What are the regulations around interest on capital contributions?

In Section 1.02, the guidelines for interest on capital contributions dictate how and when interest accumulates. Usually, interests are accrued based on contributions, but certain agreements may stipulate exceptions.

-

Typically aligned with agreed-upon rates outlined in the partnership agreement.

-

Certain partnerships may agree to waive interest or set varying rates depending on specific conditions.

-

Ensures all partners understand their entitlement and obligations around capital contributions.

What can we learn from real-life applications?

Hypothetical and real-world scenarios illustrate the practical implications of managing capital withdrawals and interest on capital contributions. For example, consider a partnership where one member withdraws capital without consent, leading to discourse and potential legal action.

-

A scenario where a partner withdraws funds, causing operational delays due to non-compliance.

-

Showcases how a limited liability joint venture successfully managed interest calculations to maintain partner satisfaction.

-

Understanding how these clauses shift depending on business structures can provide strategic advantages.

How can pdfFiller assist with document management?

pdfFiller offers tools to edit, eSign, and collaborate on capital-related forms. It simplifies the management of capital withdrawal clauses, facilitating seamless documentation processes.

-

Users can easily make changes to documents and finalize them with electronic signatures.

-

Allows multiple team members to collaborate on capital documents in real-time.

-

Offers customizable templates designed for capital contributions and withdrawals, promoting streamlined processes.

What are the legal compliance and best practices to consider?

Legal compliance is crucial in drafting capital withdrawal clauses; businesses must adhere to local laws and regulations to avoid legal complications. Consulting with legal professionals helps in formulating clear, enforceable clauses in operating agreements.

-

Helps businesses avoid legal pitfalls and ensures operations run smoothly.

-

Clearly detailing withdrawal processes, criteria for consent, and interest calculations protects all parties involved.

-

Engaging with legal advisors is a smart move to ensure the clarity and enforceability of agreements.

How to fill out the clauses relating to capital

-

1.Open pdfFiller and upload the document containing clauses relating to capital.

-

2.Select the relevant section where you need to fill in the clauses.

-

3.Read through the predefined text to understand the context and requirements for each clause.

-

4.Fill in necessary details such as the capital amount, ownership percentage, and responsibilities associated with the capital as applicable.

-

5.Review each filled section for accuracy and completeness, ensuring all relevant parties’ names and details are included.

-

6.If needed, consult with legal advisors to verify the terms you are entering meet regulatory standards.

-

7.Once filled, save the document and preview it to ensure all information is displayed correctly and no sections are missing.

-

8.Finally, download or share the completed document with relevant stakeholders for further action.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.